As expected, Saturday brought more disconcerting epidemic numbers, as the COVID-19 death toll jumped 32% in Spain, just a day after Italy suffered more than 600 fatalities in the space of just 24 hours.

Iran lost another 123 people, bringing the country’s death toll from the virus to 1,556. Hassan Rouhani pleaded for sanctions relief.

“People of the United States, in the name of justice and humanity, I address your conscience and Godly souls”, he said, in a message addressed not to the Trump administration or to Congress, but to US citizens directly. He continued:

Even under the circumstances of the pandemic, the US government has failed to abandon its malicious policy of maximum pressure; and is thus in practice aiding the spread of this virus with its sanctions. You, like others in the world, are facing this destructive pandemic and experiencing the bitterness of a concern over your future and that of your loved ones. This time, the surrounding oceans of a continent are not an adequate defense. We know the war on this virus can only be successful if all nations can win this war together, and no affected nation is left behind. This is the other side of globalization coin; a signal that happiness and calamity are both globalized.

It’s a somewhat disturbing open letter which you can read in full here.

In the US, COVID-19 cases topped 20,000 Saturday. The death toll rose to 266.

As of Saturday at lunchtime on the east coast, some 330 million Americans are under some version of a shelter-in-place order, although not every official is calling it that.

The US economic machine is effectively powering down rapidly and will likely come to a near total standstill by this time next week, as the services sector goes dark. Citizens in New York, Illinois, California, Connecticut, Nevada and Pennsylvania are all under orders to restrict their movement and nonessential businesses are closed. In total, around one-third of America’s population is now living in what amounts to quarantine.

Larry Kudlow on Saturday said the total US stimulus package aimed at cushioning the blow from the virus may total as much as 10% of GDP.

“The package is coming in at about 10%. It’s very large”, he told the media. Asked to clarify if that means the administration is looking at a figure north of $2 trillion, he said yes.

By the time the dust settled on the worst week for US stocks since the financial crisis, equity positioning across investor cohorts had fallen to the lowest on record according to Deutsche Bank.

“Last week our consolidated equity positioning indicator had fallen to financial crisis lows”, a positioning update out Friday reads. “It has now fallen further and is the lowest in our data going back to 2003”.

(Deutsche Bank)

That consolidated measure includes CTA beta, Risk-Parity beta, Vol control allocation, L/S HF beta, active MF beta, MF cash holdings, US and ROW equity flows, AAII Bull-Bear spread, cash equity short interest, ETF short interest, S&P 500 futures positions, equity put/call volume ratio, S&P 500 option skew and the residual of realized vol relative to growth.

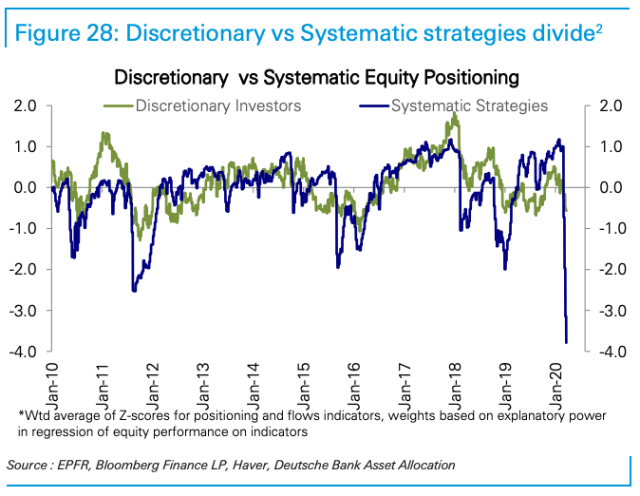

In case you were looking for one visual that gives you a rough approximation of how dramatic the deleveraging was in the wake of the biggest VaR shock since Lehman (at least), the following chart (which breaks down positioning by discretionary versus systematic strategies) is instructive:

(Deutsche Bank)

“We estimate that for CTAs, net exposures are now in the 5th percentile, risk-parity gross exposure at its lowest since early 2016 in the 20th percentile [and] Vol control-fund equity allocations now so low that it would take a -6% equity selloff for them to incrementally sell $1bn in exposure”, the bank writes.

That gives you an idea of the sheer scope of the systematic deleveraging witnessed over the course of what will go down in history as one of the three most calamitous market events ever witnessed.

“The ongoing theme that ‘there’s nothing left to sell’… means that generally-speaking, this mechanical source of ‘sell flow’ for the past two months is largely removed from the picture at this juncture and is an incremental BUYER going forward on a potential Vol normalization”, Nomura’s Charlie McElligott said Friday.

I saw at least one high-profile quant fund manager implicitly suggest (in a tweet) that risk parity had nothing to do with the recent deleveraging across assets. With apologies to that individual, this just “is what it is”, so to speak:

(Nomura)

As far as whether Steve Mnuchin and his helicopter can save you, Rabobank’s Philip Marey says it will help, but ultimately can’t rescue the US economy.

“Under current circumstances, helicopter money is an attractive alternative to outright monetary financing, especially for the US”, Marey wrote Friday. “We expect helicopter money to be effective in slowing down a sharp decline in consumer spending, although it will probably not be enough to bring the economy back on an upward growth path”.

No, “probably not”.

Here’s a thought, Nixon stabilization act freeze wages and prices, to help stabilize future shocks. I doubt the new batch of retarded GOP morons will learn from their brothers of that era, but worth a shot. Perhaps better than closing wall St and there’s a precedent!

Sir, I hate to burst your bubble on Nixon’s controls but I was there on the inside. Our company was a Tier 2 and I had to file the paperwork proving we conformed to the rules. My cousin was one of 14 Counsels to the House and wrote some of the legislation. (Typical DC, six months after writing the law he’s working for a big Tier 1 bank, testifying in Congress about how they must be allowed to raise credit card rates. What a country.) Never were so many liars conceived in such a short time. Nixon’s controls were the stroke that ushered in the era of clever packaging. A pound of sausage became 14 ounces, same price. Now they weren’t totally stupid in DC so they had anticipated and outlawed that idea. Of course, in a new package and as a “new product” (maybe a bit more salt …), no problem. Voila, 12% price increase. So much treachery to get around those rules. Then, of course, projects up for bids were exempt and a little cooperation over coffee made sure that wasn’t a problem. On the outside everything looked great but there was a reason it went away.

L.and another thing … look at the general costco like model. today in general they seem to be looking strong with a spike in food demand but meanwhile whats going on with spring garden supplies and the massive amount of dry goods sitting in warehouses? what about the supply chains thare are geared up for spring sales that will smash against a wall of weak demand? these are the type of future earnings questions that will be dumped into future earnings reports! no doubt many analysts will sweep thrse impacts under their radar but its worth the time to dig through little details that may destroy purchasing power in terms of seeing bargains next week or next month.

H-Man, as I write this post we are #3 on worldwide infections, only China and Italy are above us on the score card. Methinks we will be in the 1 hole shortly. If the S&P crashes 3300, hang on and tell Kevin to buy bonds.

Equity positioning is at the all time low but each and every share is still owned by someone. Who are the people who bought all equities that were sold in this selloff?