Well, junk bond yields are at new record lows, which would be surprising if all you were going by was common sense.

After all, 2020 was a year defined by the worst public health crisis in a century, an oil collapse that briefly drove WTI prices down to a philosophically questionable negative $37, and the first actual, real-life depression (with a “d”) witnessed since the 1930s.

That doesn’t make for a favorable macro backdrop if you’re a high yield borrower, but thanks to unprecedented policy support both from fiscal and monetary authorities, corporate borrowers have virtually never had it better.

On Thursday, junk yields touched 4.45%, a new record. The previous low mark was 4.56%, hit after the initial readout from Pfizer’s coronavirus vaccine on November 9. In all likelihood, yields will push lower still as oil prices are supported and stimulus hopes stock optimism in equity land.

Some $7 billion in junk sales priced this week. November’s total clocked in at nearly $32 billion. Coming into Friday, 2020’s total sales were almost $407 billion.

Again, that is astounding considering what happened to the global economy and the oil market this year.

Even the junkiest of junk is rallying — hard. In fact, CCC yields are at the lowest since 2014 after flirting with 20% during the panic.

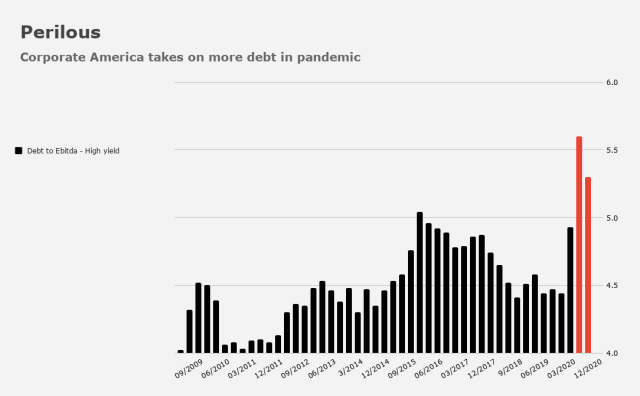

This comes amid rising leverage and palpable consternation about “zombie” firms in a post-pandemic world.

As Bloomberg noted this week, an apparent improvement in leverage during Q3 was actually something of an optical illusion. “Any company with negative Ebitda was removed from the figures because leverage becomes meaningless when that occurs, making the average look better,” a piece out Thursday reads. The same linked post notes that leverage metrics also ticked lower simply because some companies dropped out the index after going bankrupt.

If you’re curious to know whether this situation is ameliorated if you look at spreads as opposed to yields, the answer is “yes” according to some banks, but “no” according to… well, according to math.

On Friday, Bloomberg’s Sebastian Boyd looked at spread per turn of leverage, and at 99bps, we’re actually below what’s generally served as the historical floor.

In the week through Wednesday, high yield funds saw outflows of $1.39 billion on Lipper’s data. That more than wipes out the previous week’s inflow.

Investment grade funds took in another $4.81 billion — because appetite there is simply insatiable.

I’m in PHK temporarily. Junkety Junk Junk.

Could be worse – less than 30% hi yield. On the other hand, PHK’s high-quality sovereign stuff includes, for example, Argentinian bonds for ARS 758M, presently valued at $ 4M… but which PIMCO would probably gladly trade you for a handful of Walmart gift cards, if you promised not to tell anyone where you got all that Argentinian debt. Reputation is everything, you know… 😉

I have to admit to owning a couple hand grenades like this; I’ve promised myself that I’ll properly dispose of them shortly before they suddenly explode…

I have a few junk CEFs and all my distributions are flat or up. So far so good.