Earlier this year, in “The Wealth Tax And Our Shared Insanity,” I suggested that anyone worth $1 billion or more who hasn’t figured out how to avoid paying most taxes has “failed as a rich person.”

Although that assessment was meant to elicit a chuckle, it wasn’t a joke. It’s mostly true. If you’re rich and you’re paying taxes, you’re derelict in your duties as a rich person. That, even as you make good on your obligation to society, where you, like everyone else, enjoy all manner of perks ostensibly funded by taxpayers (let’s leave aside the fact that, strictly speaking, the US government doesn’t actually “need” anyone’s tax dollars to fund spending).

Tax avoidance by the rich is like most other contentious issues in at least one regard: The public periodically gets a glimpse of the unvarnished truth, but nobody really cares because everyone knows nobody is going to do anything about it.

Earlier this year, for example, a new study suggested the richest Americans “hide” 20% of their wealth from the IRS, likely “robbing” the government of some $175 billion annually. Scarcely anyone cared. If anything, it felt like the number should be higher. Other research suggests it is.

It’s with the above in mind that I read ProPublica’s Tuesday exposé, in which Jesse Eisinger, Jeff Ernsthausen and Paul Kiel detailed what they billed as “revelations” from “a vast cache of IRS information showing how billionaires like Jeff Bezos, Elon Musk and Warren Buffett pay little in income tax compared to their massive wealth.” “Sometimes,” the article’s suspenseful subtitle read, they “even [pay] nothing.”

Forgive me for channeling Steve Martin’s Neal Page: “Do you think so?”

I like to bury the lede in almost everything I write. Contrary to popular belief, I don’t do that to be annoying. If you follow journalistic protocol, you end up telling the entire story in the first two paragraphs. Below, for example, are the first two paragraphs from the ProPublica piece:

In 2007, Jeff Bezos, then a multibillionaire and now the world’s richest man, did not pay a penny in federal income taxes. He achieved the feat again in 2011. In 2018, Tesla founder Elon Musk, the second-richest person in the world, also paid no federal income taxes.

Michael Bloomberg managed to do the same in recent years. Billionaire investor Carl Icahn did it twice. George Soros paid no federal income tax three years in a row.

Why would you read any further? What else do you need to know? In fact, all but the most credulous Americans probably stopped reading after the article’s title, which trumpeted: “Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax.” There’s the whole story, right there. IRS documents show rich people don’t pay what they “should.” Next you’ll tell me politicians lie.

I didn’t want to pan ProPublica’s work. I really, really didn’t. They’re clearly quite proud of it and I’m sure Democrats (and especially Progressives) will pounce all over it to promote various versions of a wealth tax. But the article is a laughable collection of “no sh*t Sherlock” passages, including this one:

Taken together, [a vast trove of IRS data] demolishes the cornerstone myth of the American tax system: That everyone pays their fair share and the richest Americans pay the most. The IRS records show that the wealthiest can — perfectly legally — pay income taxes that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year.

And this one:

Many Americans live paycheck to paycheck, amassing little wealth and paying the federal government a percentage of their income that rises if they earn more. The confidential tax records obtained by ProPublica show that the ultra-rich effectively sidestep this system.

Nobody needed any “confidential tax records” to come to the conclusion that the super-rich “sidestep” the tax system. That’s part of being super-rich. I’m reminded of the “It’s what you do” GEICO commercials: “If you’re rich, you avoid paying taxes. It’s what you do.” Now that you mention it, that’s especially apt given that Warren Buffett owns GEICO.

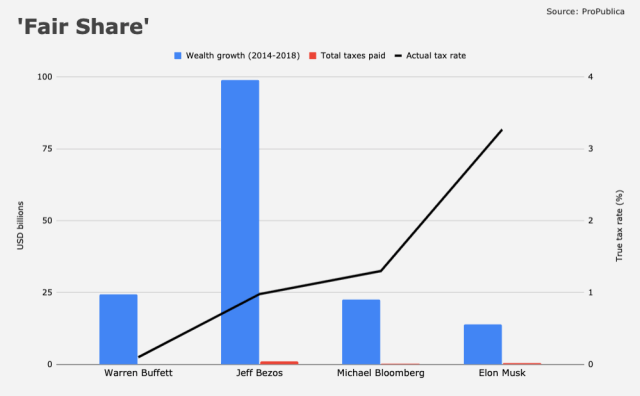

The figure below (adapted from ProPublica’s piece) is simple enough.

The red bars are useless. And that’s on purpose. The fact that they’re essentially invisible is a testament to the notion that the richest Americans pay basically no taxes, at least when compared to their wealth gains. For example, on ProPublica’s math, Warren Buffett’s wealth grew by more than $23 billion from 2014 to 2018. He paid a total of $23.7 million (with an “m”) in taxes. His effective tax rate, according to ProPublica, was thus 0.10%.

You’re reminded that the world’s richest 20 people saw their net worth balloon by a half-trillion in 2020 while the world suffered through the pandemic (figure below).

ProPublica refused to say how it got the data for the exposé. “[It] was given to us in raw form, with no conditions or conclusions,” the article said, adding that reporters “spent months processing and analyzing the material to transform it into a usable database.”

Poor guys (and gals). They should have just perused the article linked here at the outset. The richer you are, the better you “should” be at avoiding taxes. It’s part of the (mostly legal) game.

I’ll recycle some of the language I used back in March. We argue vociferously (as a society) about whether it’s “fair” to say that wealthy people “deserve” to be hit with a punitive tax. While there’s no way to answer that definitively when the discussion is couched in normative terms, there is a way to answer it definitively when you think about it from the perspective of “creative” accounting. Again: If you’re wealthy, and you’re still paying taxes, then yes, you “deserve” to be taxed at an even higher rate. Why? Because you apparently aren’t smart enough to have figured out the one ironclad rule of being rich — namely, you don’t ever pay any taxes. Just ask Donald Trump.

Although that assessment was exaggerated for comedic effect, the bottom line is always the same. Most wealthy people aren’t paying anywhere near their “fair share,” and everyone knows it. So yes, obviously, they “should” be paying more. If that’s the debate, it’s not clear it’s worth having.

Enormous fortunes tend to multiply exponentially, and the larger they are, the more true that tends to be. When you consider offshore accounts, loopholes, and business structures that allow for legal tax avoidance, the pittance the government might be able to extract in the form of a wealth tax is meaningless — a rounding error for anyone who ends up paying it, and just like all other attempts to tax the rich, they’ll figure out a way around it, likely via some kind of offset.

In closing, I’d just note that the reason Trump’s infamous $750 payment in 2017 garnered as much attention as it did wasn’t because Americans felt collectively shocked and aggrieved that Trump wasn’t paying more. Rather, it was news because of the lengths he went to to avoid releasing his returns. The public was arguably more interested in how he might react to the disclosure (by The New York Times) than to the figures themselves. The surprise would have been if Trump paid anything close to what one might describe as “fair.”

In a written response to ProPublica, Buffett said (among other things) that after his death, “99.5% of what I have will go to some combination of taxes and disbursements to various philanthropies.” He didn’t dispute the article’s contention of his “true” tax rate. “Huge dynastic wealth is not desirable for our society,” he remarked.

My only real question as taxing companies and the wealthy is not even attempted and as you say it’s from a funding perspective irrelevant… why not just eliminate federal income taxes? Why should anyone owe the government a share of their survival wages. I mean if you’re making over $100k maybe you owe something but the first $100-150K of income does not need to be taxed as heavily as it is. State taxes I understand, they after all cannot issue currency, but federal taxes on someone making $35k a year are pretty insane at this point.

Given the MMT reality and our feudal late stage capitalism capture of most wealth by a tiny fraction of people, I was thinking along the same lines. Do we really need taxes at all?

The government might be able to maintain expenditures by printing $$$ and it’s not clear it’ll be inflationary in an environment where the wealth is mostly hoovered up (i.e. not spent and thus “neutered”)

they pay little in taxes b/c its an INCOME tax. once one has a small fiefdom, all personal expenses flow through ‘the business’, and just like in Cheers, sam malone wins a bet with the rich guy, one year’s wages: $1.

good article towards a flat tax. 3% of every $ that passes to you goes the feds. but as you mention, the US doesnt ‘need’ tax money to run its budget.

the people who pay the most are the tax donkeys in the middle….100k to about 400k see significant sums go to taxes. once above that addl income is protected on more of a long term basis and may never get taxed.

So, if the value of my house goes up $ 10,000, I shouldn’t pay taxes on it (remembering I received no additional cash to use to pay taxes) but if the stock of the company one of the super-rich founded goes up, they should pay tax. Where do we draw the line? It’s hard to feel sorry for Elon Musk, but where is he supposed to get the cash to pay taxes on the increase in value of his Tesla shares? It’s like the ’80’s good news-bad news joke: “I got them down $ 500 million on the price, but they want $ 10 million in cash”

You might be able to find a better analogy than that one. If my house goes up $10,000 in value it gets assessed higher by the property appraiser and then yes, my property taxes do go up the next year.

No doubt about that, but the mil rate probably isn’t too onerous. What kind of wealth or unrealized capital gains rates are being contemplated?

property tax gets updated every year based on assessed value, so you do pay for house value increase, at least in my neck of the woods it happens

Seems like a VAT is the answer, but how to do it and preserve a decent level of progressivity?

Can’t. Families with higher income spend a smaller portion of their income, so VAT will be less of their income than the percentage for lower income families.

Buffett said that after his death, “99.5% of what I have will go to some combination of taxes and disbursements to various philanthropies. Huge dynastic wealth is not desirable for our society,” he remarked.

Of course.

OTOH, huge wealth that allows you to skew the capitalist creative destructive machine during your life is not very desirable either. I mean, I don’t know for sure what Buffett kids are up to, but my bet is they didn’t have to worry about much even with dad giving away 50% of his wealth while alive and 99.5% when he dies. And Buffett grandkids were also well looked after, I would bet… I doubt college debt was a problem for them…

FWIW, this is not anti-Buffett or anti-rich people. I would vote for guys like Buffett or Bezos etc. if they were running for office.

Yes, running a business and running government are different but I imagine there’s a fair overlap in the skillset, notably when it comes to a willingness to experiment to improve efficiency and quality of outcomes for consumers/users/citizens.

To paraphrase the Washington post, the only interesting outcome of the article will be how much jail time the data leaker will get

The heart of the problem here is that the ultra-rich seem to have made money when they get richer as their holdings get more valuable. But the wealth isn’t money until the shares are sold. Buffett doesn’t take a huge salary like Musk. He doesn’t need to — he lives quietly in Omaha. The IRS only gets to tax income. It’s not clear to me that a “wealth” tax would be legal under the Constitution (remember we had to pass a Constitutional Amendment to even permit an income tax).

The very rich can get very wealthy without cash income but the folks H labeled as “technically rich” have a tougher time. I looked into those mechanisms the rich use and avoiding all taxes can, in fact, get very expensive. For US corporations to avoid US tax on overseas earnings they have to leave the money overseas. That’s no fun. For citizens, much the same thing is true. You can shelter a lot of increased wealth but you can’t make it into actual money without creating at least some prospect of a taxable event. My net worth has increased every year for the last 40 years, starting at essentially zero. Only a small part of that increase has been taxable so for the last decade with just a simple effort my average federal tax has ranged from 7.5-8.5%. Half of my increased wealth, although quite real, is tax exempt. Anyone can do what I have done but one thing needs to be clear, like with Buffett, although I have avoided a bunch of taxes, it’s my charities and my child who will end up with most of the money.

“Rather, it was news because of the lengths he (Trump) went to to avoid releasing his returns.”

I suspect and hope there will be more to it than the measly $750 he paid in taxes as a basis for why he refused to release his taxes…as he said to Hillary in their last 2016 debate paying little to no tax would mean “I’m smart.”

Money laundering for Russian crime bosses (oligarchs) perhaps … ?

…hopefully we’ll find out…