Risk sentiment was severely impaired Monday, when acute angst about the outlook for Fed policy manifested in steep losses for global equities and more front-end fireworks in rates.

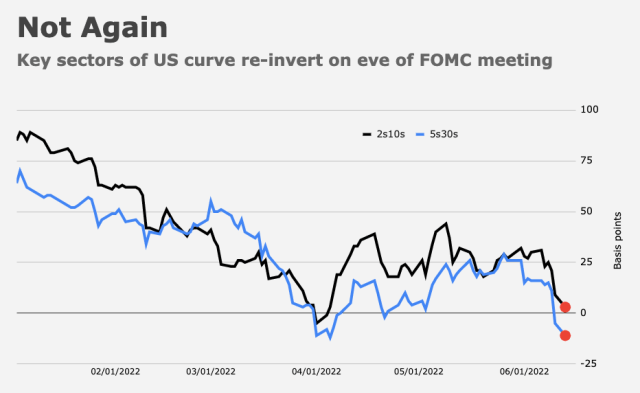

After jumping 25bps in the wake of another scorching CPI report, two-year US yields staged an encore, rising sharply to the highest since 2007, briefly inverting the 2s10s in the process. Five-year yields rose more than 10bps, deepening the 5s30s re-inversion.

The optics for the Fed weren’t great. Re-inversions (figure below) were ammunition for critics, and piled still more pressure on officials ahead of Wednesday’s critical decision.

Ideally, the Fed would like to correct the “mistake” telegraphed by the bond market, but they can’t. Or at least not via any conventional dovish tilt. That would only reinforce concerns about policy inadequacy.

It’s not entirely clear what a “good” outcome would be. A dovish hike accompanied by a knee-jerk bull steepener would almost surely backfire — it’d set off a cacophony of cat calls and could easily undermine faith in the Committee’s conviction. A hawkish hike risks exacerbating the FCI tightening impulse while doing little to answer critics who say 50bps is woefully inadequate.

Once again, I’m compelled to suggest that the optimal move is either a 75bps hike or, at the least, 50bps with an effective pre-commitment to 75bps in July. If you think that’s too aggressive, then be prepared to watch equities and bonds bleed. Because that’s what’s going to happen until the Fed establishes control and reclaims a narrative they lost long ago.

The two-day bear flattener was dramatic. Two-year US yields were up 40bps in just two sessions (figure below).

At one juncture Monday, market pricing reflected 175bps of hikes over the next three meetings. The presumed sequencing would be 50bps in June, 75bps in July and another 50 in September. All ahead of the US midterms.

Across the pond, two-year German yields jumped 10bps to 1.07%. It was the first time the German front-end has seen 1% in more than a decade.

Italian bonds sold off a fourth session, pushing yields to the highest since January of 2014. The BTP-bund spread was out to 230bps+. Expect more “fragmentation” chatter. The market continued to push the issue on ECB hikes, seemingly with the intention of forcing Christine Lagarde into multiple 50bps moves.

The read-through for global equities was dire. The figure (below) is a snapshot of the malaise.

Renewed concerns over COVID lockdowns in China didn’t help, and neither did jitters over the Bank of England and the yen’s ongoing slide.

One way or another, the Fed has to restore order, and for the first time in recent memory, that likely means surprising markets on the hawkish side.

As it stands, traders and investors are grasping at straws, and plainly think the Fed is too.

Read more: Volcker Or Bust: What To Expect From June’s Fed Meeting

The street is pushing the weak hands out of the market and will buy low. Vix was at 34 last I checked. If it gets to 40, you are looking at an entry point