Over the weekend, we spent a good bit of time documenting the myriad factors that could potentially turbocharge any post-trade truce rally in U.S. equities.

That could be a contrarian indicator. The market has a habit of doing the opposite of what everyone expects, sometimes to the extent of seemingly defying math and logic.

Jokes aside, the thesis is pretty simple. Re-leveraging levels for trend following strats are close, the buildup of upside exposure through calls leaves dealers short gamma into a rally and fundamental/discretionary investors are still underexposed after de-beta’ing massively during the October rout.

On that latter point, a decent proxy for the Long/Short crowd’s exposure might be just the beta of the HFRI Equity Hedge index to the S&P, seen below (the rampant de-risking during October is readily apparent as is the buildup of exposure in September as hedge funds apparently attempted to grab as benchmarks left them behind on the way to new highs).

(Bloomberg)

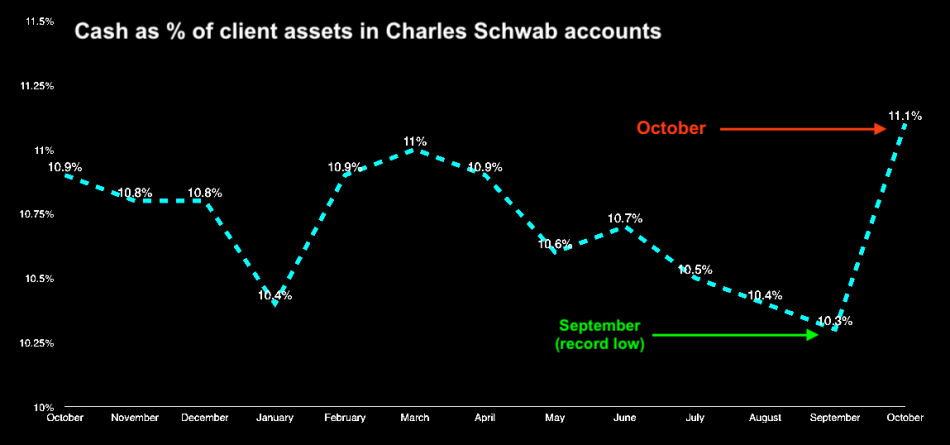

When you think about de-risking from fundamental investors, do recall that the retail crowd bailed on equities in October as well, or at least they did if you go by cash as a % of assets in Charles Schwab accounts, which jumped to 11.1% by the end of the month from a record low of 10.3% at the end of September, when stocks were still sitting near the highs.

Meanwhile, a simple read of the following chart (which is just call and put open interest on the S&P) is that the collapse in the put/call OI ratio is more the result of investors who sold it all after October hedging right-tail risk with calls than it is a manifestation of underhedging on the downside.

(Bloomberg)

The point is, put open interest has risen since the day before the October 10 momentum unwind, but call open interest has risen a whole lot more, which makes sense considering you don’t need to hedge the downside in something you don’t own, but you do need to retain upside exposure in the event the Fed relents or, for instance, there’s a trade truce.

Read more

Well, as noted over the weekend (and also on a number of occasions last week), there’s a lot of open interest in calls at the 2750, 2770, 2800, and 2825 strikes and as you might have noticed, a bunch of those calls are now in the money thanks to the trade truce rally.

(Wells Fargo)

“Investors de-risked significantly in October, but don’t want to be left chasing a year-end rally [and] they loaded up on near-dated call options ahead of G20”, Wells Fargo’s Pravit Chintawongvanich wrote on Monday in a note to clients.

That underscores all of the above and in the same note, Chintawongvanich reminds you that rampant accumulation of near-dated upside exposure into a geopolitical powder keg isn’t exactly normal. “That’s very unusual – ahead of big events people typically hedge the downside“, he writes, adding that “if people were bullish, they would have just bought stocks instead of spending premium on near-dated calls.”

And so, as Nomura’s Charlie McElligott has variously documented, the proverbial “pain trade” remains to the upside. Now, with a good bit of that exposure either in the money or very nearly so, dealers are short gamma and will need to buy into the rally to keep themselves hedged.

There’s some nuance, though. If some of that is call spreads, there could be a ceiling (figuratively and literally) on the effect and then there’s some further complexity around expiry thanks to the national day of mourning for President Bush. But the bottom line is that there’s scope for fuel to be thrown onto the rally fire.

Now we’ll sit around and wait for the market to make us all look silly.