If you ask Goldman, stocks probably aren’t a “bubble” — or at least not at the aggregate index level and not on a relative basis.

As I patiently explained in “Here’s The Reality Of ‘Bubbles,” stocks can never be a “bubble” because “bubble” is a noun that refers to a thin sphere of liquid enclosing air or some other type of gas. If you’re not the type for lengthy, philosophical, semantic debates, I penned a shorter version on Friday which simply pointed out that,

The problem with “bubble” as an adjective for speculative excess is that, through overuse and ubiquity, it’s often accepted as an objective term rather than a subjective judgment. When someone with clout calls something a “bubble” the media, and very often investors, accept that as a statement of fact rather than what it is — namely, one person’s attempt to express an opinion.

That said, there are plenty of signs that market participants are engaged in speculative activity, that investors are acting like traders, that new entrants view stocks as akin to poker chips, and that, to quote BofA’s Michael Hartnett, “those who want to stay rich are acting like those who want to get rich.”

In those types of environments it’s fair to suggest that folks who want to pretend like they’re sane (in the final analysis, we’re all insane in one way or another, but that doesn’t have to manifest in the decisions we make with our money) may want to exercise caution.

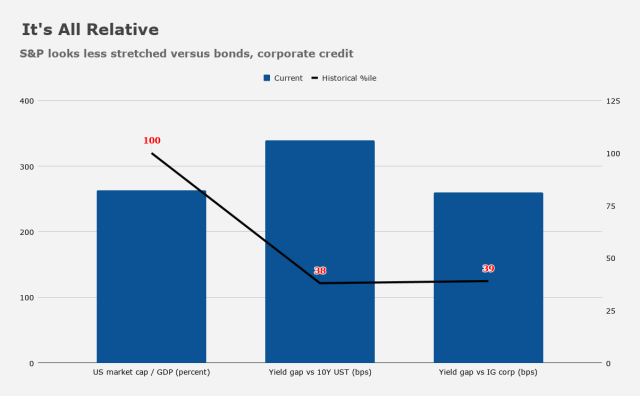

For Goldman’s David Kostin, it’s worth keeping in mind that it’s all relative.

“Among the questions we receive most frequently from clients is whether US stocks trade at unsustainably high levels (read: ‘Bubble’),” he wrote Friday.

The answer, according to Kostin, is that while “there is no doubt that valuations are extremely elevated on an absolute basis… taking into account the yield on Treasurys, corporate credit, or cash, the aggregate stock market index trades at below-average historical valuation.”

This is hardly a new argument. It’s been recapped, restated, and recapitulated every which way imaginable over the past 12 months.

I’d point out, as I often do, that it never seems to occur to anyone that two (or three) things can all be expensive at the same time. That’s pretty clearly the case with equities, bonds, and corporate credit.

Kostin didn’t attempt to ignore the obvious, though. He mentioned the mania in SPACs as an area of concern, and noted that over the past year, shares of companies with negative EBITDA have outperformed by 40 percentage points, which ranks in the 97th%ile going back nearly four decades. For reference, that figure was 140pp during the dot-com boom/bust. He also reminded folks that “just like in past economic cycles, many stocks with negative earnings today were profitable companies that dipped into unprofitability during the recession.”

As for penny stocks, where volumes have surged recently, the bottom line is that while trading in shares with prices below $1.00 has doubled since November and does, in fact, rank in the 99th historical percentile on Goldman’s data, the bank gently implored everyone to put it in perspective. “These firms only account for 1% of trading volume and less than half of 1% of market value,” Kostin noted Friday evening.

Finally, he said that the market “lacks the extreme investor leverage that is typical of bubbles.” Thanks to fiscal stimulus, disposable income is high and savings rates are elevated. Indeed, Goldman wrote that “the aggregate US household debt service ratio is nearly the lowest in at least 40 years.”

The read-through is just that while you might be inclined to say that the inexorable rise in equities is attributable in part to an influx of cash tied to stimulus, that by definition means leverage isn’t the primary driver. Whether or not there are better uses for that cash is another debate entirely. Kostin conceded that US margin debt is up, but if the post-tax cut melt-up parallel is your measuring stick, margin debt “currently registers a smaller share of market cap” than it did then. Meanwhile, money market fund assets are obviously still swollen.

Overall, Kostin’s assessment is that there are areas where “unsustainable excesses” exist, but they generally don’t pose a high “systemic risk to the broader market given their modest share of market cap.”

So, is there anything to be wary about? Well, yes. There is one caveat.

Kostin cited “extremely high-growth, high-multiple stocks” which, much like negative earners and penny stocks, have seen a lot of action.

“Trading volumes and share prices of stocks with EV/sales multiples over 20X have soared,” Goldman said, on the way to cautioning that “since 1985, the median stock trading at an EV/sales multiple above 20x has generated a subsequent 12-month return of -1%.”

“Trading volumes and share prices of stocks with EV/sales multiples over 20X have soared,” Goldman said, on the way to cautioning that “since 1985, the median stock trading at an EV/sales multiple above 20x has generated a subsequent 12-month return of -1%.”

When it comes to stocks that sport market caps greater than $10 billion, have trailing revenue greater than $50 million, and boast trailing and forward EV/sales ratios above 20X, CRISPR and Snowflake are on the list, as are DocuSign, Palantir, and Zoom.

This is one occasion in my less than storied life where a 20% correction would seem to be a development welcomed by many.

Runaway train……downhill, why stop at 20%. Starting to think the national conscienceness is aching for a real Depression.

If you look at S&P P/E chart it may make a case for things actually are different since 1990. Sit in cash 70% of the time? Has anything else changed since 1990?

Hartnett, “those who want to stay rich are acting like those who want to get rich.” Although all those who pontificate about being rich have started crying out in unison that this is not right. It is right now. Till it isn’t.

“the aggregate stock market index trades at below-average historical valuation.” I would like to see more charts like this one that show equity valuation relative to interest rate levels. With interest rates at all time lows i expect equities to be at all time highs.

Sometimes you have to take a punch, but timing is critical.