Fade it at 4,200.

That’s still the mantra for some strategists convinced the nascent rebound in US equities is likely to run out of steam at or near current levels.

In “Chasing Ghosts,” I described the thinking among skeptics. That level on the S&P 500 is seen as “a kind of bridge too far for a star-crossed bear market rally condemned to collapse under the weight of negative earnings revisions.”

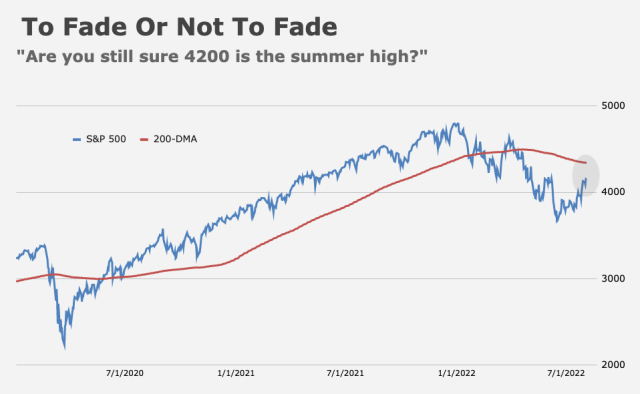

In the latest installment of his popular weekly “Flow Show” series, BofA’s Michael Hartnett underscored the point. “We say fade SPX >4,200,” he wrote. Hartnett would “go short” at 4,342, near the 200-day moving average (figure below).

There are a hodgepodge of reasons to believe stocks could run away higher in an extension of what, so far, has been a rally driven by systematic flows and short covering of one sort of another. There’s scope for trend-followers to add longs, and for vol control strats to re-allocate to equities contingent on a generally well behaved market, for example.

As discussed in the linked article (above) fundamental and discretionary investors were out of position, and some of them are chasing. “Are you still sure 4,200 is the summer high?” Hartnett wrote, describing the mood, and calling the rally “painful for many.”

“Prominent, high-profile Tech / Growth HF investors have been destroyed YTD for obvious reasons, but then too saw [big] underperformance versus the basic index during July’s rally,” Nomura’s Charlie McElligott remarked, citing recent media headlines.

The figure (above) shows the Long/Short crowd’s rolling one-month beta to the S&P. It sits in just the 9%ile.

Like Nomura’s McElligott, Goldman’s Cecilia Mariotti and Christian Mueller-Glissmann see scope for an extension of the rally driven by systematics, but also like McElligott, they alluded to the risk that material additional upside for equities from here could be counterproductive under the circumstances.

“A further re-set in equity volatility can drive an increase in positioning across systematic investors,” Mariotti said, noting that “the extent of such re-risking has been limited so far but, if extended, it could contribute to further relief in the equity market.”

In addition, Goldman said risk parity strategies “might be pushed to add risk if the VIX remains in the low 20s and rate volatility continues to be under pressure,” while Mariotti sees “very few signs of re-risking in the hedge fund community despite the equity rally of the past few weeks.” The figures (above) provide some additional context.

The problem is always the same: This rally is counterproductive for a Fed desperately trying to tighten financial conditions. Officials were adamant about the primacy of the inflation fight this week. A bevy of Fed speakers pounded the table during a dizzying array of speaking engagements.

Chasing the rally is, to a certain extent anyway, akin to fighting the Fed. Historically, that’s a losing proposition.

At the same time, the macro backdrop is very dicey. On that front, there are two paths to a “rip lower” over the next four weeks, BofA’s Hartnett said. One entails a “very hot” string of data, which would embolden the Fed, another a “very cold” spate of data, in which case stocks could “catch down to the inverted yield curve” as the recession risk becomes real.

“Without clear signs of a positive shift in macro momentum, temporary re-risking could actually increase risks of another leg lower in the market rather than signal the end of the bear market,” Mariotti wrote. “This is particularly the case if the positive shift is driven by the systematic community and not by fundamental investors.”

Global equity funds saw outflows of $2.6 billion last week (a $5 billion outflow from mutual funds more than offset a $2.4 billion inflow to ETFs), while bonds raked in $11.7 billion, the most since November.

Glad Hartnett made the weed joke so I didn’t have to.