On Thursday evening, in “And I’ll Dance With You In Vienna“, I suggested the standoff between the Saudis and the Russians over a proposed massive production cut aimed at stabilizing oil prices would likely end in a compromise.

It didn’t. Instead, Russia refused to budge, in what some say is a bid to let prices fall further in order to cripple US shale. “Small shale oil producers will bite the dust”, Commerzbank said, in a note. “The market rebalancing will be shared with more producers, not just OPEC and Russia, so we are essentially back to late 2014, when OPEC last decided against output cuts”.

From a geopolitical perspective, this may well mark the beginning of the end for what, in hindsight, will be seen as a short-lived betrothal between Riyadh and Moscow. “The OPEC+ alliance is dead”, Olivier Jakob, managing director at Petromatrix, remarked. “That is going to make it harder to support oil prices, but it also depends on what Saudi Arabia decides”.

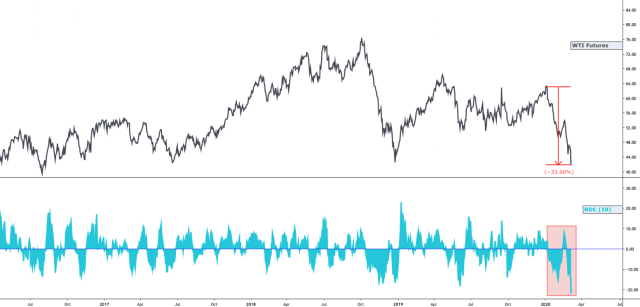

Oil plunged even further. WTI was down nearly 9% on Friday, one of the worst one-day slides in years. The losses since crude spiked in the wake of the Soleimani assassination are heinous – that’s about the best adjective I can conjure to describe the situation.

“Given today’s decision, all OPEC+ countries from April 1 have no obligations to cut output”, Russian Energy Minister Alexander Novak told reporters in Vienna after a ministerial meeting.

A simple read is that this could mean things get materially worse for junk bonds, which were already seeing massive outflows.

There’s really not much else to add at this juncture. On a day when the news for risk assets really didn’t need to get any worse, and at a time when energy shares were already trading at the lowest since 2009, this is just another body blow.

“First sight does appear to be the worst-case outcome”, Standard Chartered’s Paul Horsnell sighed. “The Russian approach risked sub-$30/bbl Brent, and they seem to have gone straight to that script”.

Technically the US dollar should fall in response to the decline in crude, being that the US is now a petrochemical state. US GDP decline should follow. I use the term ‘should’ because I am cognisant of the fact that the dollar is a safe haven asset. Nice to see the USD/JPY moving down again, but I don’t think people will be ditching their dollars for Yen en masse just yet.

So let’s add oil patch job losses to the inevitable travel/leisure/hospitality job losses. Maybe some small & medium sized bank job losses as NIM’s get crushed to nearly nothing.

Seems like today’s NFP report may end up being “peak employment” in this decade-long cycle.