The pro-cyclical rotation is over.

Or at least that’s the impression you’d get if you scanned some headlines on Saturday.

Since late summer, there have been two bond selloffs, and, due to the fact that there’s “bond risk everywhere” under the hood in equities (to quote SocGen’s Sandrine Ungari), two attendant rotations out of crowded equity expressions tethered to the duration trade in rates.

Read more: Armageddon Scenarios, Willful Ignorance And ‘Bond Risk Everywhere’

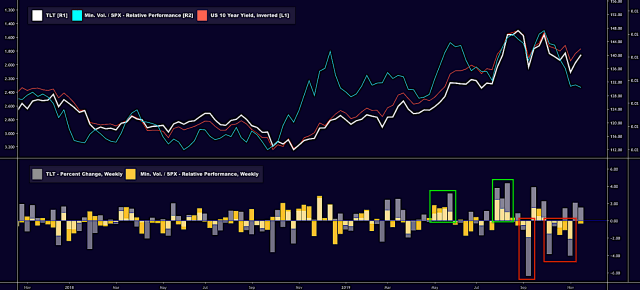

There are numerous ways to visualize those episodes. You can look, for example, at relative performance (i.e., versus the S&P) of a strategy concentrated in bubbly Min. Vol. stocks against the long bond ETF. The top pane is self explanatory, but do note how the already tight relationship between relative performance for Min. Vol. versus SPX and bonds became almost one-for-one starting in late July.

In the bottom pane, the green boxes show the weekly outperformance of Min. Vol. shares versus the broad market and the concurrent rally in bonds (TLT) during the only two months of the year when the S&P fell – May and August, both months during which trade tensions were on the boil. The red boxes show the early September snapback (i.e., when bonds were routed) and the mid-October-to-early-November bond selloff.

It’s important to note that neither of the two bond selloffs (in early September and then from mid-October to early November) were catalyzed by a convincing turn in the macro. The rise in yields that played out in early September (and the accompanying rotation under the hood in equities) was largely down to the realization that quite a bit of the bond rally witnessed in August was attributable to technical factors and mechanical flows (basically, convexity hedging in the mortgage space), not growth concerns. Because that manifested itself at the long end, the inversion of the 2s10s (and accompanying recession scare) was something of a false optic. Some of that got unwound in September, leading to an acute bond selloff and the predictable knock-on effects across various equities expressions tethered to the duration trade in rates.

Fast forward to mid-October and continuing into the first week of November, and we got another bond selloff, thanks in large part to the pricing in of an interim Sino-US trade deal and pricing out of a hard Brexit. Again, the bond selloff was accompanied by an unwind in the same crowded plays within equities (e.g., Long Momentum/Short Value, Long Min. Vol./Short Cyclicals, etc.).

In both cases, analysts suggested that consensual positioning in crowded bond proxies was at risk of coming unglued – that various bubbles in equity expressions tied to the duration trade were about to burst.

Indeed, the factor/style quake witnessed on September 9 was described by one cross-asset strategist as “one of the more stunning trades in modern market history”. About a week later, JPMorgan’s Marko Kolanovic suggested that “the extreme divergence between value stocks on one side and low volatility and momentum stocks on the other” may be the “new XIV” (a reference to the infamous VIX ETN “extinction event” of February 5, 2018).

Again, the important thing to keep in mind is that all of this hinges on rates. Indeed, once news of the “Phase One” trade deal hit on October 11, yields started to rise again after having pulled back from the early September mini-tantrum. The Long Momentum/Short Value trade started to unravel anew.

Well, over the last two weeks, bonds have stabilized (yields down), amid a lack of definitive news on trade and the realization that while an inflection in the data may be imminent thanks to, for instance, the lagged effect of monetary easing, there has been no such inflection just yet. At the same time, the unwind in the bubble trades has taken a breather (green box in the visual above).

The mechanical selling that helped push 10-year yields to the brink of 2% in the US earlier this month has abated. “We believe CTAs are likely close to being done with duration unwinds”, BofA’s Carol Zhang wrote last week, adding that “this is also consistent with our observation that momentum traders are much less sensitive to rates moves”.

“Since we pivoted last week to calling for the end of the rates selloff, UST 10Y yields have reversed from 1.94 to 1.76, with EDZ0 +16 ticks over same period and a broad bull-flattening in UST curves which fits the seasonal every year since 2010”, Nomura’s Charlie McElligott remarked on Thursday. “The Nomura QIS CTA model currently estimates that with Systematic Trend funds loading the 1Y window exclusively as that bucket remains so consistently strong, the ‘+100% Long’ signal in both TY and ED$ remain so deeply ‘in the money’ that deleveraging trigger levels are impossibly far below market, meaning that the deleveraging-flows in various shorter-term windows (1m, 3m) from these mechanical vol targeting’ strategies have now by-and-large cleared”, he went on to say.

Given all of this, it comes as no surprise that the rotation which was all the rage earlier this month has been placed on “hold” (if you will), pending confirmation from the data, definitive news on tariff rollbacks or, ideally, both.

“Lurches in retail, technology and commodity stocks are spelling trouble for newly christened macro bulls, sending an exchange-traded fund that tracks high-volatility shares to its first decline since October”, Bloomberg’s Vildana Hajric and Sarah Ponczek wrote, in a featured piece out Friday afternoon.

Hajric and Ponczek continued: “Back on top are health care, utilities and real estate, defensive sectors that dominated all year”.

Right, and, as a reminder, the Min. Vol. products are now weighting those sectors at all-time highs. The charts below show the valuation premium expanding alongside the wave of inflows (left pane) and, crucially, the extent to which this has become one trade — these products’ beta and sensitivity to rates has risen for obvious reasons (read the chart header in the right pane).

(Goldman)

The prospect of the bubble in all the various equity strategies that have become joined at the hip with the “duration infatuation” bursting, alongside optimism on trade, catalyzed a rotation by mutual funds and hedge funds.

“Both hedge funds and mutual funds selectively added to cyclical tilts in 3Q, primarily in Industrials”, Goldman wrote this week, in their hedge fund and mutual fund trend monitors.

On the hedge fund side of things, it’s worth noting that although funds raised Industrials to the biggest overweight since 2008 (+235 bp), they also lowered their combined lean toward Energy and Materials to the lowest since at least 2007 (+236 bp). Overall, Goldman notes that “cyclicals account for 54% of hedge fund long portfolios compared to an average of 60% during the past 15 years”.

(Goldman)

As far as mutual funds go, the story is broadly similar. Although funds lifted their overweights in cyclicals to the highest level since 2017 (with increases seen in relative allocations to Industrials and Semis), Goldman notes that “the current overweight to cyclicals still remains below average”.

Funds did rotate away from defensives (e.g., Utilities and Consumer Staples), but as you can see from the following chart, this pro-cyclical slant is still in its infancy.

(Goldman)

At the current juncture, things are touch and go. Recent stumbles for some retailers (Kohl’s had its worst week since 2008) have thrown the “resilient consumer” narrative into doubt ahead of the holiday shopping season and the specter of more tariffs on December 15 doesn’t help.

The 2s10s, after rebounding from the “false optic” inversion in August, has bull flattened of late, suggesting doubts about the viability of the economic inflection story. Retail sales were decent in October, but the ex-autos print was lackluster and September’s unexpected decline is still fresh in some market participants’ minds. And although the Markit manufacturing PMI printed a 7-month high on Friday, ISM has been mired in contraction for three consecutive months.

Bloomberg quotes Keith Buchanan, an Atlanta-based portfolio manager as saying that investors have gone from “‘Oh wait, we see the light at the end of the tunnel,’ to now in the past week and a half it’s been, ‘Oh, well things aren’t as good as we thought.’ Expectations are extremely volatile'”.

Correct. And that means that the rotation which has now been left for dead after being en vogue just two weeks ago, could easily come back into fashion by the end of the year.

For now, though, it’s back to the “slow-flation” regime. “Bond proxy equities [like] Secular Growth have resumed their leadership position while the deep Cyclicals [are] again suffering”, Nomura’s McElligott says, adding that from a factor perspective, US Equities “Sector Neutral 1Y Momentum” had risen nearly 6% over the past week through Thursday, while “1Y Price Momentum” was up 4.4% and “Volatility Adjusted Momentum” 3.5%.

Are you going to be here when JOHN get here?