One theme we’ve revisited in these pages over and over again is the concept of developed market central banks as the largest volatility sellers on the planet.

To be clear, we don’t mean that entirely literally, as some folks would have you take it. Rather, what we mean by that characterization is that policymakers are engaged in an ongoing effort to keep rates vol. suppressed in order to ensure that the chances of the greatest tail risk of them all being realized remain infinitesimal.

That tail risk is a disorderly unwind of the bond trade, which would almost invariably be exacerbated by constraints on dealer balance sheets. Deutsche Bank’s Aleksandar Kocic discussed this at great length more than a year ago in the course of documenting “the dark side of liquidity.”

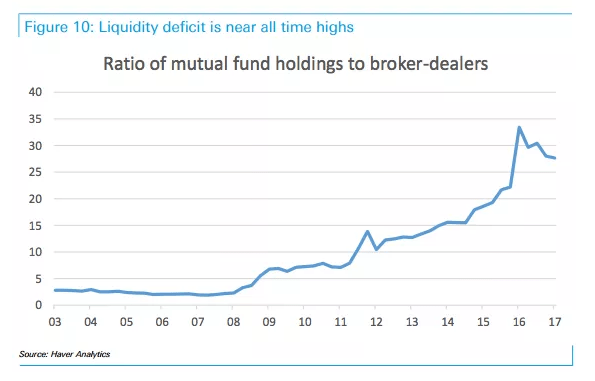

“There is currently more than $2 of duration parked in mutual funds, not all of it very liquid [and] this is happening at the same time as regulatory restrictions are limiting dealers’ ability to extend liquidity in a way they used to”, Kocic wrote, adding that “if we use the ratio of mutual funds to dealers’ holdings as an expression of latent liquidity deficit, we see what appears as an alarming trend: This ratio has been on a steady rise since 2007 and has increased from about 3 to nearly 30 during the last ten years.”

(Deutsche Bank)

As QE winds down, forward guidance becomes the go-to tool for ensuring that normalization goes smoothly and doesn’t end up triggering an unwind. BofAML underscores these points in their year-ahead European derivatives outlook piece.

“Central banks have spent more than $10 trillion of QE money over the past decade in an effort to reflate the global economy [and] in the process, they sparked a debt super-cycle”, the bank writes, on the way to noting that between governments, households and nonfinancial corporates, “global debt has mounted to $175 trillion, while global GDP is just above $70 trillion.”

(BofAML)

This is why it’s so critical that rates vol. remains moribund and BofAML goes on to say just that.

“Amid a rising pool of rate-sensitive assets, central banks have been hostages of their own policies”, the bank warns, on the way to reiterating that policymakers “have to keep rates vol. low to support a gargantuan universe of rate sensitive assets.”

In a world where QT is proceeding apace and the necessity of curbing risk taking and replenishing counter-cyclical ammo ahead of the next downturn makes normalization a must, forward guidance has taken the baton in terms of ensuring that the tail risk isn’t realized. Here’s BofAML with some color on that in the context of both the ECB and the Fed:

With their communication they want to keep vol anchored. So far, the ECB has managed to allow yields to move higher while suppressing volatility (Chart 13). Interestingly, even though yields have moved higher, rates vol has been anchored. Despite the multiple spikes over past months, vol now sits back to the lows. This is exactly what the ECB wants: a normalization of monetary policy while maintaining “price stability”. Forward guidance is now taking over from QE to keep vol low.

The Fed with the dot plot is doing the same. While more hawkish than the ECB, it does not like its hiking cycle being disruptive. Federal Reserve Chairman Jerome Powell has said that the Fed would try to avoid market disruptions by communicating its policy strategy “as clearly and transparently as possible to help align expectations” (Chart 12).

Note that all of that is precisely why Jerome Powell’s data-dependent lean is precarious. This is all about the preservation of the two-way communication loop with markets.

Way back in June, when Powell introduced his “plain English” approach, I tried to explain why “plain English” paradoxically equals less transparency. Take a second and read the following, courtesy of an excerpt from an October 2017 note from the above-mentioned Aleksandar Kocic who, at the time, was writing about the implications of a possible Kevin Warsh-led Fed:

When it comes to divergence between his and Fed’s views, the problem is that the numbers that go into these rules have become ambiguous and circularity of the Fed/market interaction that comes with the removal of the fourth wall – the dynamics that involve the market as a co-writer of the script — ensures a one-dimensional interpretation of these ambiguities. Under market’s pressure the Fed’s interpretation of the ambiguity of the economic numbers which enter the policy rules has taken a predictable path of least resistance after the markets are consulted. Warsh wants to withdraw that ambiguity of interpretation from the dialogue and make it the Fed’s discretionary right. Unlike the Fed which has been using these rules conditionally (subject to markets’ approval), he wants to switch back to their unconditional usage. In itself, this is effectively a withdrawal of convexity from the market.

When you reinstitute the unconditional interpretation of the economic data (which is what strict “data-dependence” means), you revoke the market’s license to co-author the script. The combination of ambiguous data and a two-way communication loop between the Fed and markets meant that policymakers and market participants were always on the same page. Hence: Total transparency.

Powell’s “Plain english” is the opposite of that. He has taken an approach which essentially involves stating the obvious (i.e., the U.S. economy is doing well) and then proceeding with policy tightening based on that. There is no room for the market in Powell’s “plain English” policy. There are just the rules, the data that go into those rules and the implications of that naive approach for rate hikes.

Over the past week, there have been signs that the Fed is beginning to bow to market pressure. Clarida’s “close to neutral” comments to CNBC last Friday appeared to be an effort to walk back Powell’s “long way from neutral” boondoggle and an MNI trial balloon on Wednesday morning (MNI cited sources within the Fed as saying a pause or an outright hard stop could come in March or, at the latest, in June) lent further credence to the notion that even if Powell has revoked the market’s license to co-author the script, it (the market) is still a contract consultant (if you will).

That said, it’s worth noting that the mechanics of Fed tightening (restriking of the Fed put as convexity management along with the shrinking policy gap serving as an upper bound on rates vol.) have created the conditions for rates vol. to remain subdued, even as turmoil reverberates across other assets.

For now, then, realization of the tail risk seems unlikely.

As usual a very good analysis that links several topics. Central banks have to play very carefully with expectations, a key ingredient for the investment cycle in the real economy, but also to avoid volatility that can have an impact on margin calls, collateral, haircuts, and create cascade effects difficult to stop once the ball is in motion. The Basel III rules on liquidity coverage ratios and central clearing procedures don’t give banks/brokers much room when those effects begin, they can’t so easily “lend their balance sheets” as in the old days before 2008.

A recent IMF paper went deeper into these issues, at the end there are other several links to learn more if interested https://www.imf.org/en/Publications/WP/Issues/2018/10/31/The-Morning-After-The-Impact-on-Collateral-Supply-After-a-Major-Default-46315