It’s “time to play defense”, Barclays’ head of macro research Ajay Rajadhyaksha writes, in a new global outlook piece that strikes an overtly cautious, if not wholly dour, tone, as market participants look anxiously ahead to Q4.

Although the most recent news on the trade front has been positive (on balance) a comprehensive deal is still nowhere in sight, Donald Trump’s “sooner than expected” remark this week notwithstanding. Moreover, it’s crucial not to lose sight of the fact that for all the “good” news on China ramping up purchases of US farm products, tariffs have increased on both sides over the last two months.

“In our view, the news flow on trade, as well as data flow, has clearly worsened since… the end of June”, Barclays’ Rajadhyaksha writes, adding that “there are more tariffs in place than three months ago [and] every major economy is seeing a full-blown industrial/manufacturing slowdown”. At the same time, global trade continues to decelerate in the face of protectionism and tit-for-tat escalations.

(Barclays)

Clearly, the trade tensions and persistent geopolitical tumult (which has gone into overdrive over the past month with the Saudi attacks, Brexit drama and now, Trump’s Ukraine scandal, hitting in rapid succession) have stoked all manner of uncertainty.

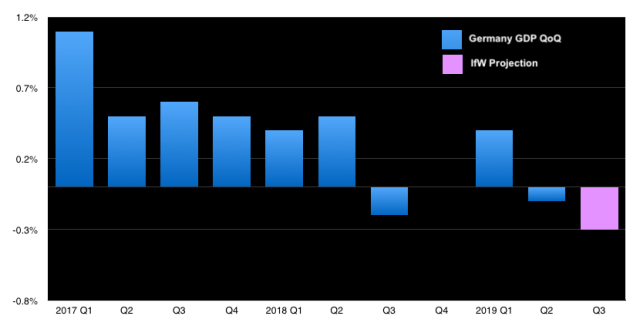

Rajadhyaksha goes on to lament the economic malaise in Europe, where Italy and Germany are teetering precariously on the brink of recession.

China, he says, has likely “downshifted to just 5.1-5.2% growth (q/q, saar) in H2 2019” while Barclays sees the US growing at just 1% in Q4.

As a reminder, recent data stateside has been mixed, but the most recent IHS Markit PMIs suggest the US economy is likely growing at just 1.5%, while trend payrolls growth has probably decelerated below 100k.

Of course, central banks are easing and fiscal policy is starting to ramp up (e.g., India’s big corporate tax cuts), albeit with some holdouts, Germany being the most recalcitrant. The following two visuals make the point quite effectively:

(Barclays)

Still, Barclays thinks next year isn’t likely to be better than 2019. Specifically, the bank suggests parallels with the rebound off the 2015/2016 mini-recession are somewhat spurious.

“Investors who keep drawing parallels with the 2015 economic slowdown should note that aggressive Chinese stimulus in 2015 set the stage for a global recovery, starting in 2016, that culminated in a very strong 2017”, Rajadhyaksha reminds you, on the way to cautioning that China may “remain far more circumspect about adding new fiscal stimulus this time”.

As for the US, Barclays notes the obvious, which is that the fiscal impulse has now waned, while “Europe’s policy cupboard [is] mostly bare”.

Throw in the bank’s projection that “the drag from tariffs [has] yet to fully hit trade”, and you’re left to wonder “Where will upside growth surprises come from?”

Good question.

And one to which there aren’t any good answers.

Read more:

Another Growth Scare? From France To South Korea To Down Under, Fresh Data Paints Dour Picture

Trump Not Yet Facing Enough Political Pressure To Strike Trade Deal With China

Equities seem to be hanging their hat on 1) a US-China trade deal (or simply calling off the war) and 2) the expected effect of global monetary stimulus (which all the analysts say acts with a 9 month lag).

Occasionally people talk about, but don’t really expect, 3) global fiscal stimulus (the US is tapped out, China is constrained by other goals, and even if Germany loosens the purse strings, it’s just one EU country).

Since #2 without #1 won’t be good enough, equities are basically going to live or die on trade.

That’s confirmed by action, i.e. the market is shrugging off almost anything else (on + or – side) but flips out at every little trade twitch.

Only a Trump cave-in on trade can save us now!

A Trump cave-in won’t be believed should it happen. Only getting rid of the idiot will help.

This is a cycle ………………..comes around goes around……CYCLE !!!! Everyone wants a miracle…..Cycles are tamper proof…..maybe ?

If you short the market because of trade war, Deal no Deal, Loves me Loves me not sort of thing, than you better ready hypertension medicine assuming my American friends can afford it of course, ( a dark joke i know ), if you short because the macro has clearly deteriorated and you expect a recession followed by systemic financial crisis than you better ready a collection of Mel Gibson movies to watch while you wait for the market to crash. All the Lethal Weapons, even the one with Joe Pesci, Braveheart, The Patriot, Ransom, Conspiracy theory etc. Than The Big Short, Margin Call for a little perspective, and of course the best of them all, Trading Places. The point is being short is not like being long. It is hard to loose money for an extended period while having to look your wife and kids everyday in the eyes. (I have those days). If you decide to go short than do it responsibly, don’t rush it, put a little first test the waters and trade daily the trade wars saga opposite to your macro position as a hedge but also to make some money if you are wrong. Anyway i am rumbling on and on, difficult time for me, so to all shorts out there “I Salute You”. Oh btw watch Gladiator too.