US equity futures were some 10% higher for the week through Tuesday morning as markets continue to assess incoming information that suggests a turning point in the fight against the spread of coronavirus may be near, even as Boris Johnson’s plight serves as a rather dramatic reminder of the situation’s severity.

“There is really only one headline today — that UK PM Boris Johnson is in intensive care”, Rabobank’s Michael Every wrote Tuesday. “The sudden deterioration in his condition comes as a major shock: last week he was clapping on the door step to praise the NHS and was still leading cabinet meetings online; yesterday afternoon we were told he was only staying at home because of an annoyingly persistent temperature; then it was a cough too — but that he was still actively Prime Minister; then he was going to hospital (by car) for some tests; and then he was in an ICU and, apparently, struggling to breathe”.

That exceptionally unfortunate turn of events aside, the rest of the news flow is broadly positive, or as positive as it can get under the circumstances. China had no new deaths for the first time since the pandemic began.

Global equities were sharply higher Tuesday. The Nikkei is really the story in Asia, up more than 6% already this week, as the government turns to massive fiscal stimulus ($990 billion) amid an emergency declaration for Tokyo, Osaka and five other prefectures.

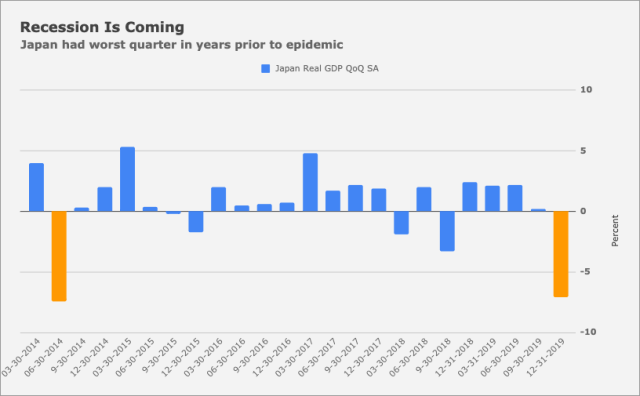

The assumption, I suppose, is that the lockdown measures will snuff out the virus, leaving only the stimulus. And remember, Japan was already recession-bound anyway, so although the hit from the virus is insult to injury, this is an economy where a technical recession was a foregone conclusion after Q4, when the combination of the tax hike and a typhoon put things on ice.

Buoyant risk appetite globally should put pressure on the yen, another boon for local equities. The Nikkei rose through its 25-DMA on Tuesday.

“Pretty much everywhere you look, there is newfound optimism. Equities continue to rally, with the S&P 500 now almost 20% off the March lows, while money continues to gush into credit markets”, Axicorp’s Stephen Innes said. “As equities continue to grind higher, investors who missed the first pass on the rally bus reluctant to put money back to work are now faced with a difficult decision and forced to pay up significantly higher for a seat at the front”.

Meanwhile, analysts are generally pleased with the gradual effects of the Fed’s efforts to tamp down funding stress and other kinds of systemic risk, where that just means the type of issues with the potential to cause the entire edifice to crack.

“It’s almost three weeks since the Fed announced that it was further enhancing the provision of liquidity through swap lines with other central banks”, SocGen’s Kit Juckes writes. “Since then, the Fed has sent out a further 19 press release with announcements about actions they are taking to tackle access to credit and liquidity in the domestic and international economies, as well as policy moves. And it’s working”.

Good vibes aside, just as I pen these very lines there’s a chyron on Bloomberg quoting a strategist from New York Life Investments. It reads: “Don’t be a hero”.

I’m still not sure why people think a virus that can be transmitted more easily than the flu for 48 hours prior to someone being symptomatic is going to be ‘snuffed out’. It won’t. I’m not a virologist but I spoke with my good friend who retired from many years at the CDC and he agreed that there is only a slight chance that international travel may be restored by fall. The virus will still be around and airports, subways, sport stadiums, restaurants, hotels, and disney world will still be prime locations to catch the virus and spread it back to your hometown. It requires an incredible amount of non-fact based hope to believe we will be getting back to ‘normal’ by the end of this quarter.

Yeah the physics of it lead me to suspect there is no normalizing of the economy possible, we may be able to allow temporary reprieves from stay at home policies. Maybe take the month of July and go out and live it up, but until a vaccine this is reality or the infection rates start going up. Even China isn’t seeing zero new cases after total in home lock downs and if it’s in Tigers at the zoo, it may well have found a new reservoir in domestic animals. Perhaps we develop some therapeutics in rapid order but that just mitigates the worst case scenario. I don’t like it, but I do not really see how it can not be the case. This is a long way from over.

Fact is they have never found a cure for the common cold. We do have better mouse traps.

Reminds me of that Jerry Jeff Walker song: “Desparados Waiting for a Train”.

The virus won’t go away but there are two points. First the subsequent waves will oscillate with lower magnitude. Second, what is probably the case is that there are 10x to 20x infections relative to what is reported. Many asymptomatic cases mean that the virulence is circa 0.5 or about 5x the flu. Once Amazon sends out antibody tests that will tell you whether you have had the disease one might expect to get some clarity on how widespread the infections really are. Count me an optimist.