Fed officials offered a modest upgrade to their assessment of the US economy at the March FOMC meeting, while preserving cautionary language to reflect the inherent indeterminacy of forecasting during a once-in-a-generation public health crisis.

“Indicators of economic activity and employment have turned up recently,” the new statement read.

That was slightly more upbeat compared to the assessment the Committee delivered in January, when the statement lamented a moderation in the pace of the recovery and “weakness” in the services sector. Still, the Fed reiterated that “the sectors most adversely affected by the pandemic remain weak.”

On prices, the new statement simply noted that “inflation continues to run below 2 percent.”

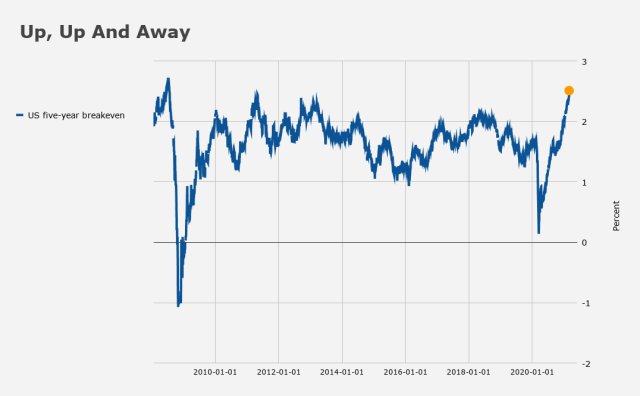

Critics are concerned about the potential for inflation to overshoot more quickly than the Fed can react. Breakevens are at multi-year wides, and some fear the combination of aggressively dovish monetary policy and unprecedented fiscal accommodation will produce inflation outcomes not seen in decades.

The new statement language suggested the Fed is, as expected, content to see how things develop. There was no sign of alarm or urgency.

One is reminded of Jerome Powell’s talking points. Average-inflation targeting is almost by definition not credible unless and until realized inflation overshoots. “At the end of the day, the public will need to see us allow inflation to move moderately above 2% for a time before the new framework will be seen as fully credible,” he said in January. Further, any hot prints over the next few months will likely be dismissed as “noise.”

All of that clears the way for yields and breakevens to rise, which the Fed has consistently characterized as evidence of the market’s faith in the recovery.

The all-important dot plot showed the Fed on hold through 2023. Seven dots are above zero for that year versus five in December. Four 2022 dots are above zero now versus just one three months back.

Despite officials’ repeated efforts to play down the notion that countenancing an inflation overshoot could quickly catch the Committee behind the curve, forcing rate hikes as early as next year, some market participants are keen on the idea that liftoff will be brought forward. At least a few folks at the Fed seem to agree.

While the “dot debate” is always a hot topic at critical junctures, it was especially topical coming into the March meeting.

Updated projections show the Fed sees PCE and core at 2.4% and 2.2% this year versus 1.8% in December. In 2022 and 2023, headline and core will be 2%/2.1% the Fed imagines. That compares to 1.9% and 2% late last year. This is consistent with the notion that the FOMC expects any spike in prices to be transitory.

Policymakers see the US economy expanding 6.5%, 3.3%, and 2.2% in 2021, 2022 and 2023, respectively, versus 4.2%, 3.2% and 2.4% at the December meeting. The unemployment rate is now seen at 4.5% this year and 3.9% next, compared to 5% and 4.2% three months ago.

Although jobless claims remain elevated above the pre-pandemic record, the February jobs report suggested the labor market may be on the mend in earnest. Crucially, employment in leisure and hospitality jumped 355,000 last month, as some states and locales lifted pandemic-related restrictions.

The Biden administration recently moved up the timeline on mass vaccination. It’s possible, the President said, that Americans will be able to enjoy a somewhat “normal” Fourth of July holiday.

Still, getting back to full employment is an uphill battle. And the Fed’s challenge in fostering a more inclusive jobs market was underscored last month, when the gap between the African American unemployment rate and the jobless rate for whites rose, despite the generally upbeat report. The Fed’s express intent to target labor inclusivity means simply returning to pre-pandemic levels of broad employment may not be enough.

On asset purchases, there was no change. Not that anyone expected something different. The recent backup in long-end yields (and bonds sold off further into the announcement) has prompted a veritable cacophony of “suggestions” from analysts, traders and everyone with a Schwab account and a Twitter handle. While WAM extension seems like a foregone conclusion, it wasn’t coming in March.

The language around asset purchases was left unchanged.

There was no IOER tweak. “The urgency for any shift in IOER/ON RRP had lessened,” BMO’s US rates team said. “It’s most likely an issue for another day.” They did boost the counterparty limit on the RRP facility to $80 billion from $30 billion.

Powell was staring Wednesday at one of the most daunting communications challenges of his tenure. As one trader told Bloomberg’s Vincent Cignarella, “if Powell gets out of this unscathed without roiling markets he should buy a lottery ticket because the powers that be are clearly on his side.”

Someone should remind that trader that Powell doesn’t need to buy any lottery tickets. His net worth is already the size of a jackpot. But, if he’s a gambler, maybe Powell should buy that ticket. Because against the odds, the press conference went well.

Full March FOMC statement

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world. Following a moderation in the pace of the recovery, indicators of economic activity and employment have turned up recently, although the sectors most adversely affected by the pandemic remain weak. Inflation continues to run below 2 percent. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus, including progress on vaccinations. The ongoing public health crisis continues to weigh on economic activity, employment, and inflation, and poses considerable risks to the economic outlook.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer?term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles; and Christopher J. Waller.

The market is happy.

Yeah, I mean “snubbed” obviously refers to expectations for the median projection to shift up for 2023

“Palatable Powell” placates players, prescribes policy palliatives

tldr: don’t worry, be happy 😉