Markets remained jumpy Wednesday as higher yields and rapidly rising energy prices kept traders on edge.

Adjectives like “ridiculous” were bandied about as Dutch and UK gas futures surged some 40% to new records (figures below).

“We are currently living exceptional circumstances,” one analyst at an energy consultancy declared.

Wednesday’s moves came atop 20% increases on Tuesday. Earlier this week, Reuters cited more than a half-dozen sources in reporting that Glencore, Gunvor, Trafigura and Vitol are all facing margin calls on their positions in natural gas markets, where trading houses managed to run up some $30 billion in shorts.

“To hedge against price differences between physical gas in the US now and the rest of the world in the future, traders need to short positions in the European and Asian gas futures markets,” the linked article noted. “The strategy caused a liquidity squeeze last month when European gas prices soared due to a variety of factors including low inventories, high demand for gas in Asia, low Russian and LNG supply to Europe, and outages.”

“To put it into context, benchmark gas prices are trading at the equivalent of more than $200/bbl of oil,” PVM’s Stephen Brennock remarked. “This should further encourage gas-to-oil switching and exacerbate the current supply deficit in the oil market.”

That switching dynamic helped drive crude prices to seven-year highs Monday, when OPEC+ decided against additional supply hikes beyond the scheduled increase for November.

“It appears that the OPEC+ producers are prepared to fill their coffers and let prices drift higher for the time being,” RBC’s Helima Croft wrote, noting the cartel’s decision to stick to the existing plan came with “de minimis discussion despite a deepening energy crisis in Europe and Asia that could dent growth rates in those regions.” “The short OPEC statement made no reference to the soaring gas prices and shortages,” Croft noted.

Aramco this week saw its market cap rise beyond the $2 trillion mark (figure below), raising the specter that the Kingdom could once again be home to the world’s most valuable company should prices continue to rise.

Apple, like other tech giants, is vulnerable to rising yields. And surging crude prices are likely to put further pressure on bonds. In other words, the convergence shown in the figure (above) is being pressured in Aramco’s favor on both sides.

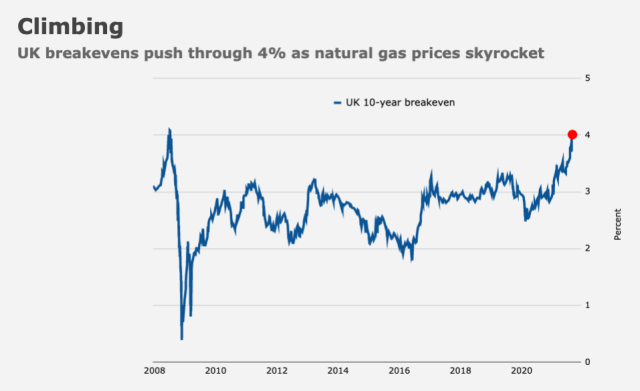

As noted here Tuesday, the global energy crisis some warned about over the summer is now “realizing” right in front of us. And, as you’d expect, market-based measures of inflation expectations are responding. 10-year breakevens in the UK hit 4% Wednesday, for example (figure below).

30-year yields rose above 1.5% in the UK for the first time since the onset of the pandemic. German 10-year breakevens hit an eight-year high. And so on.

German power for Thursday traded as high as EU350/MWh in the OTC market. The day-ahead power record was 301.54/MWh set more than 15 years ago.

There are myriad problems with this rather unfortunate conjuncture, not least of which is the read-through for monetary policy. If you hike rates to put a lid on inflation and anchor expectations, you risk squeezing the economy at a time when one crisis (the pandemic) is still percolating and another (the energy crunch) is gathering steam.

Pray it’s not a cold winter.

Asymptotic rises in energy prices fairly quickly reverse these days. In order to sustain these prices through the winter you are going to need a cold winter. An average or warmer winter will portend a fairly rapid reversal in natural gas and oil prices- especially if economic growth starts leveling out. I have seen the stories about shale not ramping up- when you see oil prices go up any more- shale producers can simply hedge their output and drill more to produce more cash flow. It cannot ramp up in an instant but shale production is pretty fast. When you get more shale you also get more associated natural gas as well. And there are more LNG facilities coming online. This spike will probably last through late December or maybe sooner. Take my forecast at face value- it is a guess- but it is a pretty well informed one.

It’s past time for nations of the world to realize we’re all in this together. ‘It’s a Complex World’ (the Young Adults) and any nation believing they can just take care of their own is screwing themselves as well as everyone else. The ‘screwing effect’ used to have a built-in delay, but not so much anymore.

Appears to be a trader’s paradise.

Are these market swings “much ado about nothing”?

We’ll find out when you get your January gas bill.

I am betting that Biden backs off “green energy/curbing oil drilling” when the cost to fill up America’s gas-guzzling trucks/SUV’s causes anger and a backlash against Dems. Same goes for natural gas.