To be sure, what market participants should be looking for from the January Fed minutes is some manner of nuanced discussion from policymakers about what the committee plans to do in the event the global economy continues to underperform, perpetuating dollar strength and thereby raising the odds of imported disinflation.

The fallout from the coronavirus epidemic will likely dent US economic growth, but the rest of the world will almost surely take a much bigger hit. That raises the odds of the greenback remaining stubbornly supported despite the Fed’s asymmetric reaction function (i.e., the dollar will be resilient even as the bar for more cuts is much lower than the bar for hikes).

That, in turn, sets up a truly absurd scenario whereby more rate cuts designed to ameliorate the situation could perpetuate the very same economic outperformance that’s driving dollar strength in the first place, thereby making it even more likely that the US will import the world’s disinflationary impulse.

Read more: Revisiting The Ultimate In Ironic, Tragicomedic Fed Outcomes For 2020

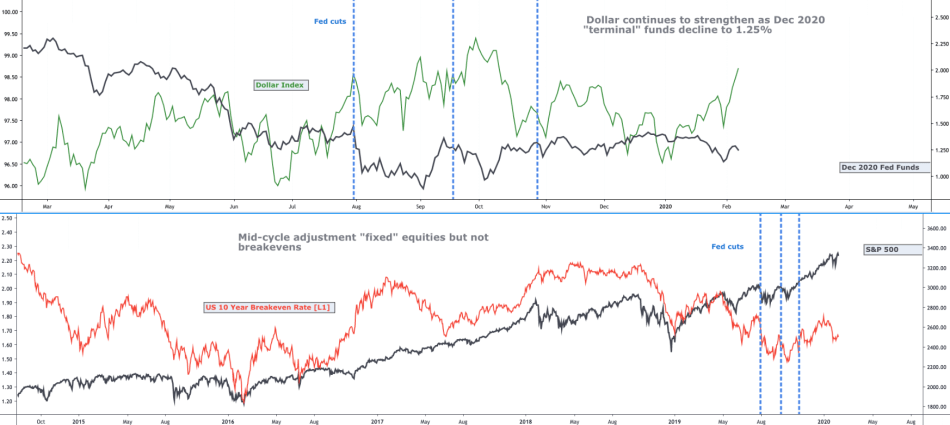

All of that would imperil the effort to bring inflation back up to target, casting doubt on the Fed’s policy review before the results are even announced. All of those points are illustrated in the following visual adapted from Deutsche Bank’s Stuart Sparks:

But, market participants are far more interested in balance sheet policy and the future of repo operations at the current juncture. That obsession can be explained by simply stating that as long as the liquidity spigots are open (as they have been since September) everything noted above (including the coronavirus itself) is commensurately less important, at least as far as equities go.

Sure, commodities have been crushed, and gold is surging, and the dollar refuses to roll over, and markets are piling into deflation trades, but at the same time, the implicit promise of “QE forever” makes all of that somewhat irrelevant to those who only care where the Nasdaq closes. (In case you haven’t noticed, it’s been closing higher lately.)

As I wrote last month, “it’s the liquidity, stupid“, and as detailed here over the weekend, that’s the furthest thing from a conspiracy theory.

The Fed is attempting to trim the size of its repo operations and soak up the outstanding stock with T-bill purchases. Eventually, they’ll have to start buying short-coupons to avoid impairing market functioning or otherwise exacerbating illiquidity in the bill market. At that point, the distinction between balance sheet expansion for “reserve management” purposes and “QE proper” will all but disappear, to the extent anyone perceived it in the first place.

“It’s still a cheap source of funding”, NatWest’s Blake Gwinn said last week, of the repo ops. “And it’s all the more reason why I think the Fed was too timid in pulling back repo operations. This is becoming a piece of dealers’ day-to-day funding strategy rather than a tool”.

That’s a bit disconcerting, depending on your perspective. The Fed said last month it will keep conducting repos through at least April. As alluded to above, the issue going forward is that the bill buying for reserve management purposes (which, again, “should” eventually obviate the need for the repos once excess reserves are returned to pre-September levels) is going to run up against supply issues, where that just means the size of the Fed’s purchases will risk affecting market liquidity. At that point, they’ll have to buy something else.

“[It’s likely] that due to the distortions which are being created in the Bills market that the Fed will need to extend purchases into short coupons by April, and ultimately, front-end USTs thereafter, in order to created ‘ample reserves’ and ease funding conditions”, Nomura’s Charlie McElligott said, earlier this month.

And, so, that’s the backdrop for the January meeting minutes, which generally find the Fed sticking to the notion that policy is appropriate – for now.

The following passage sheds a bit of light on the internal debate around whether and to what extent the Fed’s activities to calm short-term funding markets and rebuild excess reservers in the banking system have contributed to inflated prices for risk assets:

For most of the period, risk asset prices rose as market participants focused on a perceived reduction in downside risks to the economic outlook, favorable data on foreign economic activity, and expectations of continued monetary policy accommodation in the United States and other major economies. Some market participants suggested that the Federal Reserve’s actions in the fourth quarter to maintain ample reserve levels might have contributed to some degree to the rise in equity and other risk asset prices. Over the final few days of the intermeeting period, financial markets responded to news of the spread of the coronavirus that started in China, which reportedly contributed to downward moves in Treasury yields and, to a lesser extent, U.S. equity prices. On balance, U.S. financial conditions became more accommodative over the intermeeting period, with equity prices rising notably.

The Fed acknowledges that the market believes the reaction function is asymmetric. Remember, what the market believes matters – a lot. Because wrong-footing the market can tighten financial conditions, necessitating easing, in a “hall of mirrors” effect.

From the minutes:

Despite signs of reduced risks to the outlook and of some stabilization in economic activity abroad, financial market participants’ views on the likely course of U.S. monetary policy appeared to have changed little over the intermeeting period. Market-based indicators continued to point to expectations that the target range for the federal funds rate will be lowered by roughly 30 basis points this year. This was consistent with responses to the Open Market Desk’s survey, which continued to indicate that, while market participants viewed no change this year in the target range as the most likely outcome, they placed a higher probability on a reduction in the target range over the year than on an increase. Market commentary attributed the stability in federal funds rate expectations despite the perceived reduction in downside risks partly to the Committee’s communications; some market participants reportedly regarded those communications as signaling a relatively high bar for changes to the target range.

Finally, here are some key passages on the repos and the plan for bill purchases, which could be tapered in the second quarter, the Fed imagines (and yes, the use of the term “imagines” there is a deliberate attempt at humor):

At the current pace of $60 billion per month, the staff’s estimates suggested that after April of this year, the Desk’s reserve management purchases will restore the permanent base of reserves to levels above those prevailing in early September 2019. Although reserves are projected to be above $1.5 trillion before April, a surge in the Treasury General Account balance during the April tax season is expected to briefly reduce reserve levels and, in the absence of repo operations, bring reserves down temporarily to around $1.5 trillion. The manager discussed a potential plan for gradually transitioning to an operational approach designed to maintain ample reserve levels without the active use of repo operations to supply reserves. Under this plan, repo operations would be maintained at least through April to ensure ample reserve conditions. However, the Desk would continue the gradual reduction and consolidation of its repo offerings ahead of April, with the plan of phasing out term repo operations after April. As part of this transition, the minimum bid rate on repo operations could be gradually lifted, and the Committee could consider whether there is a role for repo operations in the implementation framework. In the second quarter, the manager expected reserve conditions to support slowing the pace of Treasury bill purchases, with the goal of eventually aligning growth of the Federal Reserve’s Treasury holdings with trend growth in its liabilities. As that time approaches, the Committee might wish to consider the appropriate maturity composition of reserve management purchases of Treasury securities. The manager noted that, although the pace of Treasury purchases would likely continue into the second quarter, the rate of expansion in the Federal Reserve’s balance sheet would moderate during the first half of 2020 as repo outstanding was gradually reduced.

In other words, the hope is that after the second quarter, balance sheet growth will be purely “organic” and not driven by the need to replenish scarce liquidity or reserves, and certainly not by any desire to deliberately compress risk premia in the course of encouraging speculation and underwriting the short vol. trade in all its various manifestations.