“Twitter deal temporarily on hold pending details supporting calculation that spam/fake accounts do indeed represent less than 5% of users,” Elon Musk tweeted, just before 6 AM in New York on Friday.

He linked to a Reuters article dated May 2, which cited a familiar passage from Twitter’s 10-Qs.

Every quarter (or every recent quarter, anyway), the company includes a “note regarding metrics” which briefly describes “an internal review.” Using a sample, Twitter tries to estimate the percentage of mDAUs comprised of “false or spam accounts.” Invariably, the review puts that share at “fewer than 5%.”

But Twitter always includes a caveat. “The false or spam accounts for a period represents the average of false or spam accounts in the samples during each monthly analysis period during the quarter,” the filings invariably say, noting that Twitter “applie[s] significant judgment” when it makes the determination. The company then concedes that its estimates of spam accounts may not be accurate and that “the actual number of false or spam accounts could be higher than we have estimated.”

I think it’s fair to say a lot of people question the 5% figure, and I’d also note, in Twitter’s defense, that determining the true percentage of active users comprised of spam accounts is, for all intents and purposes, impossible.

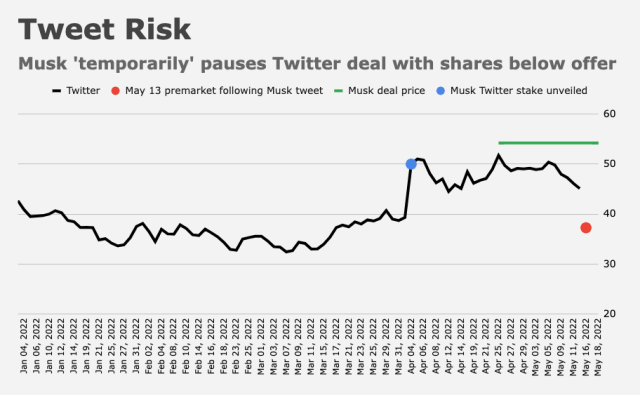

None of that is new. It’s in every 10-Q going back years. Musk knows that, of course. He’s made no secret of his disdain for “spam bots,” but considering market conditions and, more to the point, where the shares were trading versus Musk’s offer as of Thursday’s close (figure below), one can’t help but wonder if he’s looking for an excuse to negotiate better terms, possibly in conjunction with some new consortium of investors.

The stock plunged in premarket trading following Musk’s announcement (red dot in the figure). It trimmed losses, but still closed nearly 10% lower on the session, bringing this week’s loss to more than 18%.

A few days ago, Hindenburg Research suggested the deal may be in jeopardy. “We are supportive of Musk’s efforts to take the company private, and believe he could get it done, but see no reason why he should at these levels,” the firm said, citing “significant risk” that the deal would ultimately be repriced lower.

The ongoing selloff in US tech shares had already lopped some $5 billion off the company’s market cap since Twitter accepted Musk’s offer late last month. With a single tweet, he wiped away another chunk.

Meanwhile, the ubiquitous “people familiar with the matter” told Bloomberg that Musk is attempting to strike a deal with investors that would give him enough in preferred equity financing to obviate the need for a margin loan against his Tesla shares.

Initially, he was poised to borrow $12.5 billion against his stock as part of the financing for Twitter. After securing more than $7 billion from Larry Ellison, Sequoia and some Mideast royals, he needed just $6.25 billion. That’s convenient. Because, when you take into account the drop in Tesla’s stock price (which the media has partly attributed to ambiguity around the Twitter deal) and Musk’s recent share sales, he wouldn’t have been able to cover the $12.5 billion with margin loans if Tesla dropped too far below $850. If he only needs $6.25 billion, that number is (ironically in this context) $420, according to Bloomberg.

With Twitter now trading at a huge discount to Musk’s offer thanks, in part, to Friday’s tweet, he would appear to have more leverage.

I’d be remiss not to gently note that some market participants might view this situation as untoward. Some might argue, for example, that Musk is leveraging Twitter against itself. Again. It’d be ludicrous to pretend he wasn’t aware that his Friday tweet might cause the stock to plunge, and while the (apparently stalled) deal includes a $1 billion fee if Musk were to pull out, that’d be a price worth paying if he can save multiples of that with better terms. I won’t pretend to know the legal ins and outs of such a gambit, but I doubt there’s any ironclad language that precludes Musk from pursuing some manner of money-saving end-around.

Additionally, Twitter is in a very poor position here, or at least in my opinion. Friday’s knee-jerk plunge in the shares following Musk’s tweet is probably indicative of what would happen in the event the deal falls apart and isn’t resurrected. And that’s to say nothing of what might happen to the stock if Musk walked away and then sold his 9% stake in the company.

Coming full circle, some will be skeptical of the notion that the sole motivation for Musk’s decision to “temporarily” place the deal on hold was a boilerplate disclosure in Twitter’s quarterly filings.

Later, Musk said he’s “still committed” to the deal. According to an internal memo, Twitter this week implemented a freeze on hiring and unveiled new cost-cutting measures. Some offers may be rescinded. Two senior leaders are departing the company, apparently at CEO Parag Agrawal’s request.

“I think it’s fair to say a lot of people question the 5% figure, and I’d also note, in Twitter’s defense, that determining the true percentage of active users comprised of spam accounts is, for all intents and purposes, impossible.”

Have to disagree with you here H. If Twitter were to implement a real ID verification system they could actually be able to determine the percentage of active users comprised of spam accounts, they could also eliminate all spam accounts. The problem with that is, they rely pretty heavily on spam accounts to drive user engagement and thus ad revenue. Spam is a necessary evil in the social media business model. Regular people just aren’t that interesting and not worth logging in to read tweets from all day long.

“If Twitter were to implement a real ID verification system they could actually be able to determine the percentage of active users comprised of spam accounts, they could also eliminate all spam accounts.”

That is categorically false.

I personally oversaw the implementation of just such a system on a site with tens of millions of monthly users. People will go to lengths you can’t even imagine to get around those verification systems, including the use of other people’s government-issued IDs, all manner of end-arounds to circumvent IP checks and a dizzying hodgepodge of other shenanigans including, when necessary, dubious Zoom calls and fake phone numbers. And that’s to say nothing of the fact that the best state-sponsored hacking networks and arm’s-length “private” companies (think NSO Group) consistently make a mockery of even the best Silicon Valley minds. Those type of folks run laps around Apple and Google’s engineers all day, every day. The idea that Twitter can sort all of that out when Google and Apple can’t is laughable. Read this: https://www.newyorker.com/magazine/2022/04/25/how-democracies-spy-on-their-citizens

I have to ask; are you implying that the techies at the private companies are just plain smarter than those at Google and Apple? OR, are security breaches more about the nature of coding and the open nature of the internet. I guess I’m asking are the immigrants who breach a border wall smarter than the engineers who designed it. Building up is almost always harder than tearing down.

Read that linked article. NSO (and there are more) routinely stuns Apple, Google and Facebook with the sophistication of Pegasus.

For example:

“Apple’s investigation took a week and involved several dozen engineers based in the United States and Europe. The company concluded that NSO had injected malicious code into files in Adobe’s PDF format. It then tricked a system in iMessage into accepting and processing the PDFs outside BlastDoor. ‘It’s borderline science fiction,’ the person familiar with Apple’s threat-intelligence capabilities said. ‘When you read the analysis, it’s hard to believe.’ Google’s security-research team, Project Zero, also studied a copy of the exploit, and later wrote in a blog post, ‘We assess this to be one of the most technically sophisticated exploits we’ve ever seen, further demonstrating that the capabilities NSO provides rival those previously thought to be accessible to only a handful of nation states.'”

Obviously, this is a bit apples-to-oranges. But the point is just that if the question is whether Twitter has the capability to literally reduce all shenanigans to zero, the answer is unequivocally “no.” If NSO can outwit Apple and Google, any halfway intelligent person is going to be able to beat some half-baked Twitter check, in my opinion.

There’s more than just that. If twitter were to impliment ID verification, their users would drop by 90% or more. I use Twitter. I wouldn’t spend five minutes jumping through hoops for permission to use their platform, and I absolutely wouldn’t send them a scanned copy of my Driver’s License for the privilege of rage-tweeting at strangers.

I’m very aware of the Pegasus spyware produced by the NSO group and how it has been installed on many elite government official’s devices. I agree that Apple and Google pretend their security is undefeatable but rely on advertising to make that argument convincing. I am also aware that our government has done nothing in the way of sanctioning Israel over the use of this malware. Nor over its other issues involving questionable security practices as illustrated in the book “Catch and Kill” by Ronan Farrow.

I would also suggest if you have the capacity and guts that you install MVT to check if you have Pegasus installed. https://github.com/mvt-project/mvt

I would also like to point out that you didn’t mention Amazon in this list. AWS has so far been unbreachable (when properly configured) which should say something about the minds of Silicon Valley when security is a priority.

I don’t know what that has to do with requiring an ID.me type verification system currently leveraged by many government agencies including the IRS. Granted, a very ambitious hacker will eventually be able to get around that verification system, but how many would be willing to go to those lengths to do so? Even hackers employ economics in their thinking, if they have to spend months getting into Twitter to be able to setup a spambot account what’s the benefit? What could they do instead with their time and talent that would be more valuable?

And to WMD’s point, not very many casual users would be willing to go through this step just to rage tweet or read rage tweets which is kind of my point. Twitter doesn’t provide enough value to justify a lengthy registration process for most users. This probably should be a red flag for anyone interested in purchasing the platform for monetization purposes…

I see this an example of why Elon Musk is so wealthy: he’s not afraid to threaten to renege on a deal (over some dreamed up technicality) in order to get more money out of it. (Business integrity != Real life integrity).

Do you remember how much he hated on the Tesla Shorts, that they were financial manipulators?

The current “tech wreck” certainly makes his offer look foolish, and the fact that he’s rapidly pulling in other people’s billions and reducing his exposure tells me he knows it was a mistake and he’s mitigating.

Absurdly, now the Twitter board has even more incentive to finalize the sale that they at first weren’t too excited about.

Speculation is that Musk may shift TWTR to a subscription model and reduce moderation. Those sound inconsistent, but maybe not? I get value from Twitter, by following a limited number of specialists in specific fields. Unlike FB, TWTR is not aggressive about “showing me” content I didn’t choose to follow. I’d pay a subscription, especially if it got me an ad-free feed and I didn’t have to see the ugly mess that an unmoderated Twitter may become (but maybe not a Twitter that is unmoderated but behind a paywall?).

I suspect, however, that TWTR cannot be highly profitable as a subscription model, or as an advertising model without moderation. In fact, I question whether it is possible for TWTR to be highly profitable at all.