Rich folks think this market is too rich for them.

61% of more than 4,000 investors and business owners with at least $1 million in investable assets or in annual revenue, polled by UBS would like to see stocks fall between 5% and 20% before jumping in. The survey was conducted between April 1 and April 20.

Less than a quarter said it’s a good time to buy right now, and 16% said this is a bear market and as such, diving in could be perilous.

That gives you an idea of what the rich are thinking.

And, according to one Nomura strategist, human investors in general are shying away. “The machines may be getting back into the market, but human investors appear to be taking their time”, one of the bank’s quants in Tokyo wrote in a client note Tuesday. “With human market participants staying at home (both literally and figuratively), the machines have proceeded on their own to systematically buy up equities”.

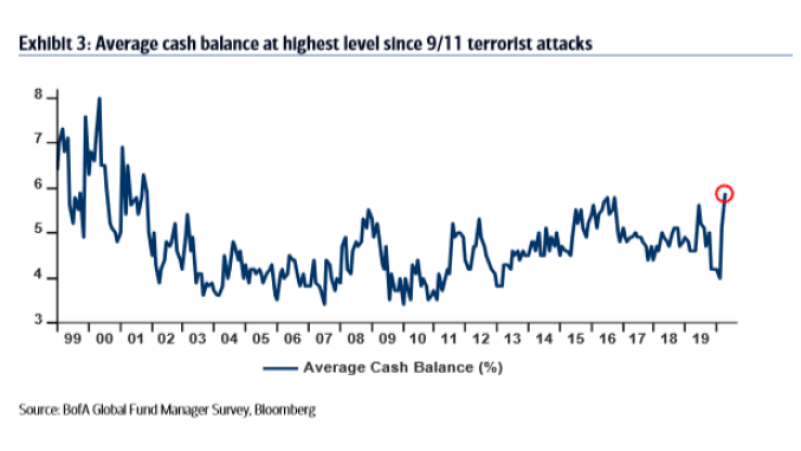

Cash levels, you’re reminded, are near the highest since 9/11, going by BofA’s latest global fund manager survey.

(BofA)

That’s a kind of anecdotal snapshot as investors attempt to digest lackluster GDP out of the US and whatever Jerome Powell manages to come up with on Wednesday. Any technical tweaks aside, the Fed’s April meeting is a “status report” more than anything. What is Powell’s demeanor? How is the committee feeling about the success (or not) of the various liquidity facilities? Some aren’t being tapped aggressively, which would, on the surface anyway, appear to be a good thing. Is that accurate? And on and on.

“The best measure of Chairman Powell and the Federal Reserve’s success in this crisis will be if these facilities never needed to be used in a meaningful way”, JonesTrading’s Mike O’Rourke wrote, in a Tuesday evening note.

“There’s a month-end feel to markets already, thanks to holidays in Japan today, in HK tomorrow and most of Europe (plus Singapore) on Friday”, SocGen’s Kit Juckes muses, in his latest. “Things that were being bought (volatility, the dollar) are being sold and things that were hated (the rand and the euro, despite CFTC data) are being bought back. I’m wary of over-interpreting any of this”.

For what it’s worth, the European Commission’s monthly sentiment gauge dove by a record in April. It’s now sitting just above GFC levels. In short, everyone is terrified.

Eurozone GDP data is due later this week and like the US, it won’t be pretty, even as the real fireworks won’t show up until the Q2 numbers.

Retail sales in Spain plunged 14% in March, data out Wednesday showed. That’s the biggest decline going back at least 24 years.

Belgium, the first European country to publish GDP data for Q1, gave market participants a preview of what’s coming. The economy shrank nearly 4% over the period.

That’s another “recalibrate the y-axis” moment.

Getting back to equities stateside, the above-mentioned O’Rourke suggests the Fed encourage corporates to take any opportunity to tap markets for cash while conditions are favorable.

“The companies hardest hit by this crisis, Carnival Cruise Lines and the Airlines, have already started to do so [and] anyone else with capital concerns should have been doing so as of yesterday”, he wrote. “Above all, Chairman Powell’s message should be that the Fed is NOT the lender of first resort, markets are functioning, take your mulligan and raise capital”.

As for investors, he says they should consider doing the same. “The same can be said for investors who were concerned as the equity market approached the March 23rd lows, a remarkable liquidity opportunity has been manufactured here”, he notes.

Still squinting to see that light at the end of this tunnel. SPX sees it, that’s for sure. GILD headline is nice, but still inconclusive. Partial reopenings here and there (although mostly just “plans”, all predicated on mass testing that is nowhere close to available yet, and contact tracing, which will be a joke in the US).

Our new case count chart may have flattened, but 25K – 35K new cases a day on a steady basis still seems like Bad News to me, especially given that these persistent increases are occurring while lockdown measures are (supposedly) in place.

Guess I just need to squint harder.