When we documented the Thursday midday massacre on Wall Street, we assumed things would get better or, at the very least, wouldn’t get worse before Friday.

We were wrong.

In case you somehow missed it, Trump sparked another bloodbath in U.S. stocks on Thursday when, seemingly out of nowhere, he balked at signing a stopgap bill to avoid a Christmas shutdown. The President is now demanding that any bill include billions in funding for “steel slats” on the border, something he apparently believes is an aesthetically pleasing substitute for a concrete wall.

Stocks were already struggling to regain their footing after Wednesday’s Jerome Powell-inspired slide and Trump’s “slats” proved to be a bridge too far for delicate sentiment. Equities briefly rebounded when House Majority Whip Steve Scalise said $5 billion will be added to the stopgap bill, but just before the close, Trump reiterated his hardline stance, adding a little extra pressure that equities certainly did not need.

“Any measure that funds the government must include border security, has to,” Trump said at the White House, adding that a “physical barrier” is “essential.” He reiterated that he’ll settle for “steel slats”, if that’s what’s necessary to secure the votes he needs.

If you’re having trouble wrapping your head around this, you’re not alone. We have now reached a point where the President of the United States is on the verge of forcing a government shutdown days before Christmas unless Congress agrees to give him $5 billion for “steel slats”.

Read more

‘Suicide From The Ambush’: A Post-Mortem Of Thursday’s Midday Bloodbath On Wall Street

One assumes (one hopes) that this will be resolved. If it’s not, it will be a disaster for markets – full stop.

But even if it is ultimately resolved, it won’t remove the clouds from 1600 Penn., because on Thursday evening, Jim Mattis resigned and in his letter to the President, he expressed his disdain for Trump’s approach to alliances and foreign policy. Clearly, that is a negative development. Take a second to appreciate the gravity of this development. The Secretary of Defense just announced his resignation four days before Christmas citing, basically, his opinion that the President is a threat to global security.

Read more

Jim Mattis Resigns — The Last Adult In The Trump Administration Is Gone

In light of what looks like things going from bad to worse, we wanted to draw your attention to some additional visuals that help to round out the collage we presented on Thursday afternoon.

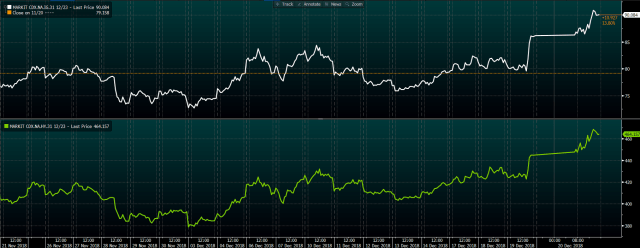

First, note that credit spreads continue to balloon wider, which is indicative of ongoing angst towards both IG and HY, which are under siege for a variety of reasons, some common, some unique.

(Bloomberg)

Alarmingly, the high yield ETFs look like they’re getting a stress test. HYG’s discount to NAV is now back to February levels and it’s the same thing in JNK.

(Bloomberg)

We hope Adam Schwartz is still hanging onto those puts, because this is looking increasingly dicey. Who knows, he may turn out to be the first person to ever time this trade correctly. HYG has suffered three consecutive months of steep declines and again, the visuals above suggest its structural integrity might be put to the test.

(Bloomberg)

Meanwhile, crude continues to plunge. We’re a long way from the early 2016 deflationary doldrums, but one can’t help but get that “history doesn’t repeat itself but it often rhymes” feeling.

(Bloomberg)

Between that and heightened concerns about global growth and a slowdown in the U.S., the reflation narrative is being bled dry.

(Bloomberg)

The other side of this coin is tighter financial conditions and the ongoing problems that’s creating for equities. On the “bright” side, cash is not only a viable alternative, it’s actually becoming more attractive by the week – just ask David Tepper’s e-mail to Joe Kernen.

(Bloomberg)

As for stocks, you already know the story, but just in case you need a not-at-all-subtle reminder of just how bad this quarter has been, have a look at the sector breakdown:

(Bloomberg)

Finally, the percentage of S&P companies trading above their 200-DMA is the lowest it’s been since the early 2016 meltdown.

(Bloomberg)

We’d like to tell you this is going to get better, and who knows, maybe it will. But we’d be remiss not to state the obvious, which is that in retrospect, everyone is going to feel pretty stupid when they reflect on the notion that somehow, Donald Trump’s fiscal largesse and generalized penchant for criminally insane domestic and foreign policy were going to co-exist with a Fed hiking cycle and a trade war without something going horribly awry.

Reading Ian Hunt’s ‘Culture’ series. On book 3, “Use of Weapons” which chronicles an endless series of wars and special circumstances, economies, religions and tragedies on a dozen worlds thousands of light years in the apart, each eerily familiar in disfunction and absurdity to our little sliver of time on this blue dot, dominated by sociopaths and the faithful that love them, in a death spiral of nihilism…

Have a great Newton Day on Monday. Maybe a ritual to Newton can bring reason back to this chaos. That said, and in honor of Newton, Warden of the Mint, my stupid gold positions of all things, are up 10% since September. Which is really really depressing…

Politics do not drive the credit markets – Central Banks do. Your website continues to put a false narrative in place to rationalize your personal political position. The seeds for this downturn in the high yield credit market were sown long ago – a process that took 10 years, with the last 4 being a worldwide credit party of epic proportions. The main question your readers should want to know, which I assume you don’t have a clue, is how deep with the asset valuation drop be, and how long will the selling persist. For the answer, history will be your best guide, not politics.

Lighten up, Daniel. The author is not over-politicizing the matter … He simply recognizes an idiot when he sees one. Too bad more in this country do not possess that ability.

How would anybody, Heisenberg and history included, possibly know what any asset valuation drop will be and for how long?

Daniel doesn’t understand that I am a university-trained political scientist.He also doesn’t understand the nexus between this administration and U.S. monetary policy. He also doesn’t understand credit. But that’s fine, because what he does understand is how to enter my URL in his browser and click “Enter”, so he can still learn.

I’ve done that too!!!!!