It’s all about Jackson Hole in the new week, which, as usual, will feel a bit tedious given that the marquee address, from Jerome Powell, won’t come until Friday.

Generally speaking, traders expect Powell to reaffirm the Fed’s commitment to the inflation fight, where that means emphasizing the importance of ensuring longer-term expectations stay anchored and, possibly, throwing his weight behind the “higher for longer” policy bent advanced, in one form or another, by most officials during recent public speaking engagements.

During remarks to reporters following last month’s policy meeting, Powell inadvertently added fuel to this summer’s stock rally with an allusion to the proximity of the neutral rate and a nod to smaller hike increments. That most assuredly wasn’t his intention. The last thing the Fed needs is easier financial conditions.

Real yields are now basically unchanged since the July FOMC, and the dollar has (more than) retraced the dramatic decline that accompanied July’s cooler-than-expected CPI report. But the equity rally is unbowed. From the June lows on the S&P, 10-year US reals fell in five of six weeks through the July FOMC meeting. They’ve risen steadily since. Stocks started to notice last week, when the S&P snapped its longest streak of weekly gains since November, but multiples are now disconnected from reals. I added a grey shaded annotation to the figure (below, from Goldman) to make the point.

It’s not so much that Powell wants to actively torpedo the rebound on Wall Street as it is that his feelings wouldn’t be hurt if something he said in Wyoming this week was interpreted in such a way that equities de-rated. The S&P’s forward multiple is back out to 18x, and hasn’t responded to the 34bps increase in 10-year reals this month. Powell’s remarks could be just the catalyst multiples need to restore the tight link with real rates.

“The Fed’s focus on maintaining tight financial conditions requires that equities do not rise by too much,” Goldman’s David Kostin remarked. “As equity valuations climb, financial conditions loosen by definition [and] our Financial Conditions Index has fallen by 69bps from its June peak,” he added, noting that the re-rating in stocks “has been the largest contributor to the loosening FCI during this period.”

Jackson Hole could have implications for the curve, and that’s where a lot of the focus is among market participants given the depth of the 2s10s inversion (figure below).

A Fed that hikes into restrictive territory and stays there risks a recession, and the implications of such a policy bent for the curve are clearly biased towards additional flattening, as the front-end responds to a higher policy rate and the long-end to slower growth and falling inflation expectations.

That’s the generic, boilerplate copy. Drilling down, there’s more nuance, but it generally points in the same direction. “Real money remains at cycle shorts versus the duration weighted benchmark according to the latest SMRA survey, an indicator that implies a rally back toward the 2.51% low yield marks in 10s would surely trigger stops and short-covering along the way [while] limited liquidity and constrained conviction will only serve to exaggerate such a move, leaving the bullish risks in Treasurys more pronounced than the prospects for a bearish repricing that puts an extended period of 3-handle 10s in play,” BMO’s Ian Lyngen and Ben Jeffery wrote, adding that “in addition to real money domestic investors remaining structurally short duration, overseas investors — particularly the Japanese — have been conspicuously absent from the Treasury market this year [but] the MoF data from early August indicates Japanese investors are once again adding foreign notes and bonds.”

This is (probably) set against profit-taking in flatteners, which have obviously worked, and news flow out of Europe, whether it’s double-digit inflation in the UK or scorching-hot factory-gate prices in Germany, could argue for the continuation of last week’s nascent steepener. But between the Fed’s determination to reinforce its commitment to getting rates into restrictive territory and the “round number” allure of 3% on US 10s, the flattener is a tough fade.

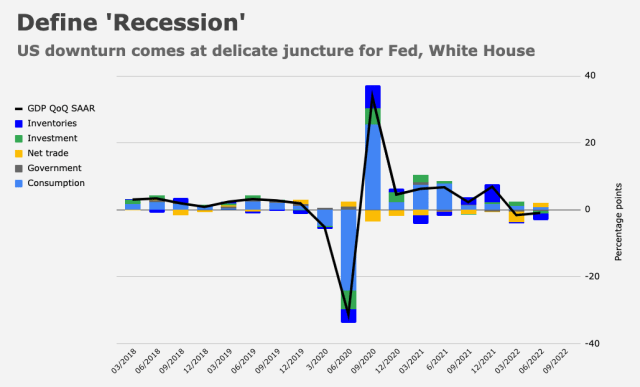

In any event, Jackson Hole isn’t the only notable on the docket. Investors will also get the second read on Q2 growth. Normally, I’d characterize that as a non-event, but given that the advance read on Q2 GDP put the US in a technical recession (figure below), any material revisions could draw some interest.

Again, I doubt the updated numbers will move any needles, but recall that the third iteration of Q1’s GDP report came with a surprisingly large revision to the personal consumption component, so it’s worth watching.

Meanwhile, the rest of this month’s housing data (which obviously reflects July’s activity) is on deck. New home sales and pending home sales will be contextualized via last week’s spate of unfortunate monthly readings, which included an eighth consecutive drop in home builder sentiment, a fifth decrease in single-family starts and a sixth straight drop in existing home sales.

Finally, and perhaps most importantly, Friday brings personal income and spending data for July, along with PCE prices. Investors are clamoring for clarity on the consumer, and the updated government report will ostensibly offer clues. The real personal spending print will be eyed especially closely, as, of course, will the price gauges. Ideally, the consumption figures will be solid without being ebullient, and the PCE price prints generally consistent with the “peak inflation” narrative.

Powell’s address at Jackson Hole will be delivered an hour and a half after Friday’s data release. Needless to say, he’ll want to avoid a repeat of last month’s press conference. Even a hint of dovishness would be counterproductive. The quickest way out of this predicament for everyone involved is for financial conditions to stay tight enough for long enough to ensure wealth effects from rising stock prices aren’t making the Fed’s job any harder. When you’re in a hole (or, in this case, a Hole proper), stop digging.

I am actually considering moving my non-taxable accounts to cash.

Ever the optimist, even I am concerned about the lack of potential “good news”.

I was hoping for gridlock in Congress, but it is almost hilarious watching how dysfunctional the Republican party is right now. The chance for “gridlock” after the midterms seems to be diminishing by the day.

On the “plus” side (to staying in the market), is the extraordinary amount of excess (meaning this wealth is not needed to buy groceries) money/wealth out there in the hands of so few that has to go somewhere. High rollers with deep pockets can stay at the tables.

I prefer incremental moves myself. I’ve been raising cash by reducing tech and even utilities (which I’m generally loathe to do) given their recent high flying performance. I’m looking to add to my underweight EDV and TLT (I think you’re not a treasury person…?) and my short SP 500 and Russell hedges, and maybe some more precious metals …going completely to cash in this inflationary environment is safest for sure but I think there’s other diversified places to balance things out…just my 3 cents worth…

H-Man, as i write tonight the 10s are sniffing a 3 handle in Chicago futures – 2.99. If the 10’s move to a 3 handle in the 3.15 to 3.40 range, not good for equities.