10-year yields are now some 9bps off local highs hit last week amid the much ballyhooed bond rout that catalyzed the largest weekly outflow on record from TLT and precipitated a veritable cacophony of rotation “hot takes” from analysts, pundits and commentators of all stripes.

If you ask Nomura’s Charlie McElligott, the Treasury selloff “feels ‘tactically tired'” following the position cleanse that saw “massive” duration selling from leveraged funds, and found CTAs settling in (if you will) to newly-established TY and eurodollar shorts (on those, Charlie says there are “no proximate next ‘sell trigger’ levels”).

Delving quickly into the specifics, Charlie notes that hedge funds have been pressing the rates selloff “as last week’s COT/TFF data showed that specs net sold $32mm/01 the week prior to the breakout from the high end of the UST yield range”.

(Nomura, COT)

That, he marvels, is “the single largest absolute duration change in either direction since the UXY contract was introduced in 2016”.

Naturally, any break in the bond selloff will be accompanied by a pause in the equity rotations that have played out alongside the rapid rise in yields. That is, if rates stabilize, the unwind in all the various and sundry equities expressions tethered to the now beleaguered duration trade should abate too.

At the same time, investors have leaned into equities upside amid the trade-inspired euphoria. McElligott breaks this down beyond the obvious, noting that in addition to CTA trend showing “+100% Longs” again in global equities futures, the vol. sellers and overwriters are back “and very active with consolidated SPX/SPY options $Gamma at 94.1%ile since 2013”. Charlie also notes that “investors are EXTREMELY ‘long’ via options (and the stock rally/appreciation), with SPX/SPY consolidated $Delta at 98%ile since 2013”.

(Nomura)

Of course, “extreme greeks” (as it were) set the stage for near-term pullbacks in stocks and upside in the VIX, if history is any guide.

The problem in all of the above is that it runs the risk of colliding with disappointments on the macro front. To wit, from Charlie:

The current market narrative which is building of ‘higher yields and higher stocks with more thematic rotation’ into year-end is at risk of going ‘wrong way’ on even just a small macro ‘negative’ with China trade / HK, or even just a ‘sell the news’ response ahead of ‘deal signing’, with the much tougher ‘Phase 2’ ahead”.

After all, much of the latest move higher in equities and the accompanying positioning cleanse/wash-out was precipitated by optimism around the realization of the “Phase One” trade deal.

But Donald Trump has spent the last several days casting doubt on the agreement, and while stocks still loitering near highs suggests most market participants believe the president is just engaging in the usual showmanship before ultimately acquiescing to tariff relief in order to get the interim deal done, there’s still a risk that things go off the rails at the last minute.

See here, here and here, for a play-by-play recap of Trump’s most recent trade banter

McElligott addresses all of this on Wednesday.

“Macro catalyst wise, Trump’s speech yesterday I think has made the crowd who was saying that the potential Dec signing of a ‘Phase 1’ deal as a SHORTABLE EVENT in Equities (‘sell the news’) now could be further incentivized to take profits sooner-than-later, as that unwillingness to back-down on tariffs makes it now look like ‘the easy money’ has been made and risk is to downside with trade news/rhetoric”, he cautions.

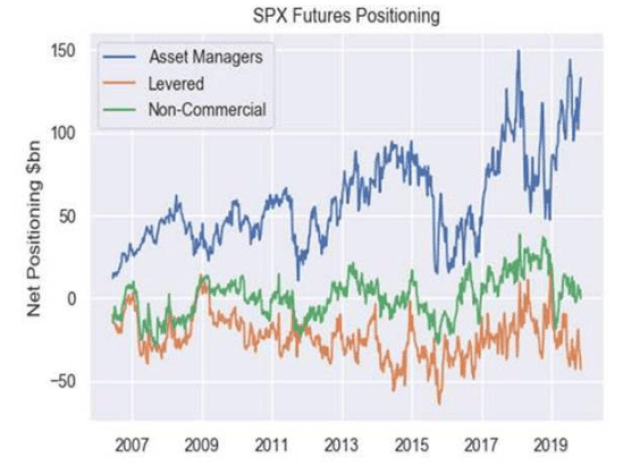

As far as who might be inclined to ring the register and get out of dodge ahead of any potential breakdown in the rosy narrative, Charlie notes that asset managers are long $132.9B of SPX. That’s in the 98.5%ile since 2006, he observes.

(Nomura)

So, is this an outright “short” equities or long vol. call? Well, no. Because with the corporate bid set to come back in play now that earnings blackouts are behind us and the distinct possibility that Trump has no choice but to go along with tariff relief unless he wants to risk a repeat of last year’s “worst December since the Great Depression” headline fiasco, things could still go according to plan, as it were.

But, again, a little caution is warranted. Because you know what they say about the “best-laid plans of mice, men” and very stable geniuses…