It was risk-on out of the gate in what’s expected to be a subdued week for global markets as investors await clarity on trade and the US celebrates that time years ago, when ignorant settlers nearly starved and froze to death, but were ultimately rescued by benevolent locals.

The results of Hong Kong’s district council elections ended up being even more lopsided than they initially appeared, with pro-democracy candidates winning between 80% and 90% of the 452 contested seats. After the vote, the pro-democracy camp has control of 17 out of 18 district councils, SCMP says.

“There are various analyses and interpretations in the community in relation to the results, and quite a few are of the view that the results reflect people’s dissatisfaction with the current situation and the deep-seated problems in society”, Carrie Lam remarked, in a late candidate for understatement of the year. “[We] will listen to the opinions of members of the public humbly and seriously reflect”, Lam said.

Read more: Hong Kong Is Center Of Geopolitical Universe As Hang Seng Turns 50

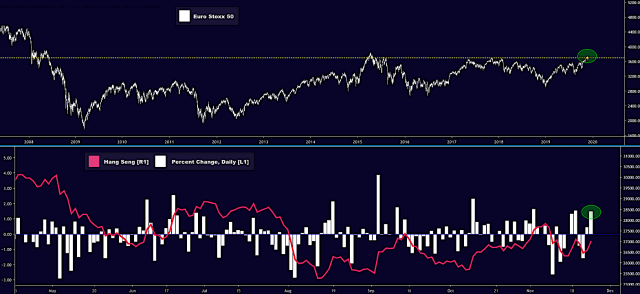

Local shares surged 1.5% on Monday, leading global equities, which gained pretty much across the board.

The Euro Stoxx 50 continues to flirt with the highest levels in half a decade. German business expectations ticked higher in November, as Ifo’s overall business climate gauge printed 95, a four-month high.

That was in line with estimates and will likely add to cautious optimism that the worst may be over for the world’s fourth-largest economy, which has been mired in the deepest factory slump since the crisis.

Bonds generally shrugged at all of this. Yields were up marginally across the Treasury and bund curves, but nothing that would reflect the sanguinity apparent in equities.

It’s unlikely that China will soften its stance on Hong Kong following Sunday’s rebuke at the ballot box. Indeed, the results will probably just serve as a reminder of why Beijing isn’t so keen on this thing called “democracy” in the first place. And yet, the fact that things were peaceful and, perhaps, the notion that the government may now feel compelled to roll out more stimulus amid the recession may help explain the move in the Hang Seng, which turned 50 on Sunday. It’s back above the 100-DMA.

Ultimately, though, the only thing that matters for markets in the near-term is whether Donald Trump decides to go ahead with the interim trade deal.

The olive branch on intellectual property theft on Sunday was widely cited as the reason for risk asset buoyancy on Monday. For now, nobody cares that Reuters says a “Phase Two” deal likely will not materialize before the US election – if ever.