“The manufacturing numbers are simply awful”, Phil Smith, Principal Economist at IHS Markit said Monday of the latest PMIs out of Germany.

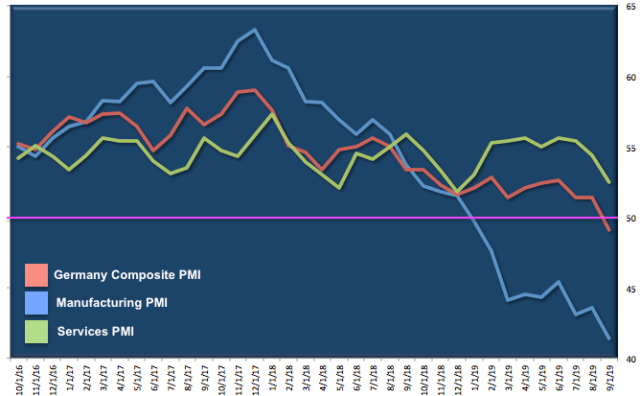

By “awful”, Phil means that the flash read for September was 41.4, a 123-month low.

Germany’s manufacturing sector is now suffering from the sharpest decline in business conditions “since the depths of the global financial crisis in mid-2009”, IHS Markit said Monday, adding that “the survey showed a sustained decline in underlying demand, with total inflows of new business falling for the third month running and at the quickest rate for seven years”.

Manufacturing orders logged the steepest decline in more than 10 years and, worryingly, there was a concurrent drop in service sector new business — the first since December 2014.

Speaking of services, the manufacturing malaise is spilling over. Germany’s services PMI printed just 52.5 in the flash read for September, missing the lowest estimate from nearly three-dozen economists.

“With job creation across Germany stalling, the domestic-oriented service sector has lost one of its main pillars of growth”, Smith said, adding that “a first fall in services new business for over four-and-a-half years provides evidence that demand across Germany is already starting to deteriorate”.

The composite PMI sank into contraction. The 49.1 print missed consensus by a mile and was well below the low end of the forecast range (51-52.2). It’s the lowest reading since October 2012. New orders dropped to 45, the lowest in seven years.

“The economy is limping towards the final quarter of the year and, on its current trajectory, might not see any growth before the end of 2019″, Markit warned.

Smith cites the obvious factors weighing on the world’s fourth-largest economy. “All the uncertainty around trade wars, the outlook for the car industry and Brexit are paralyzing order books”, he sighed.

Germany has been steadfast in its commitment to almost fanatical budget discipline in the face of a worsening manufacturing slump, and that commitment is set to be tested further. This latest read on the economy clearly shows Germany is in a recession, and it’s going to take more than a budget-neutral €60 billion euro climate package to shore up sentiment.

Loosen the damn purse strings, before it’s too late.

Read more:

Fate Of The Universe Now Hinges On Germany, $683 Billion In AUM Says

Germany’s Sacred ‘Black Zero’ Survives Climate Plan, As Fiscal Stimulus Hopes Still Remote

The problem with spending is not just fiscal/budget stubbornness, Germany knows too well the state of Commerzbank and DeutseBank and their might not be enough for fiscal stimulus AND bailing the banks out, they’re keeping that silver bullet.

Lagarde to the rescue? Brexit backdrop?

Well, there is a reason why ECB hired a lawyer to be head of their monetary policy, especially a lawyer specialized in bankrupt countries and banks.