A pair of macro notables served as a reminder that however close we may be to turning any corners, the “now” zeitgeist, if you will, remains inflation and policy tightening.

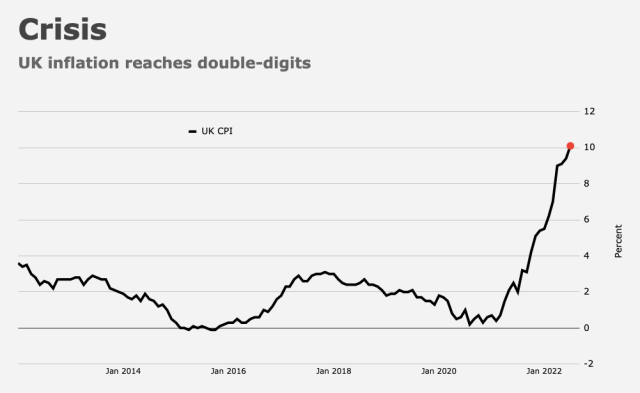

Consumer prices in the UK rose 10.1% last month (figure below), ONS said Wednesday. It was a dubious milestone. Inflation hasn’t exceeded 10% in the UK in four decades.

Wednesday’s figures suggested prices are accelerating faster than economists anticipated, which is saying something considering double-digit inflation was a foregone conclusion. Consensus expected 9.8% from the headline. July’s pace represented a marked acceleration from the prior month’s 12-month rate.

As a reminder: The UK’s cost of living crisis is, by most accounts, the worst among developed nations. And there’s no light at the end of this particular tunnel. The situation is expected to get much worse before it gets any better.

In a nightmarish set of forecasts delivered at its August policy meeting, the BoE said CPI will likely exceed 13% in the third quarter and stay close to that through year-end amid soaring household fuel bills, which were projected to rise 75% in October when the energy price cap resets. “That would mean those bills are three times higher than a year earlier,” the bank noted, flatly. The BoE also sees a five-quarter recession.

CPIH inflation rose 8.8% in July, also hotter than forecasts. Housing and household services accounted for almost three percentage points, with electricity, gas and other fuels driving the increase (figure on the left, below). Food and non-alcoholic beverages contributed more than a full percentage point, and made the largest contribution to the monthly increase. Bakery products, dairy, meat, vegetables — it’s all more expensive.

ONS noted that the overall contribution from housing components to the annual CPIH rate last month was the highest on record (figure on the right, above).

This is, plainly, a disaster, and it’s made worse by political uncertainty. The BoE is a scapegoat, which means that even if they weren’t inclined to keep hiking rates into what policymakers expect to be a prolonged downturn, they’ll do it anyway.

It’s far from obvious how additional rate hikes will help. Demand will surely crumble as the oncoming recession bites, and there isn’t anything the bank can do about energy prices. They’ve hiked rates for six consecutive meetings and are poised to commence gilt sales (i.e., proactive balance sheet rundown).

Nevertheless, Wednesday’s inflation figures were seen as raising the odds of another 50bps move. August’s upsized increment was the largest hike since 1995.

Speaking of 50bps hikes, RBNZ delivered a fourth consecutive on Wednesday (figure on the left, below). “Core consumer price inflation remains too high and labor resources remain scarce,” the bank said.

It was the seventh consecutive hike from New Zealand, which got an early start and is now squarely in restrictive territory (figure on the right, above).

Adrian Orr didn’t mince words in the policy assessment. “A range of indicators highlight broad-based domestic pricing pressures,” he said. RBNZ will “continue to tighten until… there is sufficient restraint on spending” to bring inflation back to between 1% and 3%. The bank is “resolute.”

Coming full circle, if the question is whether the zeitgeist has shifted — whether we’re out of the proverbial woods on inflation and determined efforts to bludgeon runaway price growth into submission with a blunt object — the answer is “no.”

Don’t you all think that it would be so helpful if the Fed issued updated “dot plots” once every week?

Hey honey, it’s Dot Plot Tuesday!

Better yet, we should install “interest rate sensors” on the Fed members themselves and post a live 24-hour dot plot feed on-line.

H can add a lighted daily Fed rate increase decrease odds tracker frame to his classic dystopian cold, wet, and gray street scene from years ago…that image remains embedded in my thoughts and memory as we navigate our current world and reality…

Total Blade Runner vibes