It’s pretty simple, really.

Or at least according to BofA’s Michael Hartnett it is. July will be “choppy” with a bias higher for equities. 2% is the top on the long bond going forward. 60 is the low on CDX IG spreads. And one should “sell-the-rip” in the S&P above 3,250 and a “buy-the-dip” below 2,950.

Sounds reasonable enough, I suppose. The figure (below) is from the latest edition of Hartnett’s popular weekly “Flow Show” series and it speaks for itself. The Fed has unleashed some $2.3 trillion in QE over the past four months, a pace that makes all previous iterations of large-scale asset purchases look… well, not large by comparison.

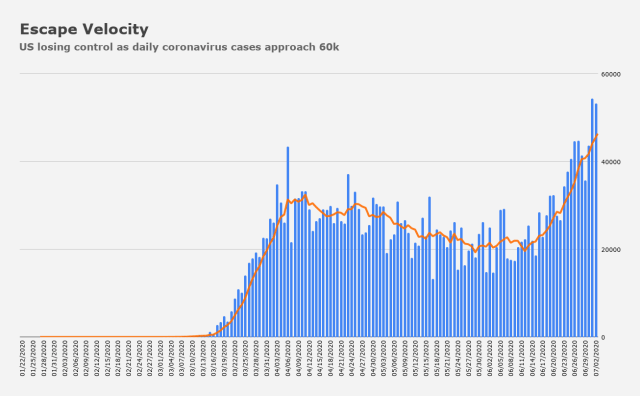

With COVID-19 now advancing on multiple fronts in the US, forcing new business closures and imperiling the re-opening narrative, the battle lines have been drawn anew. It’s stimulus versus Mother Nature.

The problem is that we seem to be heading back in the direction of “stimulus” not being “stimulus”. If the economy isn’t open, there’s nothing to “stimulate”. Rather, government assistance and central bank liquidity is life support — oxygen for a patient in an induced coma.

But we’re in dangerous territory now. Because some lawmakers are prepared to take the June jobs report at face value on the way to arguing that another virus relief package isn’t necessary or, if it is, it won’t come with some of the key elements which created what I called a “simulation game“, whereby business and household incomes were simply replaced.

Regular readers know I’m not one to ferret out the bad news just for the sake of saying something negative about otherwise good numbers. But the fact is, the number of job losses classified as “permanent” moved sharply higher in June, suggesting the economy has already suffered structural damage.

At the same time, there’s a rather glaring disparity between the number of Americans on unemployment benefits and the supposed number of unemployed. Meanwhile, continuing claims are rising now, and initial claims have all but stopped falling.

This is no time for lawmakers to get swept up in a nationalistic fervor or get duped by nebulous campaign soundbites about “great comebacks”. If there is a “V-shaped” recovery afoot, one sure way to short-circuit it is to pull back on fiscal stimulus and leave things to Jerome Powell — especially now that some workers are being laid off again amid a second round of business closures in some states. Virus cases nationwide are rising by some 55,000 per day.

“With re-openings on pause or being rolled back, and the cut-off point for June payrolls data sampling being around the middle of the month, the likelihood is that things are already stalling even though we are millions of jobs away from getting back to where we were on 4 July 2019”, Rabobank’s Michael Every wrote Friday.

“It is ‘crunch time’ in the week ahead as the spike in US cases could lead to a spike in fatalities if the most recent lead/lag patterns still hold”, Nordea’s Andreas Steno Larsen said. “Generally we find that fatal cases per capita are the best indicator for political decision-making”, he added. “If fatal cases are rising per capita, it also means that the economy will be moving towards a re-lockdown scenario”.

Fortunately, there’s not much evidence yet to suggest another surge in fatalities is in the offing, and the prevalence of new cases in those 35 years old and younger is encouraging to the extent that age group is unlikely to perish from the disease.

But, as Steno Larsen goes on to caution, “the jury is still out [and] we sadly find a high risk that the fatality spike will arrive over the next 6-10 days”.

Meanwhile, you’re reminded that bankruptcies are piling up, albeit perhaps not at the apocalyptic pace some feared.

We do have a shot at topping 2009’s mark for total filings from firms with $50 million or more in liabilities. In the retail and energy space, the pain has been particularly acute, for obvious reasons.

These are the realities that lawmakers need to be aware of as negotiations around the next relief package commence later this month.

It’s obviously true that shutting down parts of the economy again will make the situation worse for businesses. It’s also true that would be bad news for the GOP in an election year. But when you hear politicians suggesting the entire coronavirus task force should be disbanded because, to quote Rep. Andy Biggs, “Dr. Anthony Fauci and Dr. Deborah Birx continue to contradict many of President Trump’s stated goals”, you start to wonder if folks inside the Beltway are putting election-year expediency ahead of the longer-term viability of the recovery.

I have said repeatedly since March that the worst case scenario for market sentiment would be to re-open the economy and then shut it back down again. That doesn’t mean I advocated keeping it all closed until there’s a vaccine, it’s just that sentiment matters at times like these. When you’ve seen a run in equities and other risk assets like that which has unfolded since the March panic lows, there’s ample scope for a pullback in the event the “herd” (which doesn’t yet have immunity) gets spooked.

“With a massive increase in test capacity, one should expect a clear decline in positivity rates even if the virus spread is stable, simply because people with few or no symptoms are tempted to take a test if it is easily accessible”, Nordea went on to say Friday. “In Florida and Arizona positivity rates are increasing sharply despite the increase in testing, which is a crystal clear sign that the virus spread is accelerating”.

Rep. Andy Biggs (mentioned above) represents Arizona, although given these realities, I’m not sure “represents” is the right word.

To the extent lawmakers from the president’s party are pleased with the upturn in the economic data, they would do well to understand that it isn’t sustainable if caseloads and hospitalizations continue to rise. If fatalities start to move sharply higher, you can forget about it. Even GOP governors who are otherwise disposed to toeing the party line will throw in the towel when ICU capacity maxes out and their constituents are bombarded with scary-looking charts on the evening news.

But it’s a Sophie’s choice — I’ll grant Trump that. Keeping the economy shuttered for another several months would mean chancing a Depression-era unemployment rate on election day. Similarly, the president’s libertarian-leaning base (and they do lean libertarian even if they’ve never heard the term and thus wouldn’t be able to self-identify) would not like it if the White House backed stay-at-home orders over the summer.

On the other hand, opening the economy in a cavalier fashion means getting precisely what the nation is coping with now — a surge in infection rates and, perhaps, fatalities. That’s fodder for Democrats, who can accuse the administration of, at best, a bungled attempt to restart the economy, and, at worst, showing callous disregard for public health in order to engineer a few months of decent economic data headed into November.

No one can accuse me (a political scientist originally) of not understanding the president’s dilemma.

My fear is that the current “strategy” (if that’s what you want to call it) is doomed to produce a bad outcome on all fronts. Re-shuttering businesses will mean a second round of layoffs. If Congress doesn’t pass another relief bill that includes an extension of extra federal unemployment benefits (on top of state benefits), we could see a more sustained collapse in incomes (versus the fleeting record plunge and quick snapback shown on the right-hand side of the chart below).

After that, consumption will falter, and somewhere along the way, equities and other risk assets will start pricing it all in.

To be sure, I don’t have the answers. And this dour domino effect doesn’t have to be our fate. Indeed, at the current juncture, we’re looking at record highs on some equity benchmarks, and sharp inflections in most of the key economic indicators. Right now, things are getting demonstrably better, unless you mean controlling the spread of the virus, in which case things are getting worse by the hour.

But as keen as I’ve been to argue that fading the Fed is a fool’s errand, and as adamant as I am about reminding readers that deficits do not, in fact, matter in a crisis (the US government can always afford whatever the people need), I worry that the chain reaction from new business closures to new layoffs to deteriorating market sentiment, will happen faster than policymakers (especially fiscal policymakers) can respond. After all, we’re just weeks out from tax payments and the expiration of the extra unemployment benefits for those who need them, and no serious progress is expected for at least three weeks.

“The risk of a complete meltdown with a subsequent dash for cash like in March is very low, but we see a high risk of a more orderly setback for risk assets”, Nordea’s Steno Larsen says.

Rabobank’s Every employs his trademark sarcastic wit. “US payrolls yesterday smashed expectations — put another steak on the BBQ!”, he exclaims. “Unfortunately, weekly initial claims showed no sign of any improvement and new unemployment filings were once again 1.4 million”.

It’s not all good out there, folks. It really isn’t. But it’s not all bad either.

And assuming we don’t get a true viral apocalypse, at least we have the playbook for a slow-growth world, where fiscal policy ends up being inept despite the efforts of some would-be heroes, leaving the burden of keeping it all afloat on central banks.

“[The] winning YTD strategy [has been] long ‘yield’ via corporate bonds, long ‘growth’ via tech, and hedge inflation via gold”, BofA’s Hartnett said, adding that in essence, that’s been the strategy since Lehman, “a decade of minimal growth and max stimulus with 938 rate cuts”.

Earlier on McConnell said another bill would not come till late July. He was betting on the warm weather virus fade and the Southern Republican stronghold being safe from the “first round” of the virus. With the Governor of Texas instituting a mask policy it may be time for the Republicans to admit the obvious. With all of the bad news on multiple fronts I doubt there will be much selling the rip at 3250 unless McConnell acts. Divide and conquer is not always a good plan. Now we are a divided Nation and the virus is winning.

Great article. Thank you

The global solution since at least 2009 has been to pump money into the economy by those countries that can. Try and remove the money and the markets scream NO. And on it goes. There appears no way to stop this cycle without major systemic change, but when has that ever happened without extreme pain.

“No one can accuse me (a political scientist originally) of not understanding the president’s dilemma.”

Sadly, H, you understand it far more than him. Ergo, an acutely serious problem.

Chart 2, with deaths showing classic curve bottoming behavior is sobering. Seemingly on cue 8-10 days after cases curve shows bottoming behavior.

After the GFC, the Fed’s short term rates remained at effectively zero while the Fed’s balance grew (from about $1T prior to the GFC) to about a max of $4.5T by YE2014. The Fed first started raising short term rates in 12/15 and got in five 25 bps increases before starting to shrink (run off only?) the balance sheet in 1Q2018. After four more 25 bps increases (basically every quarter) and the balance sheet down to ~$4.1T, the Fed had to change its tune on at least interest rates (after the market had a tantrum/meltdown with S&P500 declining almost 20% over 4Q2018). Three quarters later, with interest rates flat and the balance sheet down to about $3.8T, the Fed decided to (“had to”?) stop shrinking and instead stared growing the balance sheet once again.

I understand the notion (but not necessarily the mechanism) that shrinking the Fed’s balance sheet constitutes monetary tightening in and of itself (and is additive to the Fed’s changes in short term interest rates).

I firmly believe in my bones that the government’s monetary/investment presence in markets should be minimized. Maybe once the economy stabilized, the Fed should lead with shrinking the balance sheet (in order to tighten monetary conditions) ahead of materially increasing short term interest rates.

Thanks for your article. I know you focus on the macro economic picture but but I wish you could investigate the impact that the biggest banks are having by reducing credit to the economy. I fear this will have a greater impact, quicker than I’d the government extends the $600 payment.

In fact because the banks have started making credit harder to get, if the government does not extend the $600 payment, the default rate should start to skyrocket.

Excellent post as usual, I cannot imagine a president or administration in recent memory less equipped to deal with a “Sophie’s Choice” type of dilemma, so I’m currently pessimistic about the outcome for the US economy and population near term. Markets will likely be fine even if volatile, the Fed has the only working vaccine for Covid and will continue to deploy it if(when) the indices catch the virus again with the rest of the country.