Last month, Larry Summers fretted that “when you see the two extremes agreeing you can almost be certain that something crazy is in the air.”

Summers was referencing the admittedly bizarre coalition that lined up in the Senate in favor of the upsized $2,000 stimulus checks demanded by Donald Trump. “So, when I see a coalition of Bernie Sanders, Josh Hawley, and Trump getting behind an idea, I think that’s time to run for cover,” he said.

I harshly derided his comments about the stimulus payments. First, it was impossible to ignore the glaring contradiction between what Summers told Bloomberg Television just before Christmas, and the approach to fiscal spending he advocated in the wake of the financial crisis while advising the Obama administration. Second, an Op-Ed he penned days later in defense of those comments came across as a lazy appeal to basic economics aimed at justifying a position that many deemed unduly callous.

Of course, there is something to be said for the notion that one should be wary of policies that garner support from the political extremes, especially when those policies can be plausibly described as an effort to literally buy votes.

Josh Hawley, you’ll recall, is the lone senator on board with the motley crew of House Republicans who intend to object to Joe Biden’s Electoral College win next week (Ted Cruz will apparently join up too, but that’s another story). Bernie Sanders, by contrast, has repeatedly insisted that Trump is an autocrat, an authoritarian, and a grave threat to the republic.

Both David Perdue and Kelly Loeffler came out publicly in favor of the larger stimulus checks, and you didn’t have to be a political strategist to know that they were primarily motivated by the proximity of the Georgia runoffs (their Democratic opponents challenged them to support the $2,000 payments, and the last thing Perdue and Loeffler needed was to land on the wrong side of a Trump tweet ahead of next week’s crucial elections). Democrats in both the House and the Senate joined Trump in backing the bigger checks with virtually no political strings attached.

Summers is justified in casting a wary eye. Obviously, everybody involved (with the possible exception of Sanders) is simply trying to shore up their own political capital. Trump wants to cement his populist bonafides either in preparation for a 2024 run or else for some kind of pre-inauguration last stand later this month. Hawley is ambitious and reckons he can curry favor with Trump’s notoriously fervent base by backing the larger checks (it’s the same reason he’s supporting the objection to Biden’s electors). Perdue and Loeffler are staring down tight races for reelection. And Democrats are duty-bound by their ostensible “bleeding hearts” to unequivocally support calls for bigger direct payments, even when they come directly from the mouth of the man they impeached.

Again: With the exception of Bernie Sanders, it’s not clear who among the key players actually cared about the impact the larger checks would have on working people. Clearly, there are some House Democrats who care, and indeed they drafted the amendment for the bigger payments. But they’re not decision makers. And that gets us to the heart of the problem.

The names that America heard repeatedly over the course of the brief debate about sending $2,000 to the majority of taxpayers (versus $600) were, in no particular order, Hawley, Nancy Pelosi, Schumer, Trump, Perdue, Loeffler, Mitch McConnell, and John Thune.

With apologies, you cannot fully trust any of those people to act or speak without ulterior motives. Obviously, some of the people listed above are more trustworthy than others, and their relative trustworthiness depends on the issue at hand. But more importantly, none of them understand the real reason why it’s feasible and (probably) desirable to upsize the payments.

Nobody was prepared to confront the reality of government finance in America, and thus the debate was couched in what amounted to fantasy. Mo Brooks (the House GOPer who’s spearheading the effort to overturn Biden’s win), criticized the idea of $2,000 checks on the notion that the US can “go bankrupt,” for instance.

From the time Trump posted a video on Twitter demanding the bigger payments, there were myriad references from lawmakers to “how we’re going to pay for it.”

And, once again, the public seemed unable to connect the dots. Consider the following tweet from Steve Mnuchin, sent December 29 at 5:40 PM:

The Treasury has delivered a payment file to the Federal Reserve for Americans’ Economic Impact Payments. These payments may begin to arrive in some accounts by direct deposit as early as tonight.

It doesn’t get much clearer than that. Obviously, Treasury didn’t hold a bond auction that afternoon specifically aimed at funding those payments, nor did the tax man spend the morning beating down doors and collecting enough extra taxes to cover the disbursements. Rather, Treasury told the Fed to credit everyone’s bank accounts with $600, and the Fed keystroked that money into existence.

Notions of Ricardian equivalence notwithstanding, you’re not going to pay for those deposits with higher taxes. Not in any direct sense and not anytime soon. China and Japan (America’s two largest creditors) aren’t going to pay for it, either. In fact, nobody is going to pay for it, because it doesn’t need to be paid for. The figure (below) is meaningless.

Stimulus payments of $600 began arriving in bank accounts days ago. Have you noticed any inflation since then? Were there lines at the grocery store featuring Americans clutching handfuls of cash hoping to get their holiday mittens on a loaf of Sara Lee before the price jumped to $45?

Of course not. Instead, there were lines at food banks, because people are broke, jobless, and starving.

As much as it pains me to say this, Hawley seemed to be the only US senator to come anywhere near the mark. “I hear a lot of talking about how we can’t afford it,” he said Friday, as he and Sanders made one last futile attempt to secure the higher payments before the chamber voted to override Trump’s defense bill veto.

“I do notice, however, that we seem to be able to afford all kinds of other stuff. We can afford to send all kinds of tax breaks and bailouts to big corporations. But we can’t seem to find the money for relief for working people that the president and the House and the Senate all support,” Hawley added.

Obviously, Hawley is just doing anything and everything he can to please Trump, but the key is that there isn’t anything denominated in dollars that the US government cannot “afford.” Just ask any country the US has ever invaded, bombed, or otherwise conducted a military operation in or against, while running a deficit.

On Saturday, The New York Times ran an article that touched on all of this, and while it fell short of employing the kind of straightforward language necessary to get the point across to a public that’s been thoroughly indoctrinated to believe the federal government’s budget works like a household budget, it nevertheless alluded to the key points.

After noting that Republicans predictably abandoned pretensions to fiscal rectitude as Trump ballooned the deficit with tax cuts that most assuredly did not (and will not ever) “pay for themselves,” the Times wrote that “come January 20, Republican lawmakers are all but certain to cast themselves as the nation’s fiscal stewards and resurrect their deficit concerns to oppose policies backed by Democrats.”

That’s standard operating procedure: Republicans are fiscal hawks vis-à-vis Democratic policy proposals, but look the other way when presented with evidence that supply-side measures favored by big business (which almost never deliver as advertised) invariably deprive the government of revenue, while doing next to nothing for the economy. The figure (above) illustrates the point.

Crucially, the Times acknowledged there’s more to this debate than the simplistic idea that politicians will buy votes when they can.

“There is a theoretical basis to the political shift. Even before the pandemic, many economists had begun to rethink their long-held view that large public deficits and debt would bog down the economy by pushing up borrowing costs for businesses and sending consumer prices soaring,” the article reads. “A decade of relatively low interest rates and steady economic growth had prompted many economists to suggest that the United States could, indeed, afford to run a budget deficit.”

And yet, the final dot is almost never connected, even when a given mainstream media article or floor speech by a US lawmaker comes tantalizingly close. For example, the Times correctly observed that with inflation running well below central banks’ targets, it’s not clear why more spending aimed at filling output gaps and eliminating labor market slack should be constrained by an arbitrary line in the deficit sand.

Unfortunately, the Times got bogged down asking the wrong questions. “Even as some economists and politicians become more comfortable with high public debt levels, others warn that they could create vulnerabilities down the road,” the article said, adding that “if interest rates increase, it could cost the government more to keep up with those payments each year – either leaving less for other types of spending or requiring Congress to pile on an ever-growing debt load to keep up.”

Those quotes from the article are nonsensical. For one thing, bond yields are a policy variable. As maddening as this is for the crowd which longs for the return of the fabled “bond vigilantes,” developed market central banks can cap yields and set the curve however they see fit. One of the attractive features of yield-curve control is simply that once a central bank commits to pegging a given part of the curve, it can (in theory anyway) reduce the necessity of buying bonds because the market will tire of pushing the issue. That is: If you’re a market participant, there’s no sense in betting on a rise in yields that a developed market central bank has explicitly told you isn’t going to be allowed.

Beyond that, though, it’s not entirely clear that it makes sense to say that rising yields would “cost the government more.” If you’re the sole, legal issuer of a currency (i.e., you have a monopoly) then what sense does the word “cost” really make? It doesn’t “cost” you anything to issue more of it in order to, for example, pay interest on an interest-bearing version. And that’s all US Treasury bills, notes, and bonds are — interest-bearing dollars. The only “cost” is whatever you have to pay for the digital infrastructure to facilitate the payments (or, if you like, the ink and paper to print the physical notes). But assuming those costs are also payable in dollars, that’s not really a “cost” either, is it?

Finally, the notion, as enunciated by the Times, that higher interest costs leave “less for other types of spending or requir[e] Congress to pile on an ever-growing debt load to keep up,” is patent nonsense.

The US government doesn’t actually need to borrow to fund spending — not on interest payments and not on anything else. And it doesn’t need to tax for that purpose, either. US Treasurys play a critical role in the global financial system as collateral and, relatedly, as a liquid asset of the highest repute. They also allow countries to recycle funds from, for example, oil exports. Taxes, meanwhile, play a crucial role in domestic policy, whether it’s disincentivizing “bad” behavior, redistributing wealth, or cooling down an economy that looks to be on the verge of overheating.

Note that none of the key functions of Treasurys and taxes are related to “funding” the US government. Not a single one. The government doesn’t need to “borrow” the dollars it issues from anyone else and it certainly doesn’t need to source them from its own citizens. When you step back and think about those myths, they seem patently absurd outside the context of decades of deficit dogma.

Mitch McConnell this week rolled out the standard line of criticism about paying for the stimulus checks, and he paired it with ludicrous allegations that it was Democrats who were attempting to institute “socialism for the rich.”

“Borrowing from our grandkids to do socialism for rich people is a terrible way to get help to families who actually need it,” McConnell said Thursday.

I implore readers: Deficit spending is not “borrowing from our grandkids.” Treasurys are not even “debt,” in any real sense. The US could eliminate the national debt overnight with one piece of legislation and one keystroke (it would probably be a series of keystrokes, but you get the idea).

There are two main reasons that doesn’t get done.

First, it would rob politicians of what is perhaps the most oft-used excuse for not funding something they don’t want to fund — the national debt is a powerful psychological weapon when it comes to fighting political battles.

Second, it would throw financial markets into complete disarray, likely with disastrous consequences that are simply impossible to fathom. Amusingly, that concern seems to get something like short shrift among MMT economists.

Circling back, for McConnell to accuse Democrats of “socialism for rich people” via $2,000 stimulus checks while simultaneously fretting over the deficit is a candidate for the most cynical, disingenuous statement to emanate from the Senate Majority Leader in a long, long time. And that’s really saying something, because everything McConnell says is cynical — it’s his calling card.

Trump’s tax cuts in part explain a laundry list of dubious deficit milestones hit pre-pandemic, including the largest monthly shortfall on record in February of 2019 (figure below), and the largest annual deficit since 2012 (second figure above).

Again, the GOP only cares about this when they’re not the ones causing it. That in itself should be enough to make the public suspicious of deficit dogma.

Chuck Schumer lampooned Republicans’ objections to the stimulus checks on deficit grounds this week. “By now, Republican objections over the debt and deficit are comical,” he said. “They added nearly $2 trillion to the debt for a massive tax cut for corporations and the wealthy – and that was during a steady economy.”

That latter bit is key. It was, in fact, Trump and Republicans who spent three years “borrowing from our grandkids” to fund socialism for the rich. That isn’t a partisan assessment. It’s a fact.

The last two figures above don’t include the pandemic. The poor budget outcomes they illustrate occurred before anyone had ever heard of COVID-19, and took place alongside an economy that was doing just fine on its own. Indeed, for all of Trump’s boasting, his economy was virtually identical to the Obama economy based on a simple comparison of GDP (figure below).

Have a look at the blue and red shaded areas in the chart. One might fairly ask what America got in return for the tax cuts and ballooning pre-pandemic deficits. Because it wasn’t better overall, average growth outcomes.

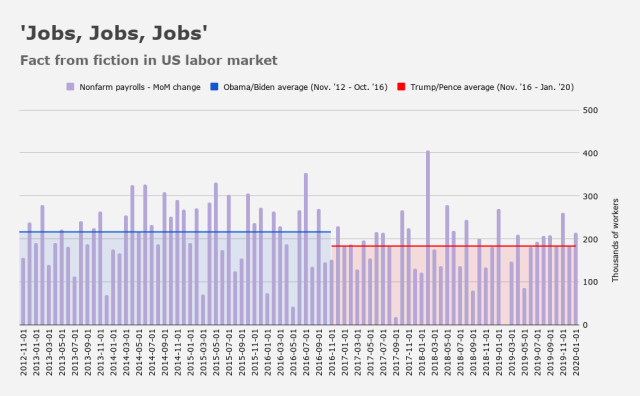

By the way, it wasn’t better labor market outcomes either. While it’s true that the unemployment rate moved even lower under Trump, his jobs market record was worse than Obama’s second term (again, the figures I’m using don’t include the pandemic).

Ultimately, one wonders why, if we can freely balloon the deficit and enlarge the national debt in part for the purposes of delivering a tax cut to the rich and to large corporations while the economy is doing fine, we can’t engage in more deficit spending and debt issuance when the economy is in a deep recession, the labor market is 10 million jobs short of pre-recession levels, and millions of Americans are suffering from food insecurity.

The truth is, the deficit/debt argument doesn’t hold up on its own under any circumstances. The deficit is a meaningless number for advanced economies and especially for the US. There is no such thing as “the national debt.” There is only “a giant pile of interest-bearing dollars that serve a critical function as collateral and as a vehicle for recycled savings.”

Until the majority of lawmakers and the public wrap their heads around all of this, the US will continue to produce sub-optimal economic outcomes. There will be millions of people who starve, millions of homeless, millions in substandard housing, millions without adequate healthcare, and millions of undereducated.

Meanwhile, lawmakers, bloggers, pundits, and economists will continue to feed you stories about hyperinflation, the collapse of the dollar, and the perilous plight of America’s unborn.

The truth is, hyperinflation will probably never come to the US. The dollar will collapse one day, but not for any of the reasons cited by doomsday pundits. And the plight of America’s unborn will indeed be perilous, mostly because, based on current trends, the country’s infrastructure will be in severe disrepair, healthcare will be completely unaffordable, societal divisions will be such that even conversing with a neighbor risks hand-to-hand combat should the topic stray into ideology, and climate change will mean that some parts of the country are either under water or hot enough to fry an egg on.

I really hope democrats shock the world on Tuesday and pull off two senate seats in Georgia. I seriously doubt it will happen, but even holding the majority for two years would be a game changer and help so many people.

Good thing Alexander Hamilton understood this.

I found it interesting that you mention the “MMT Crowd” in a less than shining light. But one and all of us deserve critique.

McConnell has every plan of fighting the last war again. His one truism is that the money could be better placed in needy hands which runs counter to many of his previous actions. The one action clear as day being the inaction of the last 6 months. Plenty of time to devise a stategic placement. What did he get done the last 6 months? Nothing.

H. Your last paragraph was on point. I’m to old to see what will happen but my over/under on our “great” society is the end of the current century. Stephenson’s Snow Crash predicted that before too long the most important thing the US will be able to offer the world is effective 30 minute pizza delivery, and that will only work because it will be run by the mafia.

OK , For the sake of argument this post says it the way it is… That last paragraph describes consequences that can’t necessarily be currently linked to today’s actions but there are consequences down the road .. The forks in the road (we take) much like if you were to apply them to (let’s say Evolution) would yield different results depending on past actions and what transpired long ago..Sorry to say we maybe don’t get to see the outcomes in our lifetimes , as this is a stimulant for our imaginations..

You have written a lot of articles on how pundits are unfoundedly scaring us with hyperinflation and collapse of the dollar. Instead, it would be nice to hear your vision of what would actually happen to inequality, wages, housing affordability and general inflation if we let go of the deficit myth and employed full blown MMT/style policies.

Getting the ship back on course isn’t going to happen with a bickering divided congress. And I think the GOP isn’t bothered by having an uneducated populous.

It was interesting that the direct payments to citizens had no measurable affect on inflation. It would seem that as long as you are giving money to cover the basic necessities of life it will not affect inflation. I would also expect if you used the same money to improve infrastructure or develop business carefully it too would not affect inflation. I assume that is why H is frustrated (no disrespect meant) but this topic does come up a lot.