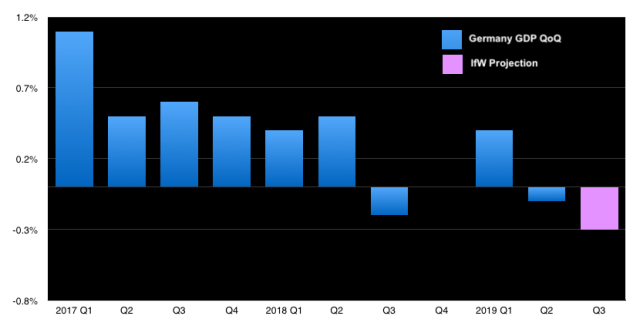

Germany will fall into a technical recession this quarter, IfW Institute said Wednesday, projecting the economy will shrink 0.3% in Q3 on the heels of the 0.1% contraction in the second quarter.

“The German economy is facing one of the weakest years since the financial crisis”, the institute said, citing “political uncertainty caused by trade conflicts and the Brexit crisis [and] cyclical factors due to the previous long upswing”.

“Germany thus formally meets the definition of a ‘technical recession’”, Stefan Kooths, head of the forecasting center, said of the new projections, adding that “this is not yet associated with a macroeconomic underutilization of capacities [and] only in such a case could we speak of a recession in the sense of a cyclical phenomenon”.

Recent data has stoked more recession fears in Germany. Last week, factory orders and industrial production numbers painted a grim picture.

If the economy does shrink in Q3, it would be the third contraction in five quarters.

Read more: Details Of Germany’s Second Contraction In Four Quarters Show Worst Export Slump In Six Years

Meanwhile, the Berlin-based DIW institute said German GDP will probably expand by just 0.5% this year. That’s down from the June prediction of 0.9% and compares with IfW’s 0.4% full-year forecast.

DIW says a no-deal Brexit outcome would likely lop 0.4ppt off Germany’s economic growth next year. Although a “crash out” scenario for the UK has seemingly been avoided in the near-term, the longer-run outlook is just as precarious as ever.

Meanwhile, the IMF has joined calls for fiscal stimulus out of Berlin. “Germany is not constrained by debt levels from pursuing good fiscal, structural measures”, Poul Thomsen, the head of the fund’s European department, told Bloomberg in an interview from Brussels.

German Finance Minister Olaf Scholz this week reiterated a commitment to fiscal rectitude, but again suggested that Berlin would embark on stimulus in an emergency situation.

As far as the macro backdrop is concerned, IfW knows what the “real problem” is.

“The real problem with Donald Trump’s trade disputes is not the tariffs themselves, but the great uncertainty about what is to come”, said Kiel Institute President Gabriel Felbermayr. “Uncertainty is poison for investment decisions”.

Indeed.