Get the latest from The Macro Tourist in real-time on Twitter (@kevinmuir)

This is a tough one for me to write as the blowback will be enormous, but I am taking a lesson from this sloth and going to just give zero f’s and trudge on.

(If the video does not load, please refresh your page)

We had the DotCom bubble. Then the real estate/credit bubble. And we are now in the third bubble of my lifetime – the bond bubble. This one is different (they always are) in that it’s not filled with the same sort of speculative froth, but it’s still ominous.

Now before we examine why this is a bubble, let’s first talk about all the BEAR arguments that are NOT CORRECT. And there are a lot of them. So let’s politely dismiss them so there is no confusion as to why I think the bond market is a terrible risk/reward.

FALSE BEAR ARGUMENT #1 The US debt situation is untenable and eventually the large amount of entitlements and outstanding debt will cause the US to default on their debt. Not a chance. There is as close to zero chance that the US will default on their debts as you can get.

FALSE BEAR ARGUMENT #2 The US relies on China to finance deficits and if they ever withdraw funding, the bond market will collapse. Again, wrong. Maybe the the Chinese could affect the market for a month, but as we have recently seen, other creditors would step in.

FALSE BEAR ARGUMENT #3 The US dollar will collapse and force the Fed to raise rates to defend it. In doing so, the bond market will shrivel faster than Costanza in the pool. Nope. Ain’t going to happen. If the USD loses reserve status, it will be a gradual affair.

There might be more bond bear market arguments, but the IMPORTANT THING TO NOTE is that: I DO NOT BELIEVE BONDS GO DOWN FOR “BAD” REASONS, but rather because of “GOOD” reasons like more growth (and along with it, more inflation).

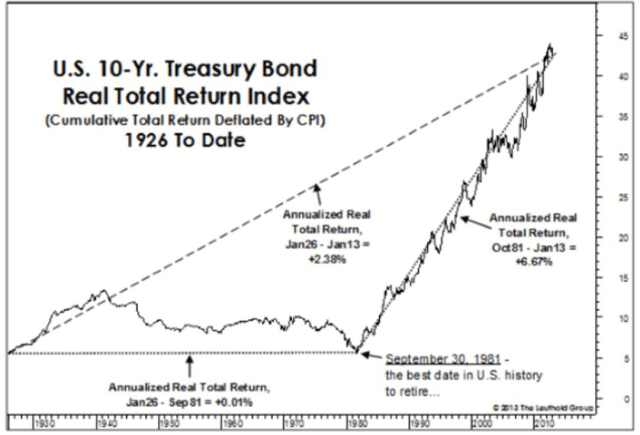

Ok, back to the idea we are in a bond bubble. Let’s first examine the psychology that is rushing through the markets. This unbelievable bond bull market is now 38 years old. That’s almost four decades of bond yields going only one way – DOWN!

(BBG)

It’s been an un-friggin’-believable trade. And every time it looks like the bull is over (see last fall’s two-closes-above 3.25% sucker play), the bond market run continues. On a risk-adjusted basis, this has been one of the greatest trades of our lifetime.

Yet what’s that line from the Cherry-Coke-loving-octogenarian? “What the wise do in the beginning, the fool does in the end”. When this bull market started, the real-yield was extremely attractive, but it’s now zero for 30-year tenors. Zero… for thirty years…

(BBG)

And if we step back and take a view of the long, long, long-term, it becomes obvious that this bond bull market is unusual:

So I stress that it is imperative when examining the risks in the bond market, one does not simply cherry-pick data from the last four decades. If you do that, then it’s easy to see that you should only be long, extra-long, or leveraged to the eyeballs long.

And ultimately this recency-bias is what’s at the heart of the bond bubble. Investors have become convinced that lower and lower rates are inevitable. That larger forces are at work and deflation is inevitable. Yet how many currencies have collapsed from deflation?

I am bombarded with argument after argument how ALL RATES AROUND THE WORLD WILL BE STUCK AT ZERO and how NO ONE CAN MAKE INFLATION. Trust me, I know the bull arguments. No need to send me your Shilling-debt-demographics will crush us all argument – I know it.

And also don’t assume that I don’t understand the relative merits of owning US Treasuries (which still have a positive yield) in a world negative-yielding debt. I get it. I understand why if the US ends up like the rest of the world, then buying UST is a great trade.

In fact, I am long the short end of the US yield curve (I am long steepeners). I suspect the Fed will give the market what it wants and lower short rates. BUT DO NOT BE SO SURE THIS IS LONG-END POSITIVE.

My bear case comes down to this.

Consensus: only way to arrest economic slow down is to do more MONETARY STIMULUS with FISCAL AUSTERITY.

Reality: this doesn’t work and the masses are waking up.

Let’s think about the European situation. Will negative 60 bps really help the economy anymore than 40 bps? Nope – not a friggin’ chance. In fact, it will probably accelerate the collapse. It’s the stupidest policy I have ever seen. Terrible idea.

If you are convinced that governments and Central Banks will simply continuing throwing more and more monetary fuel on the fire (with continued fiscal austerity), then I will be wrong. Bond market bulls are correct in that STATUS QUO means higher bond prices.

Yet let’s think about the risk/reward if you are wrong. Although Minsky wrote about the three stages of lending from the point of view of the borrowers ability to pay it back…

It seems to me that if we flip the theory to the investor, we have moved from: Stage 1: positive real return after inflation (1980-2008), Stage 2: little real return (2008-2011’sh), Stage 3: negative nominal return Stage 3 is ponzi and you relying on greater fool. BUBBLE.

European bonds have a negative yield and you will ONLY MAKE MONEY if you sell to someone else WHEN THEY GO EVEN MORE NEGATIVE. How can we not believe this to be a bubble?

The absurdity of the situation is beyond compare. Yeah, I get how bad the economy is in Europe. But the governments are literally getting PAID TO SPEND. Do you realize what a no-brainer it is for POLITICIANS to DO FISCAL STIMULUS?

Yeah, you might think it is a terrible idea. I have no desire to judge whether it is RIGHT OR WRONG. My job is not to decide WHAT SHOULD BE DONE, but rather try to discount what WILL BE DONE. Odds favour governments spending.

And stepping back, the longer-term risks are that we are on the verge of a seismic shift of attitude towards fiscal spending. Trump was the start, and it will spread to the rest of the world. If that happens, don’t get stuck relying on selling to the greater fool.

Every country has a limit on how much they can borrow. before thet become credit unworthy.

True…..the USA will likely not default on our debt, but that doesn’t mean rational investors will buy it, if our deficits keep expanding.

Where to start? It is not true to say that the bond market in the US has been in a a bull market that has lasted 38 years. The argument is so naive to put it mildly, it is like taking a chart of S&P from 1950 and declaring that S&P has been in a bull run for 69 years. There have been bear and bull markets along the way, enough to bankrupt quite a few people. The idea that the peak of 1980’s at 14% is somehow a starting point or a definition of normalcy is also wrong. It is an aberration, a once in a few lifetimes event. In fact it is a once in a few hundred years event 600 years to be exact. Nobody is buying bonds solely because they expect the Fed to ease, i know of no one at least. People are buying bonds because the macro has deteriorated, because of the yield spread that exists between US and the rest of the world, and yes because the Fed will be forced to ease, and probably also because it is easy return. Japan should be enough to provide a perfect mirror example on why it is not a bubble, and as aggressive as the move has been it is perfectly justified.

“And stepping back, the longer-term risks are that we are on the verge of a seismic shift of attitude towards fiscal spending. Trump was the start, and it will spread to the rest of the world. If that happens, don’t get stuck relying on selling to the greater fool.”

Very true. However, there is plenty of time and space for the U.S. long end to come down further before it takes off to the upside. And, there’s nowhere near enough of the anticipated fiscal policies currently in the pipeline to cause massive steepening yet. I think he’s right that we aren’t looking at NIRP for decades, and I think he’s right about why, but I also think he’s very early on the trade.

Japan not in a bubble? Secular stagnation is a bubble for Japan. Without the BoJ running the sluices pretty much wide open for the past 20years, Japan would have fallen into deflationary death spiral long ago. Demography and Japanese immigration policy may render it all just staving off the inevitable.

I bought into a long term bond fund less than 4 months ago…..it is currently up 15%. I don’t care how low rates go in the next couple of years…..that bond fund is currently not worth what people are paying…..which sure makes it look like a bubble to me. Even negative rates won’t justify the current price.

Like Chris suggested, it may be early for a trade……but I am keeping my eye on it.

trump’s insane path forward, to embrace Japan’s economic model, needs to be thought of within a much bigger picture with a broader time frame:

“By some reckonings, the total amount of wealth destroyed in Japan’s bubble collapse was greater, in relation to the size of the economy, than the devastation wreaked by World War II.”

Some will recall the firebombings of many cities in Japan, the atomic bombs, etc. In all it’ estimated that about 70 million people were killed in Japan and obviously, their paper cities became ashes.

Thus, as we enter this cool new era of smartphones and super efficiency, pondering the prospect of inflating economic bubbles, to save the wealthy and provide stability to global casinos, we may want to consider that a madman like trump, a prior casino manager with at least 5 known bankruptcies — is hoping to ignite financial bubbles and play games with risk, liquidity and stability. As with the Great Recession, it would have been far better to have let many banks and poorly run institutions Too Big To Fail turn to ash, than to save them and nurture them, so that they can ruin the world again and again and again. Hence, trump the Grim Reaper and his bag of manipulative tricks and falsehoods, is responsible to history. He can either be remembered as hitler-like, a conman or a businessman — and although morals and ethics may not be at the top of any ceo trait, most business people use risk analysis to insure that they don’t commit financial suicide. In that perspective, it seems the Fed and Powell need to accept responsibility to not turn markets into a weaponized tool for madmen like trump. If the Fed causes the stock market to decline, because of a desire to not fuel a bubble, in time, that would be seen as a sign of strength, placing distance between them and him, which would be a stabilizing factor!

Two of the largest holders of government debt in the United States are the government and the government. Money paid into Social Security was used to pay for the Vietnam War and the Great Society in the 1960’s, and have been used to patch public finances ever since. If you have full faith and credit that the United States will honor the I.O.U.s the Social Security Administration holds, in accordance to the 14th Amendment, I doubt the public does.

You can say there is not a chance the United States will default, but I would prefer a reasoned argument. FDR defaulted in 1933 when he devalued the dollar relative to gold, and Nixon defaulted when he pulled the United States out of Breton Woods. The U.S. also technically defaulted in 1979 when they missed some payments. Since these debts are dollar-denominated and Treasury prints and the Fed keystrokes dollars, maybe a fully redeemed Treasury can eventually buy you a cheeseburger and that is good enough to prevent another default – but the United States will no doubt inevitably provoke either a debt crisis or a currency crisis.

Was this article published only on HR? I don’t see any updates at MacroTourist since May