On Thursday, the OECD slashed its outlook for global growth to just 2.9% for 2019 and 3% for 2020, the lowest since the crisis.

The latest update from the Paris-based organization echoed many of the concerns voiced by analysts and monetary policymakers across the globe. One persistent theme is that sooner or later, fiscal policy needs to take the baton from monetary policy when it comes to safeguarding the increasingly fragile global expansion and helping to prevent developed economies from backsliding into deflation.

“Governments need to seize the opportunity afforded by today’s low interest rates to renew investment in infrastructure and promote the economy of the future”, OECD chief economist Laurence Boone said.

Read more: OECD Calls For ‘Urgent’ Action As Growth Outlook Slashed To Weakest Since Crisis

The allusion to “seizing” upon low rates to provide stimulus applies pretty much across the board, but especially to Germany.

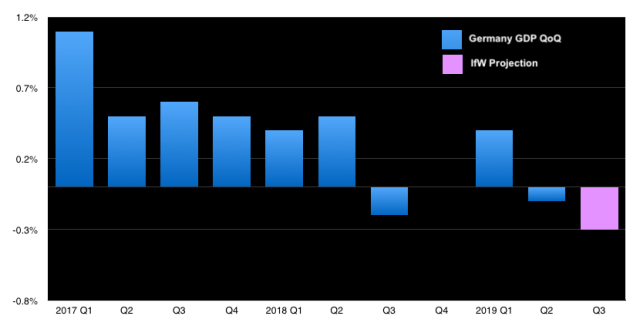

Berlin is under enormous pressure to abandon its “black zero” fiscal stance in the interest of boosting the domestic economy which, you’re reminded, is almost guaranteed to slide into a technical recession this quarter.

Markets have become fixated on the prospect of German fiscal stimulus, even as finance minister Olaf Scholz remains reluctant to countenance the idea that a major push is in the cards.

“It’s central” for Germany to be in a position to “respond with many, many billions, if indeed an economic crisis erupts in Germany and Europe”, Scholz said earlier this month. “And we will do it”, he promised.

That rings hollow for a number of reasons, not the least of which is that Germany is obsessively dedicated to fiscal rectitude to the point of religious fervor. But beyond that, there are legal constraints to take account of and it’s hard to imagine that a shallow recession like that which the country is almost surely already in, counts as “an economic crisis”.

In any case, market participants remain hopeful and, indeed, the latest edition of BofA’s closely-watched global fund manager survey (out earlier this week, but lost in the shuffle of repo madness stateside and geopolitical tumult in Saudi Arabia) shows investors would actually view German fiscal stimulus as more bullish than an aggressive Fed cut and Chinese infrastructure spending:

(BofA)

“Outside a trade war, FMS investors think a German fiscal stimulus package, a 50bp cut by the Fed in Sept’19 or a Chinese infrastructure package would be the most bullish for risk assets over the next 6 months”, BofA’s Michael Hartnett wrote, underscoring just how much of a game-changer a loosening of the purse strings in German would be in the eyes of the 235 panelists with $683 billion in AUM who participated in the survey.

The trade war remained the top tail risk in this month’s poll. Suffice to say respondents aren’t optimistic that a real, long-term solution is in the cards. In fact, 38% think it’s “the new normal” and will never be resolved.

(BofA)

Meanwhile, FMS investors see bipartisan support for the ever-elusive infrastructure package in the US, an idea that never seems to fade from the market’s imagination despite having become something of a standing joke as gridlock reigns inside the Beltway.

(BofA)

“Infrastructure spending (fiscal policy) is also the area of US economic policy where FMS investors think there is the most bipartisan support”, Hartnett goes on to write, adding that “whatever the outcome of the 2020 US Presidential election, we expect government spending to rise”.

Of course, that means America’s fiscal trajectory will remain “deplorable” – even if the occupant of the Oval Office after November 2020 is less so.

To play devil’s advocate here, if Germany’s current mild recession is largely caused by the US-China/EU/everyone trade wars – which seems plausible to me – then should Germany let itself get pushed by markets/investors into a hasty rush of fiscal stimulus?

Recessions are a normal part of the economic cycle. Domestic German stimulus isn’t going to get Chinese factories to release machine tool orders. I’m not hearing that the current German recession is overcoming its social safety net.

The US is running colossal deficits and lurching toward MMT to maintain 2% GDP growth. China is accumulating structurally dangerous private/quasi-public debt levels to maintain 5-6% GDP growth. Germany is running a balanced budget and about 0.5% GDP growth.

0.5% is too low, but maybe Germany should focus on lowering some of its structural impediments to growth: productivity, taxation, labor market rigidity, infrastructure, education, financing, attitudes toward entrepreneurship, etc. Some of this requires public spending but more of it probably requires thoughtful reforms. Perhaps its best to spend strategically as part of that reform rather than trying to spend urgently as part of an emergency response to the current recession.

In the Great Recession, we saw that when governments rush to pump 100s of $BNs into “shovel ready” projects, it doesn’t necessarily result in a commensurate level of long-term benefit.

Good comment.

Why is 0.5% “too low?” In the long run the world will have trouble sustaining any real growth.