Between an accumulated rebalancing “miss” in 2020 and equity outperformance during the first quarter of 2021, pension community demand for duration is sizable.

That’s according to the latest from Deutsche Bank’s Jiefu Luo and Stuart Sparks, who took a look at what funds “should have bought” in 2020 in order to keep portfolio weights constant, and what they actually bought.

In a note dated Friday, they calculated the cumulative 12-month sum of “misses,” noting that “at the end of Q4, the accumulated residual need for fixed income was $150 billion.”

That has potential ramifications for the curve at a time when long-end rate rise and bear steepening is top of mind for market participants.

Bonds are, obviously, under siege. Markets are concerned that concurrent fiscal and monetary largesse is inflationary, and many worry that once the US services sector (for example) reopens in earnest this summer, the world’s largest economy could overheat.

The decades-long “duration infatuation” in rates is on the ropes, and given the extent to which duration is embedded across assets, the ramifications of a prolonged, deep bond selloff are potentially serious. The Bloomberg Barclays US Long Treasury Total Return Index fell into a bear market this month. The drawdown is ~22%, the worst ever (figure below).

In a refreshingly candid assessment, Bloomberg’s Ye Xie on Friday noted that “‘bull market’ and ‘bear market’ are colloquialisms, not an official thing.” It’s nice to hear that kind of reality check from a journalist, given the media’s penchant for trafficking in meaningless hyperbole and nonsense terms.

Still, this is notable. As the same linked Bloomberg piece pointed out, the index rose 4,562% from mid-1981 through March 2020. At no point did it ever drop 20% from peak to trough.

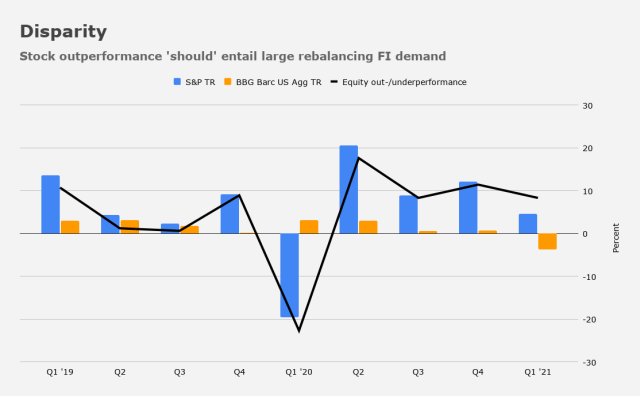

The disparity between bonds and stocks in the first quarter is thus large (figure below), despite Q1 not counting as a “blockbuster” for the S&P (although it’s certainly been kind to reflation plays and other equities expressions seen as benefiting from the new, pro-growth zeitgeist).

Bonds’ ~8% underperformance during 2021’s first three months “is consistent with a rebalancing flow of just under $100 billion out of equity, into fixed income, all else equal,” Deutsche’s Luo and Sparks said. That’s separate from the $150 billion in pent-up demand mentioned above.

To be sure, the rebalancing story is a secondary narrative considering the sheer gravity of the macro regime shift currently underway.

As Deutsche put it in their analysis, “rebalancing demand should be seen as a headwind to further increases in yields, but of secondary importance to fiscal stimulus and realized inflation.”