One of — and perhaps the — defining features of the Trump era was the subjugation of reality to one man’s parallel universe.

Initially, it appeared as though the former president’s penchant for exaggeration, wild hyperbole, and, in many cases, outright fabrication, was just an extension of the way he operated and communicated during his decades in the private sector. As discussed here last year, Trump was always just a Ponzi-scheme practitioner, socializing his risks and neutralizing himself against his bad decisions and actions.

The New York Times has exhaustively documented the extent to which Trump was never actually anyone’s idea of a “successful” businessman. It was always just a kind of legal Ponzi scheme, multiple reports appeared to show. Now, many suggest not all of it was, in fact, legal at all. The Apprentice was simply Trump playing a character — the character of “Donald Trump, successful businessman.” The irony was that the show resurrected Trump from the D-list and actually bestowed upon him a claim to actual, real success.

As his presidency unfolded, though, it was less and less clear whether Trump was simply trafficking in the same kind of balderdash and falsehoods that were always his trademark, or whether, at some point, he began to believe his own narrative — helped along by the reality distortion loop created by Fox News.

By mid-2018, it seemed Trump had lost track of the implausibility of it all. He was no longer “lying” as much as he was recounting life in a parallel universe where trade wars with China are “good and easy to win” and where he and Mike Pence had created an economic boom “the likes of which the world has never seen before,” as he told an incredulous crowd in Davos last year, just prior to the onset of the pandemic.

Of all Trump’s claims about the economy under his stewardship, perhaps none was parroted more often than the notion that a rising stock market proved he was both a successful president and a competent businessman. Well, the “reviews” (as it were) are now in and they are final, given that Trump is no longer president.

The good news for Trump is that he does, in fact, rank highly on the list of presidents in terms of stock market performance. The bad news (and the only news that’s likely to matter to Trump, by the way) is that he wasn’t number 1 and didn’t outperform Barack Obama in any meaningful way. Trump’s market was just 0.1% better in nominal terms and only 0.2% in real terms.

“During Donald Trump’s term in office, the S&P 500 generated an annualized real total return of 15%, ranking 6th out of 27 administrations since 1877,” Goldman wrote Friday evening. In addition to noting that Trump’s real annualized total return was essentially identical to the figures for the Obama and Clinton years, you might also note that the market does better, on average, under Democrats — and it’s not even close.

You could also fairly argue that this list is meaningless. If that’s you (i.e., if you’re inclined to criticize me for highlighting it) I’d politely respond that you’re engaged in question-begging. Nobody would make it a point to highlight this had Trump not himself tweeted and boasted about the stock market thousands of times (literally) over the course of his presidency. As Goldman wrote, “the 45th President always viewed the stock market as the most important barometer of his performance.”

It’s worth mentioning that the gains during the Trump years didn’t come without turbulence. There was the implosion of the VIX ETN complex, the worst December for US equities since the Great Depression in 2018, the May 2019 selloff when Trump broke a trade truce and blacklisted Huawei, the selloff in August of 2019 when Trump broke another trade truce, and, of course, the collapse in 2020 around the pandemic.

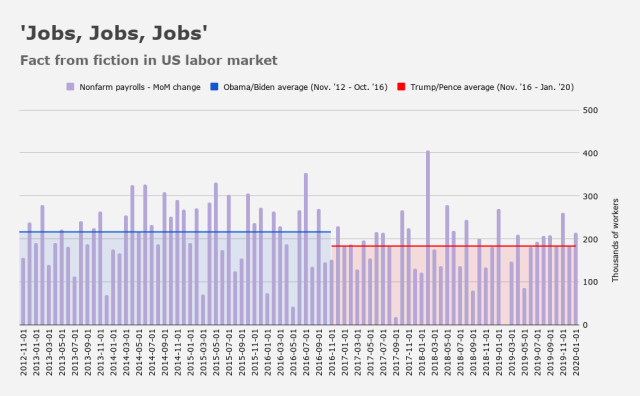

Even some folks who predicted Trump’s win in 2016 were incredulous at the claims he sometimes made. “He keeps talking about how jobs have never been created so much ever in history, except for one little fact: If you take the number of months Trump’s been in office and take the average nonfarm payrolls and compare it to the same number of months at the end of the Obama presidency, there were more under Obama!,” Jeff Gundlach exclaimed, during an interview with CNBC in 2019.

Gundlach went on to critique the role of social media in the post-truth era. “It’s unbelievable the twilight zone that we’re sort of living in, where people just say things and it gets repeated,” he lamented. “I think probably we’re numb to that because of social media.”

Fast forward to January 6, 2021, and that effect culminated in the Capitol riot.

But to Gundlach’s point, the pre-COVID Trump economy was never any semblance of historic. It was good, sure. But at no point was it anomalous. I’ve documented this exhaustively over the past couple of years. Regular readers are familiar with the two simple visuals I often use.

Leaving the pandemic aside, the figure (below) strips away the spin to show you the real comparison between the Obama/Biden labor market during their second term and the Trump/Pence labor market, prior to COVID.

Note that Trump has variously insisted that economic comparisons involving his presidency should include November and December of 2016 to account for the “Trump bump.” He also (rightly) says you cannot count the economic hit from the pandemic against him.

So, the visual (above) simply takes the average monthly gain in nonfarm payrolls from November 2012 through October of 2016 and compares it to the average monthly gain from November 2016 through January of 2020.

One gets a similar picture when looking at overall growth. Things were good, but not “great” — “again” or otherwise.

All of this is an afterthought now. The events of January 6 have forever changed the country and will define Trump’s legacy, which was already dubious on any number of levels.

Over the weekend, allegations that Trump and a Justice Department lawyer considered ousting acting attorney general Jeffrey Rosen on the way to compelling Georgia to overturn its election results only added to the former president’s long list of problems.

As Goldman put it Friday evening, while documenting Trump’s stock market legacy, “we will leave it to historians to analyze the policies and actions of the Trump presidency.”

The Trump library should be interesting. All the security briefings he never read and all the books written about what a failure he was.

Fun, and refreshingly new way to evaluate Trump’s presidency.

This actually spurs a question about rankings of the presidents. I’m not sure that the stock market during a presidency is a category that scholars of the US presidency consider. Would seem that it’s not useful because it can’t be compared across all presidencies. I’ll have to check the categories used in the Siena survey the next time I’m not on Twitter.

This is perhaps his best measure, and in it, Trump is still only as good Clinton and Obama. Despite being nestled in with them on the chart, he will never be considered to have had a successful presidency. This, as compared to Clinton and Obama, both of whom are considered to have been successful presidents. The billionaire businessman counting other people’s money for the rest of his llfe.

Assuming Trump can find a ghost writer who wants to work with him, we’ll have to wait until his memoir is released to see if he gets the irony.

Flash take from historians: Worst U.S. president ever.

https://www.nytimes.com/2021/01/23/us/politics/trump-presidential-history.html

Seems like one should also consider the expansion in the National debt ( including those portions issued to both the Fed and to third parties) during each presidency.

In round numbers, national debt increased $9T during Obama’s 8 years and almost $8T in Trump’s 4 years- so there was more equity( USD printing) and leverage (UST) used by Trump to achieve his stock market return.

I would also point out that if you take out the mechanical effect of the tax cut (about 10% or ~ 2.2% annualized) he comes out slightly behind Bush#1, pretty much in the middle of the pack.

I never got this insistence on measuring Presidents economic performance especially via simple measures like jobs created or stock market returns.

Both are pretty random – maybe you can try and make a case for D, on average, outperforming R, across cycles etc. But nothing much can be said of any given 4 years – especially if one neglects the changes at the Fed Reserve level.

I think it’d be more interesting to look at policy effects where economic sciences has something to say. R economic policy can be resumed to 3 pillars : cut taxes on the rich (and we KNOW, scientifically, that is useless macro wise), cut regulations on businesses (generally favorable to businesses and business activity) and cut social safety nets (very unfavorable to the lower quartile of the pop).

D economic policies are more complex but, as Krugman recently pointed out, it’s interesting to see the evolution of the minimum wage issue. As most practical studies show that small to medium increase in minimum wage don’t have strong disemployment effects (indeed, sometimes the reverse) and is a very effective tool in fighting poverty – more and more D policymakers are onboard with rising minimum wages…

It’s not just D policymakers getting onboard with rising minimum wages…while Trump won Florida by 3% the $15 minimum wage got 61%. That’s a lot of Trump voters and people scared of “socialism”.

Fair enough and GPWM but voters aren’t likely to be guided by much economic knowledge. Generally, Trump voters are not adverse to Big Government as long as “he hurts the right people (to quote a Trump voter).

Convincing the R elites holding veto power points (whether the Senate, SCOTUS, states governorships etc) has always been the problem.

… but I hope you’re right and that increased minimum wages work out well.

FWIW, it’s not my favorite tool (even without disemployment effects at the macro level, some job losses are impossible to avoid and I’d rather add jobs than recycle workers) and I do suspect that, past a certain point , it gets counter productive. It’s easy to see if you reason ad absurdum, with a $50 minimum wage. So whether the right number is $10 or $15 and/or whether it varies depending on location, or industry… TBD.

The first two paragraphs give a summary of Trump pretty well.. Do to the constantly changing Political landscape and tenure of the Empire in question it is pretty hard to draw a lot of conclusions about the Presidency and equity performance.. The narrative changes along the usual lines when viewed in Historical terms and scrutinized for common denominators..but still rendering objective criteria very difficult..

“It’s unbelievable the twilight zone that we’re sort of living in, where people just say things and it gets repeated,”

I have no doubt that Goldman opted to report all the way back to the 19th century. But I think it’s fair to question that decision. While Henry Poor published, originally, an investor’s guide to the railroad industry, I’d argue a better starting point is the 90-stock daily index introduced by the Standard Statistics Company. in 1926. At the least it’s more similar in construction to the current product.

The protocols may be looser on the Street, but combining unlike things like that would have been frowned upon uptown, where the object of study was nothing so tawdry as money but data, methods and social research.