Donald Trump is milking his “Phase One” trade deal with China for all it’s worth when it comes to building suspense.

“We’re in the final throes of a very important deal”, the president told the media on Tuesday at the White House, where he pardoned a turkey and joked about Adam Schiff just as Jerry Nadler made public a letter informing Trump that he has until Sunday to decide whether to participate in the House Judiciary committee’s first public impeachment hearing. “It’s going very well”, Trump said of the China deal.

Later, he chatted with Bill O’Reilly. “I’m holding it up because it’s got to be a good deal”, the president explained. “We can’t make a deal that’s like, even. We have to make a deal where we do much better, because we have to catch up”.

That’s a familiar refrain. Trump habitually insists that any deal with Beijing can’t be “50/50”, because it’s his sworn duty (as “the chosen one”) to address myriad historical injustices foisted on the US by China. Xi, on the other hand, insists that any deal must be based on mutual benefit and “respect”. Trump wants a “victory”, Xi wants a “win-win” and only one of the two leaders realizes that everyone “loses” in a trade war.

Stocks see no reason to question any of this – or at least not right now. All three benchmarks are gunning for another week of gains. For the S&P, it would be the seventh in eight.

In addition to some possible rebalancing flows after a month that saw equities outperform bonds handily, volatility stateside is tamped down by extreme greeks (if you will).

Read more: The ‘Perfect Virtuous Feedback Loop’ As Gamma Gravity Pins Equities

Most of the year-ahead outlooks from Wall Street paint a reasonably upbeat picture, as usual. Stocks are seen rising by most. Even SocGen – whose base case calls for a shallow recession – hasn’t ruled out a “melt-up” to 3,400 in the first half of the new year on trade euphoria.

And yet, it’s never clear whether Trump is saying anything that’s worth saying. The soundbites mentioned above may have no basis in reality whatsoever. The USTR has been largely mute over the past several days, even as the Chinese Commerce ministry suggests the most recent phone discussions between the principals (Liu He, Bob Lighthizer and Steve Mnuchin) have been largely constructive.

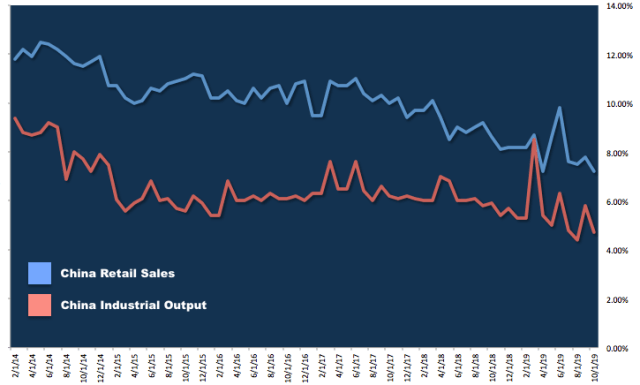

Chinese officials who spoke to Reuters for a piece out last Sunday said Trump wants the deal more than Xi. After all, he’s facing impeachment and next year is an election year. And yet, the Chinese economy continues to decelerate. Industrial profits fell by the most on record last month, data out Wednesday showed.

That’s attributable to the pernicious combo of PPI deflation and lackluster domestic demand.

On Wednesday, the finance ministry said local governments need to make sure special purpose bonds issued to finance infrastructure are issued and used asap “to ensure we can see results early next year and the economy can be effectively boosted soon”. That’s according to a statement on its website.

“This is a big decision, which means that the government is pretty worried about the downward pressure on the economy”, Hua Changchun, an analyst at Guotai Junan Securities, told Reuters.

Fixed investment disappointed last month, along with retail sales and industrial output.

The PBoC delivered a series of token rate cuts this month as part of an ongoing effort to administer a slow drip of monetary accommodation aimed at keeping things some semblance of stable as the trade talks move forward, but many observers are looking for more. “The central bank should coordinate with fiscal policy. It should release more liquidity, so we expect it to cut RRR again toward the year-end”, Tang Jianwei, senior economist at Bank of Communications in Shanghai said Wednesday.

Ultimately, it’s hard to see how either side has any choice but to pacify the market and validate expectations for some manner of tariff rollbacks or, at the least, the avoidance of the scheduled December 15 escalation.

Remember, record highs notwithstanding, not everyone is buying into the rally. “A broad variety of measures indicate that positioning in US equities is quite bearish across several types of investors”, Barclays wrote Tuesday, adding the following:

Short-interest is relatively high. However, the rally over the past few weeks has not been a true “short-squeeze” rally in that stocks with high interest have not materially outperformed stocks with low short interest. Figure 32 shows that the option investors are also increasingly nervous. Option skew and the ratio of Put and Call open interest are both at recent highs. At the same time, more recently the call skew has flattened, indicating an increase in demand for upside calls, a reflection of some investors looking to “hedge”the upside melt-up scenario. Figure 33 shows that a similar flattening has typically coincided with SPX hitting new highs.

Although skepticism among some investor cohorts leaves scope for things to run further assuming a benign resolution to the trade talks (as participation from holdouts could provide further upside), it also underscores lingering caution.

But even as some express palpable concern about the deal falling through, Trump looks to be dragging things out as long as possible in order, one supposes, to extract leverage and revel in the same combination of brinksmanship and showmanship that went down like a lead balloon in May and August.

“Trump suggesting that negotiations are near completion have buoyed the idea that a deal could be struck before year end, all of which is feeding the uptick in investor sentiment and subsequent risk appetite”, Simon Ballard, a macro strategist at First Abu Dhabi Bank said in a client note, before sounding a cautious tone. “But we have traded up on such optimism before, only to then be let down”.

We’ve said it before and we’ll say it again: If the White House does decide to escalate things anew over the next two weeks rather than acquiesce to the market’s demands (implicit in record highs on US equity benchmarks), the “ratings” will be anything but “tremendous” headed into Christmas.

This comment is not specific to this post but is equally applicable to the last half dozen or so I am reading this morning..Volumes of News like we are seeing and hearing used to ‘ tank ‘ the equity market if only one item or two were spilled on the proverbial table…. Nowadays , we are so dependent on money policy (manipulations without rational alternatives) as the solution to virtually every problem almost everyone is anesthetized resulting in a Tina Fomo trance…. (we all know her)… Like Lemmings we are drawn to the edge and the inevitability of this seems not to be sufficient to do anything but cause an occasional hiccup…

The real question is going to be….What combination of intellectual and personality characteristics will it take to prevail at the termination of this cycle or will it just be random luck of the draw…We are trying hard to master this enigma not all of us ,however, for the same reason..

Trump needs a deal (even a bad one and will tell everyone how great it is). The deal will return us to the place we were before the trade war. It is all reality tv and the trump supporters will buy it as reality. SAD!!!