Over the past few months, several banks have gone to great lengths to address fragility and liquidity provision in the context of modern market structure.

This is an extremely important discussion for all manner of reasons, not the least of which is that the current system (characterized as it is by the presence of HFTs, systematic strats, programmatic trading and the proliferation of passive investing) has never been truly stress tested. The events that transpired on the afternoon of Monday, February 5 and the flash-crashing madness that unfolded on August 24, 2015, certainly seem to suggest that when it is, it will fail (or at the very least not pass with flying colors).

The two dates mentioned above are but two examples of something that happens on a smaller scale all the time.

There have been probably a dozen other acute episodes since 2008 and God only knows how many fleeting instances of “anomalous” price action. All of those events lend credence to the notion that something isn’t quite right.

If you’re looking for culprits when it comes to explaining these anomalies (which, by virtue — or maybe, by Virtu is better — of their increasing frequency aren’t really “anomalies” anymore) the presence of machines in market microstructure is a great place to start.

Here’s what JPMorgan’s Marko Kolanovic wrote earlier this year about the February selloff:

We have noted in the past that a combination of computerized sellers, and computerized market makers poses a threat to equity price stability. As volatility increases, systematic investors have to sell, and at the same time market depth as provided by electronic market makers quickly disappears. For instance, S&P 500 futures market depth dropped over 90% during the February selloff. What is the reason for such a dramatic drop in liquidity? The most important driver is likely the increase of volatility (e.g. VIX), given that many market making algos (as well as business models) were calibrated during the years of low volatility. As these programs don’t have an obligation to make markets and are optimized for profits, they likely adjust quotes and reduce size in order to maximize their own Sharpe ratio.

For their part, Goldman has released a series of notes documenting the trends in fragility and liquidity provision, some excerpts from which can be found in Goldman Asks: ‘Will The Machines Amplify the Next Downturn?’ and Goldman Delivers Ominous Message: ‘Markets Themselves’ May Pose The Greatest Risk.

On Monday, the bank’s Rocky Fishman (who last year jumped ship from Deutsche Bank, where he wrote extensively about the rebalance risk inherent in inverse and levered VIX ETPs prior to the implosion of those vehicles on February 5), is out with an interesting new piece that takes a fresh look at some of the issues outlined above in the context of E-mini depth.

Fishman begins by noting that the concept of “liquidity” is inherently amorphous and cannot be observed directly.

Liquidity is unmeasurable: when defined as the ease (or cost) of executing a large trade, the only true way to measure liquidity is to actually trade large amounts, but that act would in itself alter liquidity conditions (liquidity’s Heisenberg uncertainty principle?)

That said, Fishman explains that “market bid/ask depth is a meaningful indicator of liquidity [as] even if investors do not need to instantaneously execute large trades with zero market impact, if execution algorithms are sequentially trading listed depth a smaller bid/ask depth will increase their execution costs.”

Part of Rocky’s analysis also seeks to determine whether liquidity conditions were deteriorating prior to the February vol. quake or, put another way, whether decreased liquidity made things worse than they might have otherwise been. The answer, unsurprisingly, is “yes.” Here’s Goldman:

Bid/ask depth had deteriorated prior to 5-Feb’s VIX spike. In the week prior to 5-Feb, bid/ask depth was roughly 50% of its typical size from early January or late 2017, and was smaller than the rise in volatility would have indicated it should be. The week of January 29 was the worst week for bid/ask depth in years for SPX futures and key US equity ETFs.

Unfortunately, things have not improved materially since.

“Months after the VIX spike, bid/ask depth is still not back to normal and even adjusting for volatility, top-of-book depth is below its pre-2018 range”, Fishman goes on to observe, adding that “while in late 2017 over $40mm notional was on each side of E-mini futures’ bid/ask at a median moment, recently the median range has been $10-20mm notional.”

What are the implications for volatility? Well, they aren’t great. Here are the broad stroke takeaways from Fishman:

Low liquidity means high vulnerability to shocks. To the extent diminished top-of-book depth is indicative of potential weak liquidity in a sell-off scenario, we may continue to be vulnerable to severe market shocks. Heightened potential for liquidity to weaken in a sell-off ultimately contributes to volatility of volatility: when volatility rises sharply, weakening liquidity can make incremental trades move markets more, pushing up volatility further.

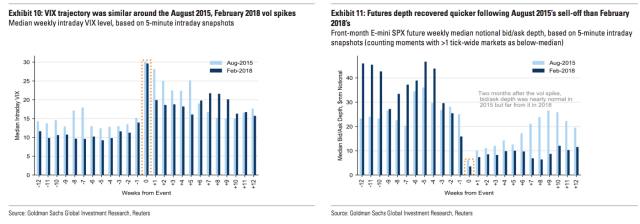

But perhaps most worrying of all for everyone out there who is now drawing a parallel between summer 2018 and summer of 2015 given all of the similarities (e.g., the dramatic weakening of the yuan, China growth worries, EM concerns, etc.), Goldman notes that while August 2015 and February 2018 witnessed similar VIX trajectories, “bid/ask depth returned to its pre-event range around two months after 2015’s sell-off – but this year it has not.”

That would appear to suggest that if we were to witness another August like 2015, liquidity provision is going to be lacking – at best.

JPMorgan seems to agree.

“We would like to draw our readers’ attention to another vulnerability emerging into August”, the bank’s Nikolaos Panigirtzoglou wrote in a note dated Friday, before highlighting one of the bank’s favorite liquidity indicators, a volume-based measure of volatility in futures contracts called the Hui-Heubel liquidity ratio.

While there’s nothing particularly alarming in the latest read there, the recent trend in the ratio is higher (note that the Y-axis is reversed). “The lower this Liquidity ratio the higher the number of trades behind each percentage price change, and thus the higher the market breadth or liquidity”, Panigirtzoglou reminds you, cautioning that Figure 9 amounts to “tentative evidence of some deterioration in market breadth.”

Take all of that for what it’s worth, but do note that this discussion becomes more and more important over time because, as I wrote last week, market structure is evolving so fast that we simply can’t keep up with the myriad implications of that evolution.

Excellent piece. Tks.