“Futures positioning [is] now mattering in a big way for US Equities”, Nomura’s Charlie McElligott wrote Monday, flagging massive covering in what was a 0.1%ile Leveraged Fund net short position.

This “unprecedented cover” (as Charlie dubs it) was +$23.9 billion across S&P, Nasdaq and Russell futures. Nomura calls the buy/buy-to-cover in Nasdaq and S&P futs “particularly extreme”, in the 100th%ile and 99th%iles, respectively.

“The surge in short-covering comes as traders wrestle with what to do after a pause in one of the most unloved rallies in recent financial history”, Bloomberg wrote Monday, documenting the same action, and adding that “short interest as a percentage of shares outstanding in SPY had fallen to 4.9% Friday from 6.7% at the end of May”.

If you’re wondering whether the market is still vulnerable to “chop” as it was last week post-Op-Ex, the answer, according to McElligott, is yes.

“The market remains open to gappy moves into the final days of the ‘post June Op-Ex seasonal drawdown window’ which we have called accurately since June 1st”, he says, noting that “after the blast lower last week, we see Dealer positioning remain firmly in ‘short gamma’ territory”.

(Nomura)

The flip line into benign, positive territory, where dealer hedging would tamp down directional moves as opposed to amplifying them, is all the way up near 3,078 on the S&P.

Last week, CTA “chop” was “a big flow that mattered” in equities, Charlie goes on to write, noting model oscillation from short to long signals. He also reiterates that the risk across global equities is “a ‘buy to cover’ spasm from CTAs as 12 of 13 futures signals are ‘short’, but most with additional ‘sell’ signals significantly below market, while ‘buys to cover’/’flip’ for some remain somewhat proximate”. Meanwhile, the vol.-control universe continues to re-leverage in lagged, somewhat glacial fashion.

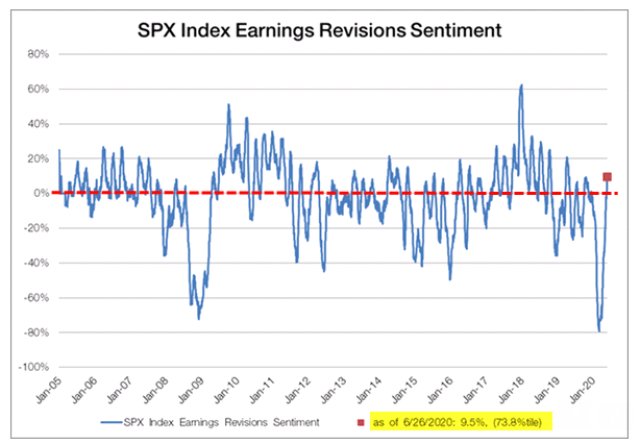

Finally, McElligott says the “largest local ‘risk’ to Equities stabilization/rally might be EPS, where WoW we now see our ‘Revision Sentiment’ monitor turn from NEGATIVE to POSITIVE”.

(Nomura)

That’s a pretty big swing — i.e., from -80% to +10%.

Why is that potentially problematic? Well, as Charlie reminds you, “perversely, ‘NEGATIVE revisions’ in earnings are a bullish signal for forward returns, while ‘POSITIVE revisions’ are actually a local ‘negative’ signal for Equities”. That’s based on past returns over six weeks of earnings season.

As ever, all of this has a tactical bent, and you should consider it in conjunction with the broader macro narrative, something McElligott has an uncanny ability to document in real-time.

Putting all of the pieces together (i.e., the local technical/flow catalysts that could impact near-term returns, the medium-term macro story, and the long-term, “big picture” narrative) is admittedly challenging, but for most folks, it’s enough to simply have a working understanding of how it all fits, even if you’re not inclined to try and trade each and every bend in the road.

McElligott’s overall message on Monday: “All’s well unless, perversely, earnings revisions continue higher”.

Better earnings is a perversion the labor market/consumer can live with.

the whole market is one giant perversion—see James Grant in WSJ