Those looking for reasons to be skeptical of the furious bounce in stocks off what seemed like a hopeless nadir late in March, don’t have to search very far for confirmation bias.

For one thing, we’re finding out what a “modern” depression feels (and looks) like. Inquisitive minds have pondered that prospect since 2008, when a complete collapse was averted by what, at the time, seemed like “extreme” policies (as it turns out, we were just starting to learn the meaning of “extreme” when it comes to policy accommodation).

Now we’re in it – a modern depression, that is.

If you’re not willing to “look through” or “write off” the second (and likely third) quarter, well then you’re bearish. Why? Because the near-term outlook isn’t just bad, it doesn’t exist. That is, there is no near-term outlook. Some firms won’t have any profits and in some sectors of the economy, there hasn’t been any activity to speak of for weeks.

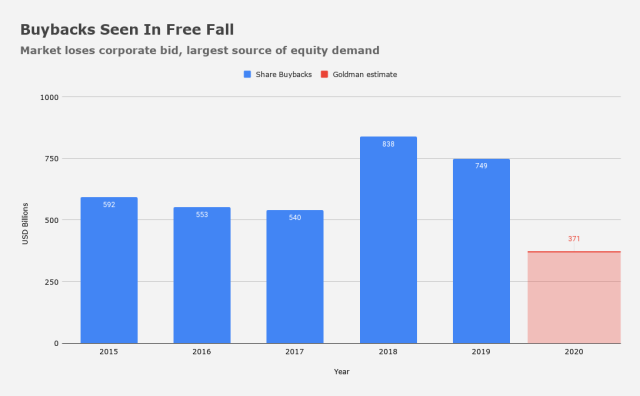

But even if you are inclined to look past all that (if you think we have a future, as I put it Friday), there are myriad more specific concerns, not least of which is an expected collapse in buyback activity.

I’ve addressed this at length (i.e., ad nauseam), but just to reiterate, the corporate bid has been the largest source of US equity demand for years, and it’s seen falling off dramatically in 2020 for obvious reasons.

So, there goes the demand side! What about the supply side?

That too could be a headwind for stocks if companies resort to the 2009 playbook to raise capital. “Secondary offerings are popping up among distressed firms, including United Airlines, which raised $1 billion”, Bloomberg wrote, in a piece out over the weekend.

The good news is, even if you do see a wave of secondaries, it doesn’t have to be the end of the world. After all, 2009 was a record year for equity sales ($230 billion), and stocks managed to surge 23%.

At the same time, don’t overthink things. Falling demand (in this case a possible 50% reduction in buybacks) and rising supply (XYZ billions in public equity sales) is a self-evidently bearish recipe for whatever it is you’re talking about.

Ironically, rallies could be just the motivation cash-strapped companies need to sell shares, especially at a time when debt markets are likely to be unforgiving, the Fed’s efforts notwithstanding.

If a shrinking market (i.e., less total shares outstanding) was in part responsible for the resiliency of equities over the past ten years, well then a ballooning market could potentially create a fundamental headwind.

And we don’t need any more headwinds, that’s for sure.

Not at a time when economic policy uncertainty has surged to almost unimaginable levels – during an election year, no less.

C-suite stock option and stock awards will most likely continue. If those awards are no longer offset with corporate buybacks, the stock awards ( part of the C-suite compensation) becomes dilutive. Don’t even have to have a secondary offering to get a dilutive effect.

LOL

For some “fun with math”, I am going to recalculate some EPS numbers, assuming shares are still issued for compensation without offsetting buybacks.

Please let us know what you come up with. Thanks!

There is a mitigating factor – as the options are usually issued with a strike price equal to market when issued, a lot of options are out the money right now.

Unless the board of directors, in their wisdom, decides that is terribly unfair and votes to reset the strike prices lower. We’ll, at least for the more senior execs.

This happened quite a bit in 2009-10 and mostly went unnoticed.

Thanks for posting this. I’ve been slack jawed with amazement over how few are commenting on this.

Costco p/e will be 1000 by yr end

Every month 401K contribution indiscriminately flowed in the market like clockwork, a significant portion of that is going to drop off and some of the unemployed may even draw down their holdings.

“Ironically, rallies could be just the motivation cash-strapped companies need to sell shares, especially at a time when debt markets are likely to be unforgiving, the Fed’s efforts notwithstanding.”

More irony will be when (if it is possible) the self-same cash-strapped will, without rinsing or even washing, repete for the same reason.