Whatever happens later, the “now” is still under the influence of the same set of generalized tailwinds.

That’s one message (among several) from Nomura’s Charlie McElligott, who was in rare form Thursday, something he apparently realized: The title of his latest missive is “A Hot One,” and the first line promises “a lot of good stuff.”

Earlier this week, McElligott joined Goldman (among others) in warning on the potential for a near-term pullback in equities based on a sentiment overshoot, but said the most likely outcome locally remained a “‘right-tail’ CRASH-UP scenario” due to “bullish/supportive options flow dynamics into Quad Witch Op-Ex and VIX expiry.”

Writing Thursday, he reiterated that “the thematic Equities Vol trade here looks ‘short Vol, long Gamma,’ as the broad tailwinds still apply into year-end melt-up views.”

Those tailwinds are familiar. First is simply a quarter-century of pro-cyclical seasonality that generally favors higher equities, a weaker dollar, higher yields, rising crude, and outperformance from value and small-caps.

Beyond that, stocks are supported by central banks and familiar flow dynamics.

As expected, the ECB topped up its pandemic QE program by €500 billion on Thursday, albeit with a silly caveat about not intending to use it all. The full €1.85 trillion in PEPP power (if you will) “need not be used in full,” Christine Lagarde said, during Thursday’s press conference. It all depends on “if favorable financing conditions can be maintained.”

That’s the old Hank Paulson “bazooka” logic, but I’m not sure it’s applicable these days. Markets expect ongoing asset purchases in perpetuity, so, if you say you’re prepared to buy up to €1.85 trillion in assets as part of an emergency program, the market will likely extract that from you one way or another, over time. And don’t forget that the ECB’s pandemic QE program is running alongside “regular” QE of €20 billion per month. It’s just QE on top of QE.

At the same time, fiscal stimulus needs financing. Literally in the eurozone where countries can’t print the currency they use, and figuratively everywhere else in the developed world until such a time as everyone involved is prepared to drop the charade and admit that inserting a bank intermediary into the equation doesn’t mean you’re not just buying bonds from yourself or, put differently, printing money. That arm’s length arrangement is absurd, and should be abandoned in favor of direct government financing, not necessarily because that’s the “right” thing to do, but rather because everyone is already doing it anyway.

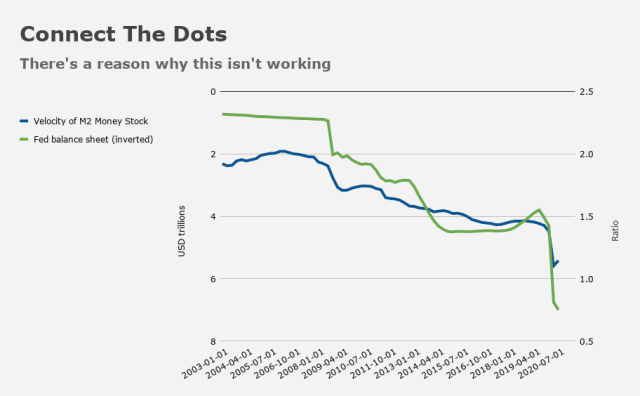

What’s the point in maintaining the charade after a decade? It’s clearly not working — or at least not as intended. Money velocity is non-existent. Growth and inflation were perpetually sluggish in advanced economies even prior to the pandemic.

If you want to break free from the cycle of QE driving up the price of financial assets while doing next to nothing for the real economy, you need to fix the process so that the middleman stops impairing the transmission channel. It’s just that simple and everyone with any sense knows it.

One way or another (i.e., whether the problem is on the supply side or the demand side when it comes to credit), what you see in the figure (above) is failure. So it’s probably time to try something else.

It would take an ideological reckoning of epic proportions for economists and central bankers to just come out and admit that while direct monetary financing and cash handouts might sound insane, the current conjuncture is even more ludicrous, as evidenced by myriad distortions across financial assets (e.g., $18 trillion in negative-yielding debt globally), absurd wealth concentration (e.g., Elon Musk making $129 billion on paper over the course of just 11 months), and the rising cost of a ticket to the party (e.g., the average nonsupervisory worker in the US having to work two whole days just to buy a single share of the most popular S&P 500 ETF).

Ideological reckonings can be psychologically devastating for everyone involved, so rather than issue a press release detailing their come-to-Jesus moment, economists and central bankers will work behind the scenes to correct this situation, starting with Janet Yellen at Treasury.

On Thursday, Nomura’s McElligott underscored the point using his signature cadence. This is the second of three crucial tailwinds for equities and risk assets:

Dovish central bank tilts at Dec mtgs as “vol suppressors,” maintaining (or in case of ECB, growing, as confirmed this morning with PEPP to E1.85T from prior E1.35T) “lead-footed” QE and forward guidance while continuing to jawbone desire to run-hot on inflation and YELL LOUDLY about fiscal stimulus, which with the explicit merging “congruence” of Janet Yellen into Sec of Treasury role with her Fed proximity confirms the evolution to outright debt monetization and MMT “policy-harmonization” to stimulate growth-, inflation- and full employment- is kicking-off nicely.

As for the third tailwind, it’s all about the flows dynamic which, I remind you, is absolutely crucial and arguably becoming more important over time.

“From a ‘flow’ perspective, the current dealer ‘long Gamma vs spot’ dynamic [is] ‘pinning’ markets,” McElligott wrote.

This comes “in conjunction with increasingly supportive Vanna- and Charm- flows into next week’s Options Expiry off the back of the recent remarkable ‘Vol Compression’ slingshot,” he added, reminding folks that the absence of a worst-case post-election scenario “has forced a spectacular vomiting of ‘crash’ hedges” which were “force-unwound into the market in the days and weeks that followed [the vote] with endless supply of implied volatility.”

None of that rules out a near-term pullback, though, nor does it negate the tail risk from a possible Democratic sweep of the Georgia runoffs. As a reminder, the implications of a Democratic win would be dramatic indeed.

That scenario “would completely reopen markets to unprecedented government deficit spending and super-stimulus, which risks lighting the sleeping macro giant of the decade-long ‘inflation skepticism’ on fire,” Charlie wrote, before cautioning that when you consider the possibility that these policies “would be paired with across-the-board tax hikes and re-regulation of industry, we see heightened odds of [a] stagflation-looking trade thematic.”

You must be logged in to post a comment.