On Tuesday afternoon, I spent some time reflecting on what counts as a “selloff” or a “correction” these days.

Coming into the week, the Dow had gone more than 30 sessions without a 1% move to the downside, discretionary exposure hit a record on one bank’s composite positioning gauge and even in the wake of Monday and Tuesday’s selling, five-, 10- and 20-day realized vol remained indicative of a somewhat somnolent spring drift.

What constitutes a “buying opportunity” in a market that only rises? It’s the same psychological phenomenon that drives inflation. If you think it’s going to be more expensive tomorrow, you buy it today. If it goes on sale today, even better.

Read more: 2% Is The New 10%

Sure, another big rout is inevitable at some point. That goes without saying. But given policymakers’ desire to keep risk assets stable (and risk-free asset prices almost completely administered), it’s possible that dip-buying becomes so preemptive that serious downdrafts are only possible to the extent they’re mechanical, flow-based or otherwise attributable to unemotional selling by market participants “who” aren’t carbon-based.

What does that mean? Well, think back to the dynamics which allowed “BTD” to metamorphose from a derisive meme about retail bagholders into a viable (indeed, a nearly infallible) trading “strategy.” Investors became acutely aware of their own role in shaping the evolution of monetary policy — they learned that beyond a certain threshold, central banks would verbally intervene to reassure markets. Once investors knew to expect verbal intervention at, say, 10% down on a major benchmark over a short window, it made little sense to wait on equities to fall 10%. If you know it’s coming down 10%, you buy down 7%. But if you suspect the next guy (or gal) has made the same calculation, you won’t wait around for him (or her) to buy down 7%. Rather, you’ll buy when stocks are down 5%. Everyone is front-running everyone else in an effort to front-run central banks, and before long, the entire exercise becomes so recursive and self-referential, that even the most minuscule of drops are immediately bought.

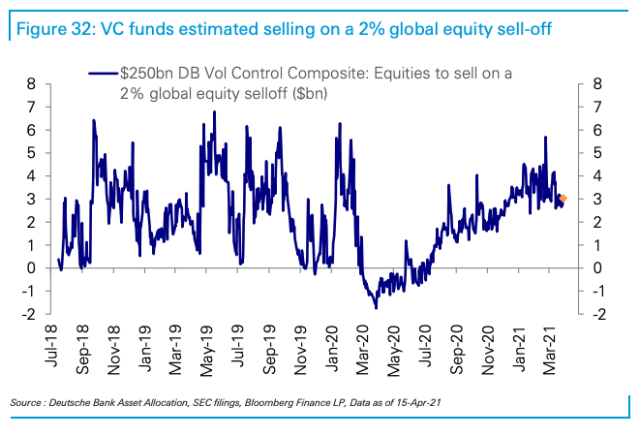

That’s a kind of “rules-based” approach, but it’s also inherently ridiculous and depends quite a bit on human psychology, both as it manifests in discretionary investor behavior and the behavior of the policymakers investors are trying to front-run. Systematic strats, on the other hand, are literally rules-based. Exposure gets toggled up or down depending on a variety of signals and triggers, the most important of which is volatility. Note the deterministic character of the language used in the chart, below, from Deutsche Bank.

Quite a few of the major drawdowns witnessed over the past several years wouldn’t have been nearly as acute without the dreaded liquidity-volatility-flows feedback loop that ends up creating self-fulfilling, selling-begets-more-selling behavior tied to unemotional strategies.

With all of the above as the context, consider the following headline Bloomberg ran on Tuesday afternoon: “Stumble in Stocks Lacks Easy Explanation for Wall Street Pundits.” Suffice to say none of the explanations offered by the pundits cited in the article were very satisfying.

SocGen’s Andrew Lapthorne, writing Wednesday, offered something a bit more concrete. “[Tuesday’s] strong correlation between price momentum and beta factors suggest systematic selling,” he said.

“Sometimes the correlation between factors and daily share price movement is so strong it suggests a systematic process may be dominating the price moves,” he went on to remark, noting that this week’s early selling exhibited “a very strong relationship between individual stock betas and the daily price moves.”

For his part, Nomura’s Charlie McElligott, wellspring of daily quotables, said Wednesday that although the “down-trade in benchmark US Equities index was not particularly jarring [on Tuesday], the factor- and thematic- moves were substantial.”

Commenting further on the correlations mentioned above, Lapthorne noted that “top-down investors and fundamental investors don’t usually move stocks in such a uniform fashion.”

I am wondering if the sell off could be caused by continuing selling by Credit Suisse, liquidation of Infinity Q Diversified Alpha Fund ( really? A “math error” was their excuse!) and any other hedge funds/ family funds that are in serious trouble.

Hard to know what is going on with the “big” funds.

I feel like I am in my blow-up floatie in a sea of sharks.

“Luke, trust your feelings.”

I was thinking that ” buy the dip” was winding down. I will be mindful of this view. And use it for cherry picking.

The DTCC. Naked shortselling has gotten out of hand I bet all that free money the fed printed was put to terrible use by wallstreet.

It is really all about sentiment. Looking for fundamental reasons here is futile. The narrative is basically positive. Until confidence gets dented the market will continue to go up in irregular fashion. The world is awash in liquidity and confidence in central banks. Fiscal impulse is positive in the US as well. We could easily go up another 25% in a vacuum- regardless of some of the silly valuations out there. Just look at Dogecoin, SPACs, meme stocks. All the nonsense like that can continue for some time. Of course when sentiment shifts watch out- anyone’s guess as to when that happens..or why?

So I should stop worrying that entities/individuals who leveraged way up (and put up collateral) /bought on margin and their trade is going against them – are going to be forced to sell everything- regardless of whether their trade is going the right or wrong way- and cause an avalanche?