“Zeitgeist bearish”, BofA’s Michael Hartnett writes, in the latest edition of the bank’s closely-watched global fund manager survey (FMS).

In last month’s poll, just 15% of respondents said the economic recovery would closely approximate the “V-shaped” miracle the White House is keen on facilitating. 52% said the rebound would be “U-shaped”. More than one in five feared the dreaded “W”.

Fast forward a month, and after a deluge of horrific data, the percentage wishing on a V-shaped star dropped to just 10%. 75% see a “U” or a “W”.

A quarter see a new bull market, while 68% view the current situation as a bear market rally.

You might recall that in April, on the heels of the panic, FMS cash levels jumped for a second month, all the way from 5.1% to 5.9%. That was the highest since 9/11. In May, the figure dropped a bit to 5.7%, but that’s still elevated versus the average of 4.7% over the last decade.

Not surprisingly, a second wave of the virus is the biggest tail risk, while a breakthrough on the vaccine front is seen as the most likely catalyst for the “V-shaped” rebound. Monday’s surge was an example of what happens when there’s news that suggests vaccine development is proceeding apace.

In a testament to the effectiveness of the Fed’s actions, fear of a systemic credit event dove from 30% to just 8%. That’s obviously been reflected both in spreads and in flows.

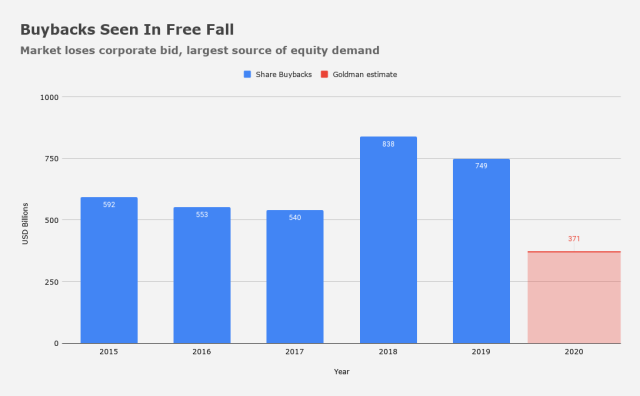

Investors’ defensive lean on balance sheets remains front and center. Just 7% of respondents said corporate management teams should buy back shares and/or increase dividends, while nearly three-quarters expressed a preference for debt reduction.

As a reminder, cash usage is expected to plummet in 2020, dragging down capex and buybacks, with the latter seen down ~50%.

Perhaps the most interesting bit from the May FMS survey comes from responses to an inquiry about the post-COVID reality.

68% say the biggest structural shift will be supply chain re-shoring, 44% said protectionism and 42% said higher taxes.

Expectations for on-shoring are behind some warnings about the long-term inflationary impact of the virus (i.e., once the near-term deflation wave abates). I’ve repeatedly emphasized that political opportunists (e.g., Peter Navarro) will seize the moment, and capitalize on the pandemic to argue for accelerating the protectionist push, which was already well underway headed into 2020.

Read more: After The Virus, Hyperinflation Or Deflationary Spiral?

BofA’s Hartnett goes on to say that the “pain trade for stocks and credit [is] still up, consistent with SPX>3020, RTY>1500 [and] high yield spreads <650bps”.

The most crowded trade is seen as “Long tech and growth”, which is hardly surprising.

The crowdedness of that trade is why Morgan Stanley this week warned that if a pro-cyclical shift like what showed up during Monday’s action were to become entrenched, lots of folks would be caught offsides.

Of course, we’re not there yet. “For a sustained shift that goes beyond an ‘excess positioning gross-down’ into an actual rebalancing towards a growth-ier and more reflationary outlook, markets will require further fiscal stimulus, likely in conjunction with supply-chain disruptions to stoke inflation”, Nomura’s Charlie McElligott said Tuesday, adding that, for now, we’re still dealing with “ever-present and pervasive skepticism [as] investors set up for a secular disinflationary world”.

Finally, for those wondering, BofA’s Hartnett notes that BofA’s Bull & Bear Indicator is still “pinned at 0”.

“Investors”, he writes, are “still extremely bearish”.