We’ve seen it before. The Fed pivots hawkish, only to recant in the face of a market revolt.

On the heels of Jerome Powell’s abandonment of “transitory” last week, I suggested the Fed chanced a December 2018 redux. Between the apparent prioritization of fighting inflation, the prospect of an accelerated taper pace and the implications for liftoff of a taper that ends three months ahead of the original schedule, the Fed is on the brink of implementing a multi-faceted tightening push — without actually doing anything other than announcing a plan to buy less bonds starting in January.

The market tends to bring forward expected future policy shifts, which means tomorrow’s prospective tightening can become a semblance of real today through asset prices and volatility.

“The Fed’s recent coordinated messaging shift to ‘inflation fighter’… has risk assets stuck in a de-leveraging and exposure reduction cycle,” Nomura’s Charlie McElligott wrote Monday, noting that the dynamic is especially acute given crowding in “‘easy-policy’ trades like leveraged bond proxies and against a general complacency as it pertains to the Fed’s ability or willingness to tighten.”

That latter bit is key. Markets have every reason to doubt policymakers’ resolve, hence the above-mentioned crowding.

McElligott noted the Fed’s “intolerance for pain” since the financial crisis, citing policy reversals around the Taper Tantrum, the so-called Shanghai Accord (in early 2016 when the world looked perilously close to a disinflationary spiral six months on from China’s overnight yuan devaluation) and, of course, Powell’s comical about-face in January of 2019.

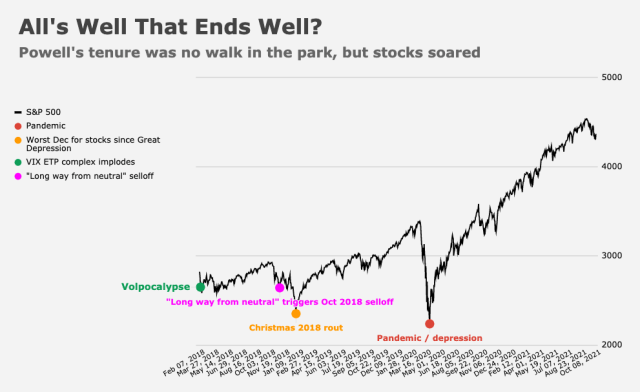

Powell’s early 2019 reversal (communicated during a panel discussion with Janet Yellen and Ben Bernanke) followed a harrowing Q4 for markets, including the worst December for US equities since the Great Depression. The tumult was catalyzed initially by Powell’s “long way from neutral” communications misstep, which he inadvertently exacerbated two months later with the infamous “auto-pilot” faux pas. As a quick reminder, Powell’s first term was fraught, mammoth gains for stocks notwithstanding (figure below).

In any event, there’s palpable concern about the Fed being “serious this time,” so to speak. After all, policymakers weren’t staring at the hottest annual inflation prints in 40 years during previous reversals. And, for once, it’s at least possible that the executive wants tighter policy, not easing.

And so, everyone is trapped. The Fed, by inflation. And markets by positions taken on the assumption that monetary policy wouldn’t deviate too sharply or too abruptly from the script, especially not in the direction of tightening.

“Last week de facto evidenced a sense that the ‘Fed Put’ has been (at least temporarily) re-struck lower,” McElligott went on to say Monday, adding that positioning is being “netted- or grossed- down into year-end risk mitigation and illiquidity, as the Fed is now viewed as unable to ‘bend the knee’ to a market which is conditioned for a [dovish] pivot.”

There’s a sense in which all bets are off until inflation cools, especially considering the poor optics for the White House of persistently rising prices. Economists expect PCE to come down starting early next year (figure above).

“It seems increasingly clear that until CPI likely peaks in Q1 2022, the Fed is unable to kick-save us ‘easier’,” McElligott added, calling inflation “a tier 1 political hot potato.”

Powell is flexible and subject to data and market gyrations. That is good. He was correct to pivot tighter. The economy was given several shots of morphine over the last 2 years and rightly so. If it was too much, the easiest way to adjust is for the Fed to taper and if necessary raise rates off the zero bound. If the economy runs hot and the FOMC does this that is a good thing. Being at the zero bound for interest rates is suboptimal from central bank policy making and economics anyway. If the FOMC is able to raise the funds rate to 2% or more for the right reasons- the economy is growing fast/running hot- what is the problem with that? In fact, if you really think about it, that is ALL GOOD. The problem for the FOMC is the question – is this a head fake and the economy fades just as they start to tighten? Solution- stop buying bonds, and wait and see a little bit before raising rates after the taper is done. Better to be a little bit too late than too early. And it appears that is what Powell and Company are doing. Nobody has a crystal ball. And Powell stumbled in 2018-19. But he seems to have learned from his mistakes…. it is all you can ask.

H-Man, when Powell did the pivot he was encouraging inflation which was a stated goal of the Fed. Now that his wish has come true, not sure a pivot will be an escape hatch. Methinks he will stay the course until the demon has been subdued.