Governments beset with social unrest are rolling out stimulus packages in an effort to pacify the aggrieved masses.

On Tuesday, Hong Kong’s embattled chief executive Carrie Lam promised a third round of measures aimed at shoring up sectors of the economy hit hard by months of violent protests.

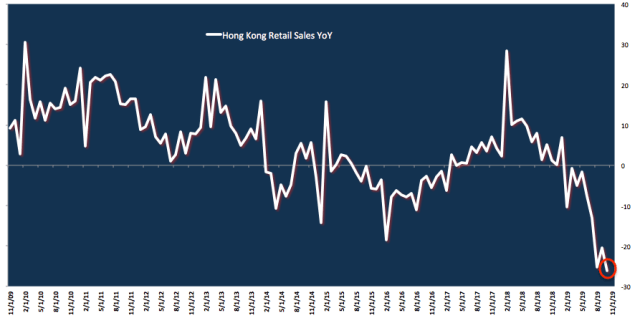

Addressing reporters, Lam said the government planned to announce the new, “targeted” measures “soon”. She didn’t elaborate, but her remarks came a day after the city reported an egregious plunge in retail sales, which shrank 26.2% by volume in October and 24.3% by value.

In August, Hong Kong unveiled a $2.4 billion stimulus package, followed by an addition $2 billion in measures in October.

Generally speaking, that’s seen as wholly inadequate in the face of the city’s existential crisis, which has already plunged the bustling financial hub into recession.

The unfavorable external environment is insult to injury. Exports have contracted for a dozen consecutive months.

Meanwhile, Chile is set to spend $5.5 billion in an effort to create 100,000 jobs over the next year. Like Hong Kong, Chile is in turmoil amid violent demonstrations which have shuttered businesses and stymied public transportation. The peso fell to a record low last month as the situation deteriorated.

“These measures are on the whole transitory and designed to create jobs both directly and indirectly through public investment and support for smaller companies”, the country’s finance minister Ignacio Briones said Monday.

Much as the effectiveness of Hong Kong’s measures depends on the abatement of violence, Chile’s efforts to get the train back on the tracks will hinge on deescalation, something Interior Minister Gonzalo Blumel emphasized.

Chile’s economy collapsed in October. The Imacec index – a GDP proxy – plunged 5.4% MoM. That, Bloomberg marvels, “was even bigger than the 4.1% drop in March 2010 that followed an earthquake and tsunami which devastated much of the center-south of the country, kill[ing] more than 500 people and knock[ing] out electricity to 93% of the population”.

Briones says government spending is set to spike nearly 10% next year. That would be the largest jump in 10 years, and will balloon the deficit.

The beleaguered currency may get a lift, though. The stimulus package “should mean faster inflation, higher yields and a stronger peso”, Santiago-based Sebastian Boyd said Tuesday, adding that “the government will tap [its] savings — most of which are in hard currency — for $7.6 billion and sell $9 billion worth of bonds, including $3.5 billion in dollars” to raise $16.6 billion. “That implies huge inflows into the peso, pretty much matching the $10 billion of spot buying from the central bank, which the market should start pricing in straight away”, he added.

Chile’s national statistics agency said Tuesday that October retail sales fell 12.1% YoY, double the drop consensus was expecting. Commercial activity dropped 9.5% and vehicle sales fell nearly 24%.

On Monday, Hong Kong Financial Secretary Paul Chan said the city will likely log its first budget deficit in 15 years due to falling tax revenue, declining income from the sale of land, the cost of stimulus and the generalized economic malaise.

Don’t leave out Nigeria, Iraq, Iran.

https://heisenbergreport.com/2019/11/16/what-to-know-about-the-iran-protests/