Earlier this month, in “‘So Many Things Could Go Wrong’,” I talked briefly about the reversal of a 2016-era Trump trade — namely, buying the ruble and selling the Mexican peso.

Headed into the 2020 vote, that’s been flipped on its head. The ruble has had a rough go of it, in part due to the assumption that a Joe Biden administration won’t be predisposed to taking a conciliatory approach to the Kremlin.

Trump is fond of insisting that “nobody has been tougher on Russia than me,” but I think it’s fair to say that even some of the president’s most ardent supporters are a bit dubious when it comes to that claim. Whatever the case, you’ll note that the currency probably “should” be trading at least a bit stronger based on a simple overlay with crude prices.

“Arguably, the currency market has nearly fully priced in a Biden win,” SocGen’s Jason Daw wrote Tuesday, noting that Biden’s persistent lead in the polls has coincided with weakness in the ruble “while the Mexican peso and North Asian currency bloc are amongst the strongest.”

For SocGen, “geopolitical undertones are at least partially responsible for this price action.”

The assumption is that Biden will clamp down on Putin, repair fraught relations with Mexico, and, as Daw puts it, “take a more traditional and diplomatic approach to China even though the acrimonious core of the trade and tech disputes will remain intact.”

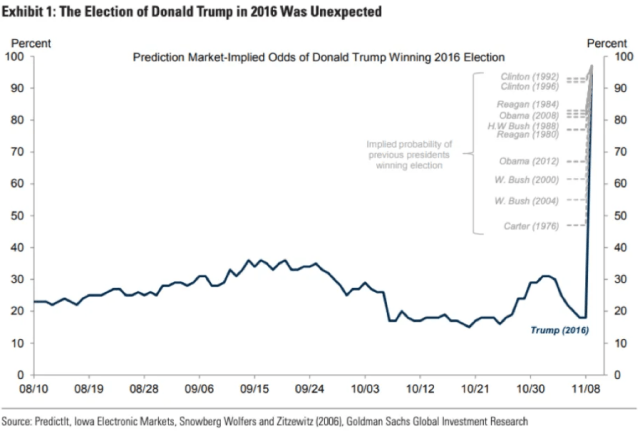

But is this just another example of the market being too sure for its own good? That is, is the tail risk of a come-from-behind Trump victory now completely underpriced by EM FX? And perhaps most poignant of all: Would it even be a “come-from-behind” victory if Trump won? Perhaps those who insist the polls are just flat-out wrong are correct.

The president says the “real polls” show he’s ahead. And while he habitually comes up empty when pressed to identify which polls he’s referring to, we shouldn’t forget the lessons of 2016 so easily.

While SocGen pegs the probability of a Biden win at 78%, the bank asks a simple question: “What if the unthinkable happens and he pulls it off again?”

In that scenario, “ruble-based reversal trades” would be suddenly en vogue, Daw suggests.

So, if it’s tail hedges you’re looking for to protect against a Trump victory, that gives you a hint of where you might want to look.

The title of Daw’s note is, amusingly, “Oops! What if he did it again?”

Only in Merica!