Larry Fink is terrified – that corporate tax rates will go up.

According to one person’s account of a recent call “with clients of a wealth advisory”, the BlackRock boss described a grim future for America, as the country attempts to navigate an arduous path back from economic oblivion.

Among the poltergeist haunting Fink’s nightmares: Corporate tax rates as high as 29% or, put differently, corporate tax rates that are still less than they were prior to the Trump tax cuts.

(Goldman)

“Even as the US is plunged into deepening economic gloom, it will have to raise taxes to pay for emergency efforts to rescue sectors grappling with a difficult recovery”, Bloomberg writes, adopting a dark cadence that suggests raising taxes on corporations is somehow an unthinkable prospect, even in the face of the worst downturn in modern history.

“The 21% corporate rate signed into law as part of 2017’s tax overhaul [could rise] to about 28% or 29% next year”, Bloomberg’s source said, citing Fink’s crystal ball. (Oh, the humanity.)

Fink has a long history of using his annual letters to virtue signal, and one of the most famous instances of that came in 2017, when he excoriated corporate America for overindulging in buybacks.

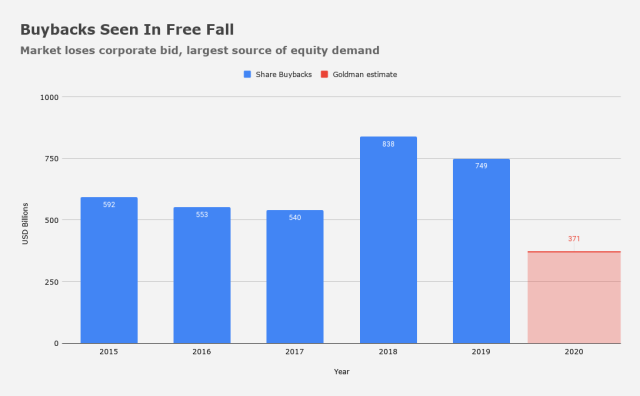

Trump’s tax cuts were, of course, an invitation for management teams to repurchase even more of their own stock, which they promptly did. Buybacks have represented the largest source of US equity demand for years, but are set to plunge in 2020 in the wake of the COVID-19 crisis.

As Treasury borrows trillions to “pay for” virus relief, Fink is apparently concerned that “the government may be forced to extract a larger share of companies’ and individuals’ income”.

Leaving aside the fact that the whole idea of someone needing to “pay for” the stimulus is nonsense, it would hardly be a tragedy if corporations had to foot some of the bill. As The Washington Post wrote back in December, recapping a report from the left-leaning Institute on Taxation and Economic Policy, “400 of America’s largest corporations paid an average federal tax rate of about 11% on their profits” in 2018.

As discussed here at length earlier this week, the Trump administration is angling to cut taxes going forward, not raise them. The idea of rolling back the corporate tax break would be anathema to Republicans, but clearly, raising taxes on middle- and lower-income families is a non-starter right now. Trump is also fully aware of the extent to which promoting some manner of tax break that could plausibly be spun as primarily benefiting everyday Americans could help him come November.

But, with the debt hawks circling, it’s probably just a matter of time before fiscal conservatives start demanding some kind of offset to the spending necessitated by the crisis.

On of the biggest worries surrounding a possible Bernie Sanders or Elizabeth Warren presidency was that the tax cuts for corporate America would be rolled back, resulting in sharply lower profits. Now, that debate is irrelevant for two reasons: 1) Sanders and Warren lost to Joe Biden, and 2) the threat to corporate profits turned out to be biological, not political.

In any event, Fink thinks higher taxes may be necessary to pay for more stimulus, and he also reckons the Fed may have to do more.

But higher corporate taxes aren’t the only wraiths and phantasms floating around Larry’s tortured dreams.

According to Bloomberg’s source, Fink also sees “mass bankruptcies, empty planes, cautious consumers” and, like many other observers, worries that consumption and travel habits will never be the same.

I’ll leave you with what Fink said about the tax cuts just weeks after they became law.

From Larry Fink’s 2018 letter to CEOs

In the United States, for example, companies should explain to investors how the significant changes to tax law fit into their long-term strategy. What will you do with increased after-tax cash flow, and how will you use it to create long-term value? This is a particularly critical moment for companies to explain their long-term plans to investors. Tax changes will embolden those activists with a short-term focus to demand answers on the use of increased cash flows, and companies who have not already developed and explained their plans will find it difficult to defend against these campaigns. The U.S. tax bill is only one such example — regardless of a company’s jurisdiction, it is your responsibility to explain to shareholders how major legislative or regulatory changes will impact not just next year’s balance sheet, but also your long-term strategy for growth.

Taxes need to go up- the beneficiaries of the recent generosity are the ones that need to pay up for sure- upper income and corporations. But that won’t raise all that much money. The middle class used to be the cash cow, because of numbers. These days that cohort has shrunk greatly. A VAT which would be structured to be at least mildly progressive would be a very good way to go. It could help partially fund social security, medicare and go towards universal health care (notice not medicare for all) based on ability to pay. Universal care could be structured so that the bottom 3/4 of population gets taken care of at no or very little out of pocket. The upper 1/4 could pay based on ability to pay. Medicare could be left intact, but we could roll this out for everyone else. If we were able to bend back the cost curve on medical care it would help pay the freight. Remember most people pay for health care anyway- the VAT would just be a shift in the method of payment for many. It is abundantly clear that the safety net for a large part of America has been destroyed since 1980 and needs to get rebuilt. A VAT could also be refundable at the border, so that it could help US exports and still comply with WTO rules.

‘It is abundantly clear that the safety net for a large part of America has been destroyed since 1980″ — a/k/a the Reagan Revolution.

Enough already. It’s time to bring the profligate corporations back to being a responsible part of our economy. They don’t make all that money without the people you propose screwing. I’m already going up two brackets because my wife died and the damn feds take 30% of my SS, which was my money, for taxes and Medicare, I’ve had it.

I patiently wait in cash to see what the post-apocalypse world looks like

I have given that posture serious thought lately. Any second thoughts?

Mr. Lucky – No second thoughts. I have been in the stock market for 35 years and have had no problem staying in the market when the economy and the equity markets were still tethered, even though the PE ratios were stretched for various reasons – such as during 2018 and 2019 (QE). However, because the economy and the stock markets are completely disconnected, as I think they are now – I will wait for more clarity on the economy.

Most of the money I have made in the stock market over the years is from buying great companies that got “beat up” for invalid (IMHO) or short term reasons and these types of situations will still be available going forward – so if I miss this entire run up, I will find another way to invest. The downside risk is way too much right now.

You and me samo-o.

You’re darned if you do and darned if you don’t.

Oh the humanity! Thousands dead and millions unemployed but Fink is haunted by the long shot possibility of a minor increase in corporate taxes. If the US decides it needs to tax to fund further stimulus, which it does not, tax the bastards, most of the wealth sits in corporate balance sheets and the brokerage accounts of the top1%, it is the logical place to tax and raise revenues. Fink, take your taxes like a man you douchbag!