Although Tuesday’s can-kicking exercise that found the Trump administration delaying the imposition of tariffs on some Chinese goods until December 15 gave optimists a glimmer of hope, the outlook for global growth remains tenuous at best, dour at worst.

Singapore’s rather unnerving forecast cut and a truly terrible read on investor sentiment in Germany, were the latest shoes to drop. Now, all eyes will be on Berlin Wednesday for the latest GDP data amid loud calls for fiscal stimulus.

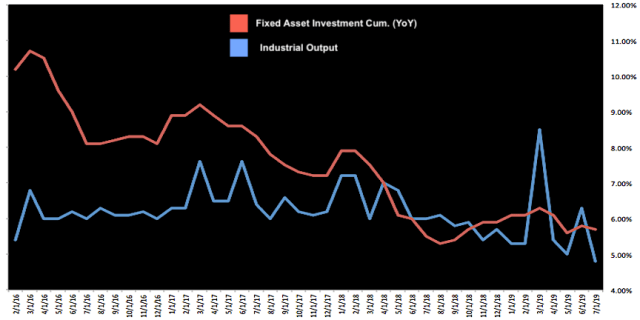

But before assessing the state of the German economy, markets will need to digest what looks like a set of extremely underwhelming activity data out of China, where industrial output rose just 4.8% YoY in July, missing estimates of 6%, and representing the slowest pace of growth in 17 years.

Retail sales missed badly too, rising 7.6% YoY last month, versus the 8.6% economists were looking for. January-July fixed investment rose 5.7% YoY versus an estimated 5.8%.

This come hot on the heels of data out last week which showed PPI deflation arriving in China for the first time since 2016. One assumes that slowing retail sales mean domestic demand isn’t holding up at a time when the external environment is highly uncertain. Throw in the lackluster credit growth data out Monday, and the overall picture isn’t pretty.

It’s also worth noting that the surveyed jobless rate hit 5.3%.

On balance, virtually all of the recent data out of China suggests the world’s second-largest economy got off to a sluggish start in the third quarter after logging the slowest pace of growth in 27 years in Q2.

The reaction across markets was predictable, with the Aussie dropping to session lows and Treasury yields falling.

This comes after the offshore yuan staged a furious rally on Tuesday amid renewed trade optimism – the currency will likely give some of that back, barring some kind of positive macro catalyst that offsets today’s data disappointment.

Traders are probably exhausted with reacting to every headline at this juncture, but Wednesday’s retail sales/IP/FAI trio isn’t something that anyone will be inclined to “look through”, so to speak.

It’s further evidence to support the contention that Beijing will likely need to ease policy sooner rather than later. Even if trade talks are set to proceed in September, and even though the yuan’s recent slide will help to cushion the blow from additional tariffs, it’s clear that the Chinese economy is still decelerating.

And besides, there is no plan, let alone a time table, to lift the existing tariffs.

Bad news is Good news… more yield curves will invert….the CTA’s will drive up asset prices further.. FOMO & BTFD is back! Happy Days are here again ! Pensioners…go to hell!

Yeah, VM take another look and you’ll see the left front wheel just fell off…lol