Right on cue, Elizabeth Warren assailed Jerome Powell again on Tuesday.

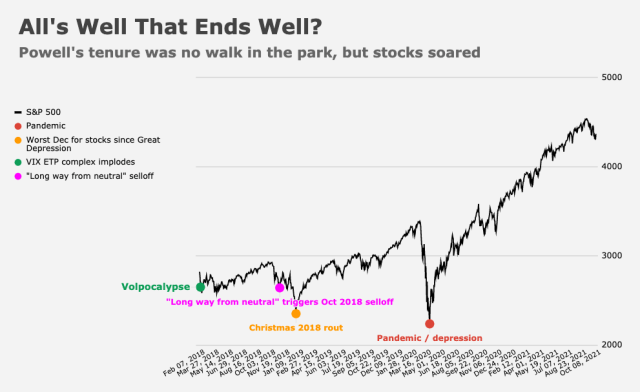

Powell has “failed as a leader,” Warren said, effectively tripling down on her public opposition to a second term for a man whose tenure as Fed Chair included the implosion of the VIX ETP complex (on his very first day at the helm), a trade war, a bear market, a pandemic, another bear market, a fleeting depression and a two-year, one-sided war of words with Donald Trump.

A walk in the park it was not (figure below). Part of me is surprised he doesn’t simply drop out of contention and retire.

Warren’s latest broadside came just a day after she called for an SEC investigation into trading activity at the Fed. “At a minimum,” Robert Kaplan, Eric Rosengren and Richard Clarida exercised “really bad judgment,” she said, during a Senate speech.

She also wondered “why Mr. Powell did not take steps to prevent these activities.”

It’s a good question. Powell would likely plead ignorance. In fact, he already has. Last month, when quizzed by reporters during his post-FOMC press conference, Powell said he “was not aware of the specifics of what they were doing.”

Although uncertainty around the Fed isn’t helping when it comes to shoring up confidence at a delicate juncture for markets, it was no hurdle for this week’s installment of “turnaround Tuesday.” US equities stormed back from Monday’s swoon thanks to — I don’t know, just write your own boilerplate copy. Pretty much anything will work. Just ask a journalist.

If you ask an analyst, in this case TD’s Priya Misra, Tuesday was a reflation-on day. “Longer term, I think the rate move is pricing in the Fed exit,” she told Bloomberg. “Today the move is more about TIPS breakevens, so the energy crisis is being priced into the rates curve.” That underscores some of the points I’ve made here over the past several days about the composition of the move in rates and how the energy crisis could mean a change of driver even as the direction of yields (up) remains the same. 10-year breakevens hit a four-month high.

There was plenty of fretting over the debt ceiling. Lisa Murkowski said she’s “looking for a compromise.” Chuck Grassley said he’d “vote to raise the debt ceiling if the GOP was at the table.” Mitch McConnell, who on Monday blamed Joe Biden for the standoff, said there’s “no dispute” about whether the issue “needs to be addressed.”

All you can do is laugh. Analysts aren’t laughing, though. Or if they are, they’re keeping the jokes out of their notes. The irony of a technical default would almost invariably be that long-term Treasurys would rally. Hard. If you’re looking for something that might arrest the selloff at the long-end, a flight to safety (in this case to obligations issued by the defaulting government) would probably do the trick.

“I do regard October 18 as a deadline. It would be catastrophic to not pay the government’s bills, for us to be in a position where we lacked the resources to pay the government’s bills,” Janet Yellen told CNBC’s Andrew Ross Sorkin. “I fully expect it would cause a recession as well,” she added.

Asked “what keeps them up at night about the stock market,” respondents to RBC’s Q3 US equity investor survey offered a variety of quotables. To wit, from RBC:

- “Rapid interest rate rises triggering Value over Growth outperformance – since currently not structured for such”

- “A perceived change in monetary policy that surprises the market (faster than consensus due to inflation that is not so transitionary)”

- “Fed is really, really late. Small changes in interest rates will weigh very heavily on government, corporations and consumers”

- “Powell being forced out”

- “US government policy and spending plan could be secular drag on GDP”

- “Congress not passing budget or raising debt ceiling”

Those were among the US-focused replies. Respondents also worried about “Contagion of some sort coming out of China’s problems,” “China invading Taiwan,” “Israel bombing Iran,” “feckless Biden” and “shots fired between dueling hegemons.”

None of that is supposed to be funny. And it’s not. But at the same time, note that those are actual, verbatim survey responses. If you didn’t emit a chuckle (or three) imagining institutional investors sitting at a desk somewhere muttering about bombs, “feckless” leaders and world wars, you should check your pulse.

For whatever it’s worth, bearishness is on the rise while bullishness has leveled off. “Those describing themselves as bullish or very bullish were flat from our latest survey at 47%,” RBC noted.

As the figures (above, from the survey) show, those professing to be bearish or very bearish on stocks doubled to 28% from 14% in June.

“Pessimists on the overall US equity market continued to rise, but remained below past highs,” the bank’s Lori Calvasina said. “This suggests the unwind in institutional investor sentiment… hasn’t fully played out, which may contribute to further volatility in the stock market near term.”

I’m no fan of Finance, but methinks Sen. Warren’s effectiveness as a critic of the sector has passed its sell-by date.

She is boiler plate of herself. Intellectuality gone completely political.

Her effectiveness is not great, but her message is still on-point. In a properly functioning government, it should be a matter of course that everyone above a certain level of power would put their finances in a blind trust while in office. If you don’t want to do that, don’t run for office.