I’ve heard some bad ideas in my time. Indeed, I’ve had some bad ideas in my time. And I’ve participated in plenty of bad ideas conjured up by other people.

As someone who speaks from experience, let me tell you something about bad ideas: They don’t always go wrong. Especially not in the near-term.

In fact, bad ideas involving schemes to make large sums of money have a way of going right in the near-term, assuming the people involved are smart, conniving, or, less frequently, actually believe what they’re doing is a good idea. (It goes without saying that stupidity ruins good ideas at least as often as it does bad ideas, so that need not apply.)

Bad ideas do tend to go awry over the long-term, though, but even that’s not guaranteed. Especially when one considers that humans work on a finite time horizon. Eventually, everyone dies.

That’s the lens through which I view MicroStrategy’s… well, their strategy, when it comes to Bitcoin.

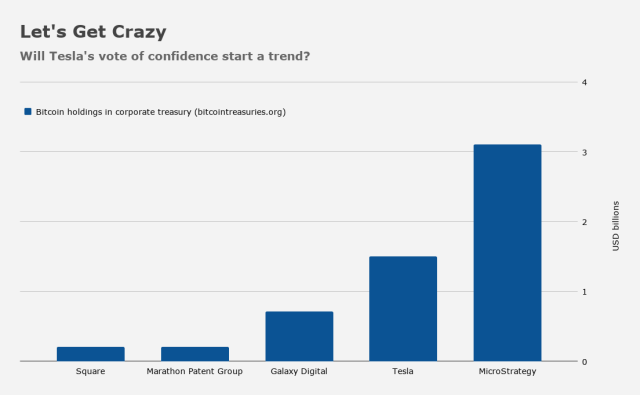

Most readers are probably apprised of the MicroStrategy story. CEO Michael Saylor is a fan of corporations putting Bitcoin on the balance sheet. Since last summer, when MicroStrategy made a highly touted, $250 million bet on Bitcoin, Saylor has been busy putting his money (and that of others) where his mouth is. The initial bet reflected a “belief that Bitcoin… is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash,” he said at the time.

MicroStrategy bought more Bitcoin on December 4. Then, a few days later, the company said it would sell convertible bonds and invest the proceeds in additional Bitcoin.

That latter move was billed by some as a “no-lose” proposition, even as it came across as somewhat exotic and, dare I say it, bizarre. MicroStrategy’s fate is bound up with that of Bitcoin. But, being convertible bonds, the downside for buyers of the notes is presumably limited, as long as you think MicroStrategy is highly unlikely to fold. The upside, on the other hand, is large because, again, MicroStrategy’s shares are trading like what they are: A sizable bet on Bitcoin.

Thus far, this has worked for seemingly everyone — and spectacularly well, at that. So well has this worked, that MicroStrategy’s shares have easily beaten Bitcoin itself over the past eight or so months (figure above).

Now, though, things are getting even weirder. For example, Bloomberg ran an article Tuesday which noted that MicroStrategy’s latest plan to issue more convertible bonds to buy even more Bitcoin, presents what Crystal Kim and Tom Contiliano called “a math problem,” the gist of which is that if you’re just in MicroStrategy for the Bitcoin exposure, you’re better off buying Bitcoin itself.

Why? Well, because the initially planned $600 million convertible offering would have allowed MicroStrategy to add about 12,250 Bitcoin to its stash, bringing the total to some 83,250. Here’s where it gets funny. “With about 7.6 million shares outstanding, each share would be entitled to 0.011 Bitcoin,” Kim and Contiliano said, adding that if you assume the $820 rally in the company’s shares since it first got into the Bitcoin business is attributable to the (official) shift in corporate strategy, it “would mean an investor who bought today would pay about $75,019 per Bitcoin.”

Obviously, that’s a kind of back-of-the-envelope way to go about things, but why not? You can’t value Bitcoin on any “fundamentals.” It seems to me that the ad hoc arithmetic presented above is just as plausible as anything else these days. How much was Hertz worth last summer, for example? And how do you get to GameStop at $483?

Of course, MicroStrategy is more than Bitcoin. So, perhaps that shouldn’t deter anyone.

What might deter me, though, is a suspicion that this will prove to be misguided over the long-term. That brings us full circle. This idea — selling convertible notes which investors view as “no-lose” propositions to fund the acquisition of billions in digital tokens with annualized volatility in excess of 75 — is a bad one, at least in my opinion.

And yet, it’s worked out spectacularly so far, despite what I would subjectively describe as myriad embedded absurdities, including what I assume is the possibility of significant quarterly volatility tied to accounting rules. I talked quite a bit about that as it relates to Tesla earlier this month.

The convertible notes issued to buy Bitcoin introduce a new wrinkle. As mentioned repeatedly above, some believe it’s not possible to lose on those notes. For example, one PM who spoke to Bloomberg late last month said that “even if Bitcoin goes down 30% to 40%, the company still has enough to pay this bond off easily.” I assume that’s accurate. But Bitcoin can fall 30% in a matter of days. It can fall 10% in a matter of minutes. It’s extraordinarily volatile, something everyone involved readily acknowledges.

To reiterate, my assessment that this “strategy” will perhaps be remembered as an epic boondoggle, is a subjective judgment on my part.

Often, when I lack what I consider to be the proper expertise to assess a situation with the type of veracity I typically demand of myself (usually the case in matters involving Bitcoin), I lean on common sense, but also on experience with bad ideas involving ways to make large sums of money.

That admittedly crude framework has served me well in the past. Indeed, it’s allowed me to profitably exit bad ideas when I’ve judged they might be nearing the threshold beyond which contrivance is no longer sufficient to overcome inherent danger or structural flaws.

That threshold has not been reached for many investors vis-à-vis Bitcoin or MicroStrategy, though.

On Wednesday, the company upsized its latest convertible offering to $900 million and slashed the coupon to zero. The notes will bear no regular interest. In other words, it’s entirely fair to suggest that these notes are being viewed by at least some investors as riskless Bitcoin calls.

They are perpetual calls- with giant counterparty risk. The market is probably not pricing that risk properly- that is obliquely what you reference as your common sense not liking the idea even if it works well in the short term.

Living at the beach on the Oregon coast is a dream life. However, you know that every 300-900 years, there will be a massive earthquake on the Cascadia subduction zone, with an accompanying tsunami that will wipe out everything on the coast. The last such quake happened in the year 1700. Several generations could live and die on the Oregon coast before there is a major earthquake. But someday, somebody will be wiped out.

The real question is regarding the “no risk” part. If BTC goes to zero (say), can MicroStrategy still pay off its loans based on its mundane revenue?

Same question if BTC goes to 10K, 20K, 30K… I assume that, above 30-40K, MicroStrategy would be okay but who knows? What’s their average initial cost on BTC?