“Competition without innovation is low-level competition and zero-sum competition between vested interest groups,” Shi Jianzhong wrote, in a commentary for China’s Economic Daily.

Who is Shi Jianzhong? Well, Shi is a member of the “expert board” of the State Council’s Anti-Monopoly Commission. And Shi’s commentary suggested Beijing should further hasten the pace of legislation aimed at ensuring fair competition in the digital economy. Shi decried “monopolistic activities” by China’s largest online platforms, which use “discriminative algorithms” and leverage “enormous capital.”

Problems in China’s digital economy are at least partially attributable to “blind spots” in the regulatory apparatus. Companies, Shi said, “take advantage of loopholes in the coordination between different government agencies and legal institutions.”

You have to chuckle. It’s not that any of that is untrue. Shi’s assessment is all too accurate. What’s funny is that scarcely a week goes by without Beijing reminding the tech industry that Xi is nowhere near satisfied, almost a year into China’s sweeping antimonopoly push.

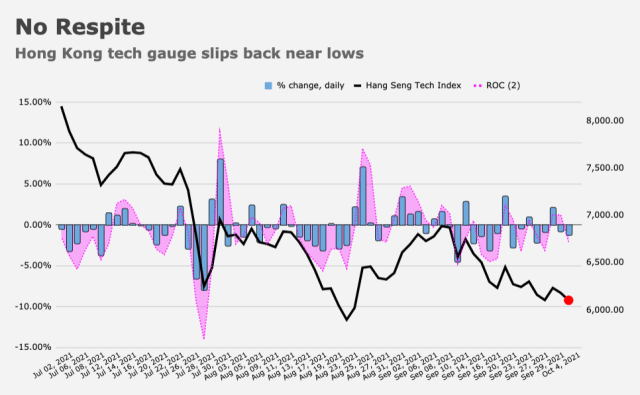

Don’t look now, but the Hang Seng Tech Index is back near the August lows (figure below).

Alibaba hit another record intraday low in Hong Kong Thursday.

It didn’t help that SCMP ran yet another story suggesting Chinese regulators have effectively halted approval of new online games. No new video game licenses were announced for August and September, an article dated Wednesday said, noting that the vacuum “break[s] a tradition of monthly approvals.”

Earlier this month, SCMP jumped the gun in suggesting Beijing ordered a complete moratorium. Subsequently, the paper “clarified.” Beijing hadn’t, in fact, suspended all new approvals. Rather, Chinese regulators had merely “slowed” approvals “temporarily.”

Fast forward three weeks and SCMP again described a “halt” which it said “reflects Beijing’s harsher stance on what constitutes appropriate gaming content.” The paper cited a memo from “a recent internal training course organized by China’s state-backed gaming association” in reporting that “regulatory review of gaming content is getting stricter and companies will have to stay clear of a long list of red lines if they want games approved in the future.”

Meanwhile, coal prices in China hit another record. As mine output struggles to keep up with power demand amid the country’s worsening energy crunch, prices have doubled in 2021 — and then some (figure below).

Coal futures in both Zhengzhou and on the Dalian hit a record Thursday.

The official manufacturing PMI fell into contraction territory for September, data out before the holiday showed (figure below).

The Caixin gauge printed 50, while the official services sector index rebounded sharply after diving in August on renewed COVID protocols.

Finally, rounding out the news flow from the world’s second largest economy, Evergrande managed to make payments to some wealth management product holders.

“Dear investors: According to the previously announced ‘Hengda Wealth Investment Product Redemption Plan,’ for investment products that expire in September, our subsidiary Evergrande Financial Wealth Management has completed the first 10% redemption on September 30,” the company said. “Relevant funds have been issued to the corresponding investors’ accounts.”

As a reminder, irritated investors have three options for recouping their “relevant funds.” One is to collect 10% of principal (plus interest) on a quarterly basis. Other options include discounted real estate or an offset to payables on previously purchased residential units.

If it ever seems like I close articles without a punchline, note that quite often, the deadpan cadence is the punchline.

My first read is usually just your words. A second read is for “between the lines” and what was not said.

Is this going to be similar to Japan in the early 1990’s, when Japanese and global capital flowed out of the TSE and into the NYSE/NASDAQ? This time around, I am paying attention. In the early 90’s, I was focused on other things…..