Last year, Recep Tayyip Erdogan promised to get interest rates (the “mother and father of all evil”, as he calls them) back into the single-digits.

When it comes to domestic affairs, Erdogan takes an “or else” approach to things he wants. That is, if he wants something from you, you’ll give it to him, “or else”.

For former central bank chief Murat Cetinkaya, “or else” meant losing his job last summer for failing to cut rates fast enough. His replacement, Murat Uysal, swiftly delivered the largest rate cut in history and subsequently lowered the benchmark another six times including cuts in January, February and an emergency cut last month.

On Wednesday, Uysal cut rates again, which was expected.

What wasn’t expected, though, was the size of the eighth cut in less than a year. At 100bps, it was twice as large as the market expected. The benchmark is now 8.75%. The total amount of easing under Uysal is 1,525bps.

As you can see, the lira has struggled of late, as emerging markets attempt to navigate the COVID-19 crisis.

I talked at length late last week about the state of play for developing economies amid the pandemic. In “An EM Crisis Is Not ‘Coming’ — It’s Already Here, One Bank Says“, I noted that Turkish banks have been blowing through billions to defend the currency, and that can only go so far.

Fighting the market is an uphill battle, and as Credit Suisse warned, “doing so [puts Turkey’s] ability to service the country’s external debt at risk”.

(Credit Suisse)

According to a pair of traders who spoke to Bloomberg, government-owned lenders sold “at least $600 million” to shore up the lira after Wednesday’s rate cut. They’re defending 7.00, and it’s probably a lost cause.

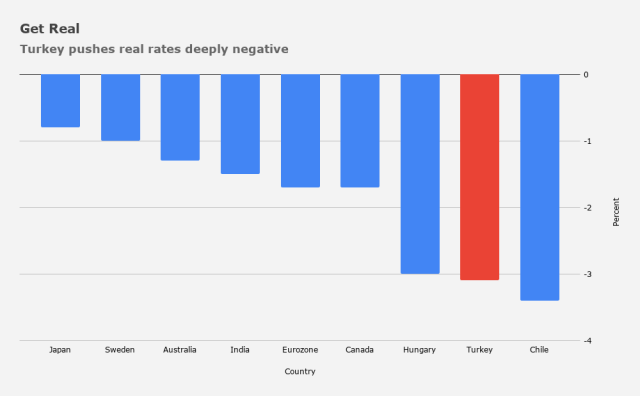

Although inflation in Turkey fell in March, at 11.9% simple math dictates that the central bank (at Erdogan’s urging) is chancing a disaster by driving real rates deeply negative in the middle of a global financial crisis.

“The CBRT has once again demonstrated through its actions that its overriding objective is to support economic growth, and it is willing to make the necessary trade-offs on the lira as well as on financial stability and price stability considerations”, SocGen’s Jason Daw and Phoenix Kalen wrote, on the way to cautioning that “with net international reserves (excluding CBRT FX swaps) essentially depleted, and with real policy rates now at -3.1%, pressure on the currency is likely to escalate”

Yes, it is. There’s also some key nuance to be had. “A larger-than-expected reduction means very little for foreign hedge funds and fast-money types because offshore rates are already well below the central bank’s”, Bloomberg’s Constantine Courcoulas points out, reminding you that “the banking regulator last week severed offshore funds from the domestic money-market, limiting the amount of cash local banks can lend to and borrow from clients abroad to just 1% of their equity” which led offshore lira funding costs to “completely decoupled from the central bank’s own benchmark”.

In any case, this probably won’t end well although, as I will never tire of reminding readers, Erdogan has a knack for extricating himself from dicey situations.

“Will they get away with it?”, BlueBay’s Tim Ash asked on Wednesday, referencing the latest rate cut. “Turkish markets are so micro managed these days”.

That’s Erdogan for you – “micro manager” extraordinaire.

H-Man, Turkey has a limited supply of dry powder and when that runs out, time to devalue the currency and start over. Sorta like taking an eraser to the chalkboard.