Nomura’s Charlie McElligott has a lot on his mind, but he’s got “no long-form prose today”, so his adoring faithful will have to be satisfied with a bullet point update on what he calls “a number of important developing trends and analogs.”

The title of McElligott’s Wednesday piece is – and I kid you not – “BIGLY UPDATES” (all caps in the original as usual).

Just what, you might ask, is so “bigly”? Well, a lot of things.

For one, Charlie notes that “Fed rate cut bets are accelerating again, with ED$ curves flattening powerfully overnight after the past few days of US data misses’.”

(Bloomberg, Nomura)

Rate cut bets were stoked last year as i) the data began to come in soft, ii) parts of the cash curve inverted and iii) the recession narrative proliferated as markets began to fear the Fed had tightened the economy into a slowdown. Now, rate cut bets are being bolstered by the Fed itself, with the language in last week’s statement suggesting the next move could be a cut or a hike with the onus squarely on the data to flip the committee back hawkish.

That said, Charlie goes on to flag signs that stimulus is finally starting to work its way through China’s clogged transmission channel. We talked at length about this over the weekend.

Read more

‘Unavoidable Option’: Only Analyst To Nail PBoC In 2014 Says China Rate Cut ‘Imminent’

“However, the ‘Chinese Credit Impulse’ looks to be pivoting HIGHER after printing post-GFC cycle lows in 4Q18, as the lagging impact of easing / stimulus / liquidity injections begins to show in the ‘rate of change’ trajectory now pointing upwards”, he writes, adding that as a consequence, “we are seeing highly ‘liquidity-sensitive’ Industrial Metals too turn higher, which has shown to be a precursor to a short-term boost in Inflation Expectations and Cyclical / Value Equities.”

(Bloomberg, Nomura)

As for systematic flows, McElligott reiterates his call from Monday, when he flagged a positioning flip in S&P and the Russell futures, as CTAs pivoted from short to “Max Long”, just as they did in the Nasdaq last week.

“CTA Trend continuing their pivot from recent shorts in Global Equities to now ‘Max Long’ in Nikkei, FTSE and CAC over the past day, joining recently made ‘Max Longs’ in U.S. Equities SPX, NDX and Russell which have driven a large notional buying impulse in the market”, he writes on Wednesday.

(Nomura)

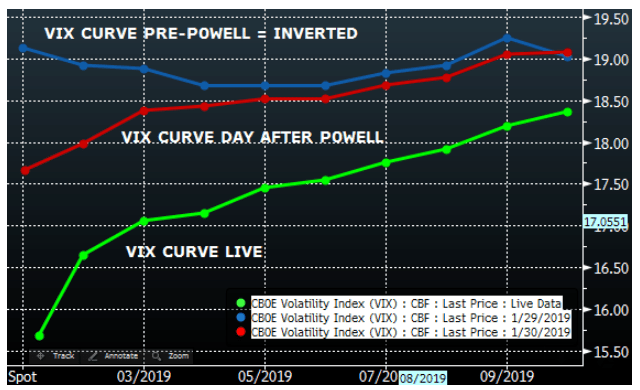

Next, Charlie circles back to a point he made a couple of weeks ago (or at least it seems like it was a couple of weeks ago – every day feels like five on Trump time), noting that roll-down vol strats are “again short vega for the first time since Oct ’18, as the curve reverses the nearly 4 month inversion and has again moved upward sloping since Powell synthetically shorted vol last Wednesday with his epic ‘bending the knee’.”

(Bloomberg, Nomura)

Finally, he notes that the NY Fed Recession Probability Index touched 21.35% at the end of December. It’s crossed that Rubicon 11 times previously and 8 of those presaged a recession with an average / median lag of 13 months (after crossing 21.35 or higher):

(Nomura)

As ever, Charlie has some trade ideas too, but the above represent the macro themes.

As you can see, it’s a tug of war and also a race against time as STIR traders bet on cuts, algos go long equities as upward momentum builds thanks to those same rate cut/policy put bets and China’s stimulus measures (slowly) work their way through to the real economy stoking some signs of reflation, all set against a backdrop where recession probabilities are rising.

The world continues it’s self inflicted top heavy blunt forced trauma and the freak-out deepens. Central banks are telling us (with a straight face mind you) that all is well, at the same time buying gold bullion as fast as they can (2018 the most ever). I guess a lot of doors need to be stopped. The holes in the dike are getting harder and harder to plug.

The great brains of the Central Bankers are in quite a pickle, their boys in big bank land have taken their ball and gone home. Liquidity will continue to dry up and the am’t of QE needed to re-inflate these bubbles will REALLY put the middle class and lower folks on the totem pole under MORE stress than they already are. Inflation is NOT 2 fuking %. Tough sht right, it’s their own fault, right? Folks it’s their tax dollars just like it’s yours and mine that are funding this “Fu*K you I got mine, It’s not my fault you didn’t get yours” bank and corporate welfare debacle.

The “smartest guys in the room” are whining about 200 basis points and balance sheet run off is too much. Life was pretty fu*king good when $$$$ were as good as free, right boys. What a joke. Can’t QT, can’t QE (they will anyway) which will absolutely make the longer term even worse. It would be funny except it totally is dead serious.

Buy some physical gold and silver because many doors need to stay open.

Short gold, long bitcoin.

The dilemma, thanks to the QE wealth effect (amd all other emergrecy aid programs), is the lack of distribution despite the massive inflow of monetary aid. And so the Fed will become even more hyper-sensitive to inflation risk as its failure to wind down its balance sheet continues.

In the end not the wealth effect, but the waste effect…

Will everyone use Japanese ratios to justify their liquidity measures over the next decade?

Looks like Charlie is on the wrong side of the trade again. His 15 minutes of fame seem to be up.

you keep saying this, but it’s not clear what you’re talking about. you seem to be trying to cherry pick certain passages from research you haven’t actually seen (in its original format) and then match it up with certain ticks on futs intraday when it allows you to make a snide comment. that’s fine and all, but it can’t be taken seriously.

I mean, CTA flows don’t mean that stocks won’t dip on bad trade headlines. what kind of sense does that make?