US electricity markets grappling with a vicious deep-freeze aren’t the only places where a supply/demand imbalance has created fragility threatening to catalyze an “accident.”

That’s also the situation in the vol complex, Nomura’s Charlie McElligott said Tuesday, reiterating a handful of key points discussed in several recent notes.

Like electricity in some frozen locales across America, forward vol “has been bid only,” McElligott wrote, citing a set of what, by now, should be familiar “demand-over-supply” dynamics.

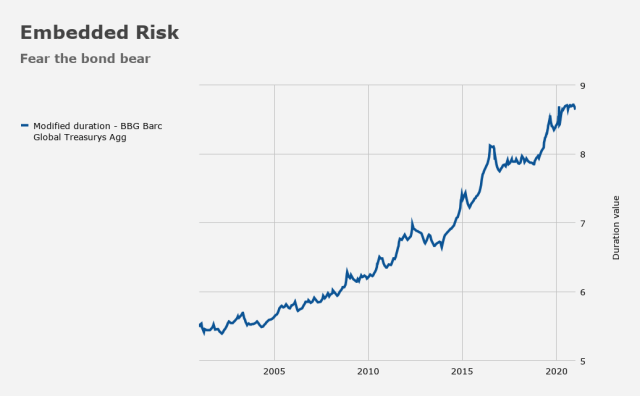

First, dealers are constrained in their capacity to be short size in crash hedges, tail risk, “and any term implied volatility,” due to VaR risk management and onerous regulatory burdens. Second, fixed income investors are looking to equities vol for hedges amid what many perceive to be a growing risk that the tried-and-true, decadesold, negative stock-bond correlation will no longer hold coming out of a forty-year bond bull, and into a reflationary regime characterized by massive stimulus, potentially combustible monetary-fiscal policy “partnerships,” and pent-up demand that could be released into the (still partially dormant) economy once vaccine rollout is complete. Third, as Charlie wrote Tuesday, there are “remarkable inflows into VIX ETNs creating enormous and incessant demand for Vega.” And fourth, folks are concerned that equities might run totally away from them (to the upside), so right-tail index is bid. The figure (below) is just calls and puts volume — a snapshot.

All of this follows naturally if you’ve kept yourself apprised of the various overlapping narratives.

Bonds are off to their worst start to a year since 2013, and there’s lots of duration embedded across markets, which means you need a new hedge in the event your old hedge (i.e., bonds) turns out to be a source of risk or, worse, volatility. So, you turn to equities vol, and that creates new demand against constrained supply.

When it comes to the “grab” for upside exposure, that’s in no small part a product of the quick rebound and subsequent sprint higher out of the GameStop shock.

“The rage deleveraging via the short-book ‘VaR-down’ calamity of just a few weeks ago then set the stage for an inevitably painful ‘grab’ higher thereafter,” McElligott said Tuesday, reiterating that “now we’re see[ing] signs of ‘crash-UP’ chasing from buyers into the Equities call-wing / right-tails, where there was already extreme downside put skew, which is in danger of adding to ongoing fragility in the Vol space.”

This all becomes a bit perilous. Why? Well, Charlie has explained this on a number of occasions recently (there’s additional color in the linked articles below), and he did so again Tuesday.

The “remarkably extreme term-structure steepness screams ‘roll-down’ from vol players… so specs are short front-month VIX futures in bulk vs long 1m / 2m,” he said, adding that “this is why we have experienced a handful of VIX short-squeeze ‘freakouts’ on only modest SPX pullbacks in recent weeks, speaking to the ‘broken’ nature of this supply / demand imbalance, with said fragility keeping us ripe for an accident in the near-future.”

At a 30,000-foot level, the whole world has felt “ripe for an accident in the near-future” for nearly a half-decade now. I don’t know about anyone else, but I, for one, wish that lingering sense of imminent calamity would go back wherever it came from.

Read more:

Volatility shock takes time to unwind. The inflation narrative currently being jawboned is highly suspect, in terms of treasury rates. The 10-yr is being pushed as a significant wake-up call, but most likely within 6 months that dog won’t hunt, because real growth isn’t likely to explode. I think we see the strange pandemic financial disconnects phase out slowly, leaving us with low rates and unrealistic asset levels. If anything, people will continue to be hyper-vigilent and over-reactive — versus the exact opposite of where they were for the last decade or so, i.e., hesitant and unsure, unwilling, frozen.

Thus, as everyone waits on the edge of their anxiety filled doubts for the massive pandemic to explode, the bubble will grow denser and volatility will be more normal — something to look away from and ignore. In that framework, people who have been chugging along in relative safe pension positions will grow increasingly disturbed by YUGE gains to penny stocks — and the bubbles will wobble and chaos will chug along, until the overall global pandemic actually, realistically subsides and fades away for the vast majority.

Here’s a glimpse from FRED of volatility with 2 yr, 5yr and 7 yr treasuries:

https://fred.stlouisfed.org/graph/?g=B7MB