It was an ugly open for Japanese shares on Tuesday following the Christmas Eve massacre on Wall Street, and suffice to say things did not improve over the course of the session.

We documented the initial bloodbath on Monday evening, noting that the early losses put the Nikkei (which fell through 20,000 for the first time since September 2017) on track to join the Topix in a bear market. By the time it was all said and done, the Nikkei fell by more than 5%, its worst day since the U.S. election.

(Bloomberg)

Almost nothing was green.

(Bloomberg)

As detailed here on two separate occasions Monday, yen strength is exacerbating this situation. At one point Tuesday, USDJPY touched 110.0.

Read more

Japanese Stocks Plunge As Nikkei Takes Out 20,000, Falls Into Bear Market

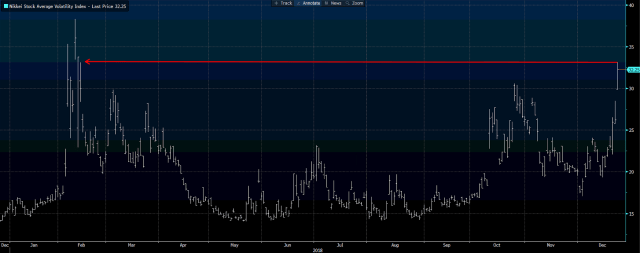

In a further testament to the safe-haven bid, 10-year JGB yields fell to zero for the first time in 15 months. Nikkei volatility, just like the VIX, is now sitting at post-Vol-pocalypse highs after surging during the Tuesday rout.

(Bloomberg)

To say this is a “bad” month in the historical context for the Topix would be to grossly understate the case.

(Bloomberg)

Meanwhile, in China, the vaunted “national team” sprung into action in the afternoon, and very much unlike Steve Mnuchin’s ham-handed effort to rescue the Dow, Beijing’s plunge protection team was some semblance of effective, as the SHCOMP and the SSE50 rebounded dramatically off the lows.

(Bloomberg)

I haven’t seen any estimates of how much national team buying took place in Q3, but you can bet the 21 entities that comprise Beijing’s (literal) plunge protection cabal were buying in October when some feared an unwind in pledged stock transactions might ultimately lead to a rerun of 2015 for Chinese shares.

Read more

A Quick Look At China’s 5 Trillion Yuan Pledged-Stock Margin Call Trap

Realized vol. stateside has pole-vaulted over A-share volatility.

(Bloomberg)

And so, the drama continues. Most investors will get a reprieve from the mayhem on Tuesday for Christmas, but it’s likely to be short-lived.

Remember, the man in the Oval Office is “all alone” and seething. “Poor” him.

I am all alone (poor me) in the White House waiting for the Democrats to come back and make a deal on desperately needed Border Security. At some point the Democrats not wanting to make a deal will cost our Country more money than the Border Wall we are all talking about. Crazy!

— Donald J. Trump (@realDonaldTrump) December 24, 2018