If Jerome Powell was trying to spark a global equity rally by effectively sealing the deal on a July rate cut from the Fed, he surely succeeded.

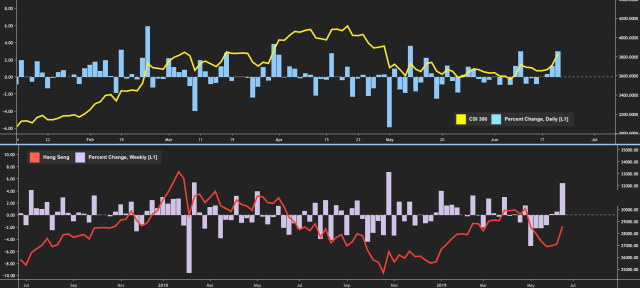

Chinese shares surged to eight-week highs on a combination of developed market central bank dovishness, trade hopes and ahead of FTSE Russell inclusion next week. The CSI 300 jumped more than 3% Thursday, on high volume.

Shares in Hong Kong extended this week’s rally, rising 1.2%. This is set to be the best week for the Hang Seng since October, ironic considering the mood in the city.

The dovish tide swept across bond markets Thursday, driving yields sharply lower. US 10-year yields fell below 2% for the first time since November 2016 (i.e., since election month), a move that grabbed headlines from New York to London to Tokyo.

Speaking of Tokyo, the BoJ left it all unchanged (mostly because there’s not a whole lot left they can do, Kuroda’s protestations notwithstanding), but forecasters now see easing as the most likely next move for the bank. Japan is running low on ammo, but if the rest of the world keeps easing or otherwise leaning dovish, it could pressure the yen stronger, as could any geopolitical tension which catalyzes a safe haven bid. Obviously, a stronger yen makes the BoJ’s elusive inflation target even harder to hit.

Notably, Kuroda did not push back on plunging JGB yields. “There is no need to be extremely and strictly mindful about a concrete range for the rate”, he said. That sent JGB futures to record highs, and it opens the door for 10-year Japanese yields to “catch down” (if you will) to German bund yields, which plunged below -30bp earlier this week following Draghi’s comments in Sintra.

Meanwhile, yields in Australia and New Zealand fell to new record lows and France and Spain sold debt at all-time low yields.

It’s a party. But the Norges Bank decided not to go. Indeed, Norway on Thursday hiked for the third time since liftoff in September. Not only that, Governor Oystein Olsen says you can expect another hike later this year. The krone obviously surged.

“The policy rate forecast indicates a slightly faster rate rise in the coming year than projected in the March Report”, Olsen said. “Our current assessment of the outlook and balance of risks suggests that the policy rate will most likely be increased further in the course of 2019.”

And so, it’s doves all around with one lonely exception (and Norway is indeed exceptional on multiple fronts), which means folks are buying everything on Thursday, as the promise of perpetual liquidity provision from the benefactors with the printing presses reinvigorates the QE trade.

Now, if the US and Iran can just manage to stumble into a shooting war, we’ll be at Dow 30,000 in no time.